picha

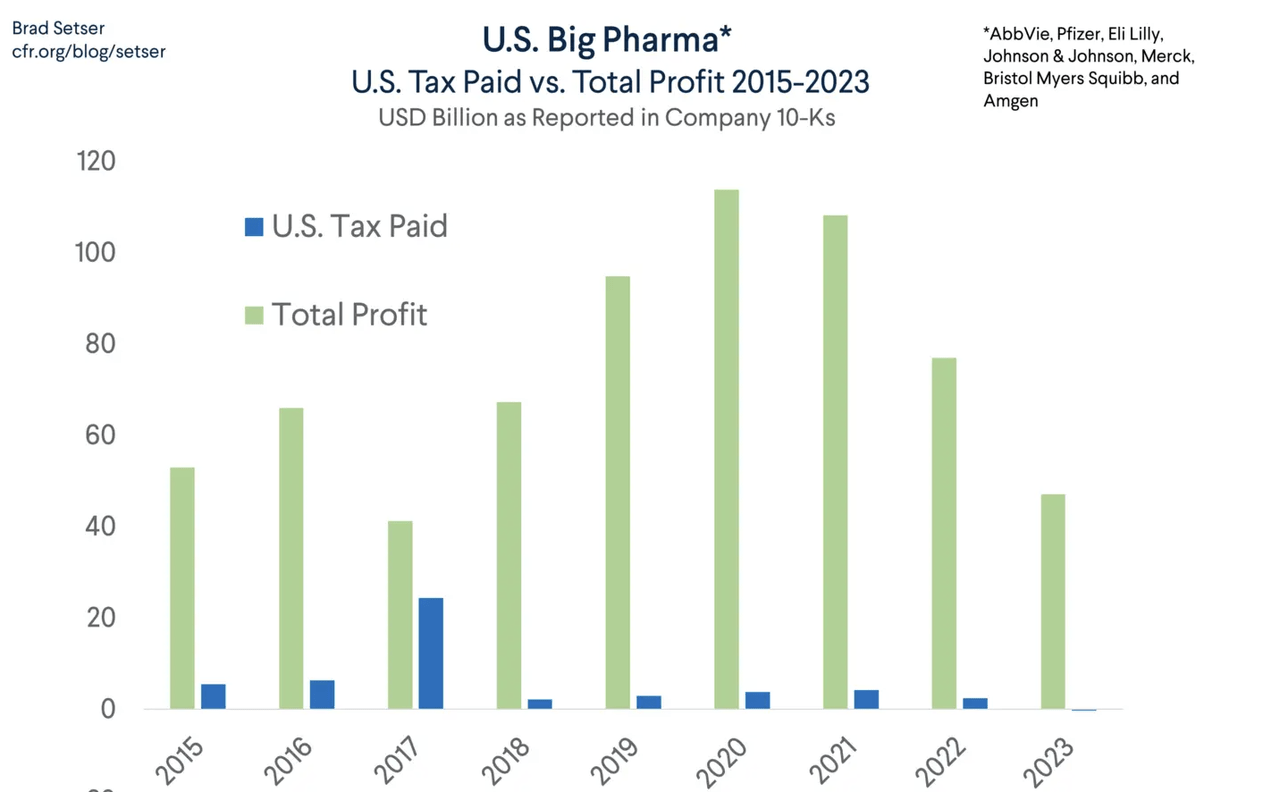

Although they receive the bulk of revenue from sales in the U.S. and report large overall profits, most large U.S.-based pharmaceutical companies don’t pay any taxes in the country.

A new analysis of corporate taxes paid by the largest U.S. pharma companies by the Council on Foreign Relations found that in 2023, the top seven based on revenue had a combined U.S. tax obligation of (-)$250M.

CFR noted that Pfizer (NYSE:PFE), Johnson & Johnson (NYSE:JNJ), and Merck (NYSE:MRK) had no U.S. tax liability in 2023 and even had tax losses to carry forward.

AbbVie (NYSE:ABBV) did pay a little in U.S. taxes, but CFR authors Brad Setser and Michael Weilandt added that the company books the profits from its blockbuster drug Humira (adalimumab) in Bermuda because that country has no corporate income tax.

Finally, many pharmas have moved their intellectual property to wholly owned subsidiaries in locations with more favorable tax rates than the U.S.