As software companies plunged on Thursday even after some of their big names reported positive earnings, Microsoft (MSFT) was in focus when the company at some point was projected to end on its seventh worst sell-off day in its history.

The software giant ended -9.99%, losing $357B in market cap—its strongest fall since March 2020.

The software sector “was hit hard, as the market is starting to realize that AI is destroying competitive moats in this industry,” Seeking Alpha analyst Leo Nelissen said.

“Even if companies like Microsoft (MSFT), Adobe (ADBE), ServiceNow (NOW), and others have a strong growth outlook, a re-rating is applied due to new competitive risks,” he added.

Other big names that struggled on Thursday included Atlassian (TEAM) -10.7%, Strategy (MSTR) -9.6%, Tesla (TSLA) -3.4%, and Datadog (DDOG) -8.8%.

Meta (META)—although its stock climbed +10.4%—is now “priced for perfection,” according to Laura Martin, senior analyst at Needham & Co., with a possible downside of 10% or 15% if the company does not hit their revenue acceleration numbers.

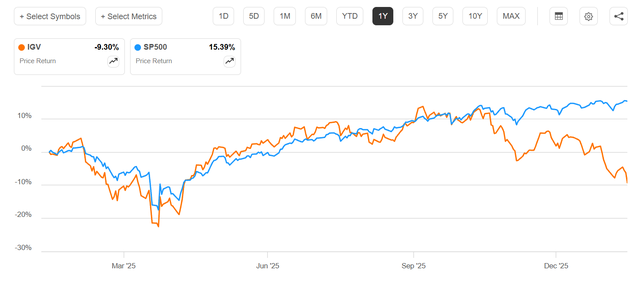

In addition, the iShares Expanded Tech-Software Sector ETF (IGV) declined -4.9% on the day, officially entering bear market territory as it is now 21.8% from its high.

IGV vs. S&P 500 (Seeking Alpha)

“Investors are finally asking the uncomfortable question: AI is insanely expensive—but where are the returns?” said Marc-André Fongern, former Deutsche Bank and Goldman Sachs investment banker. “Microsoft’s massive AI spending spooked markets because costs are real now, profits are still hypothetical.”