Torsten Asmus

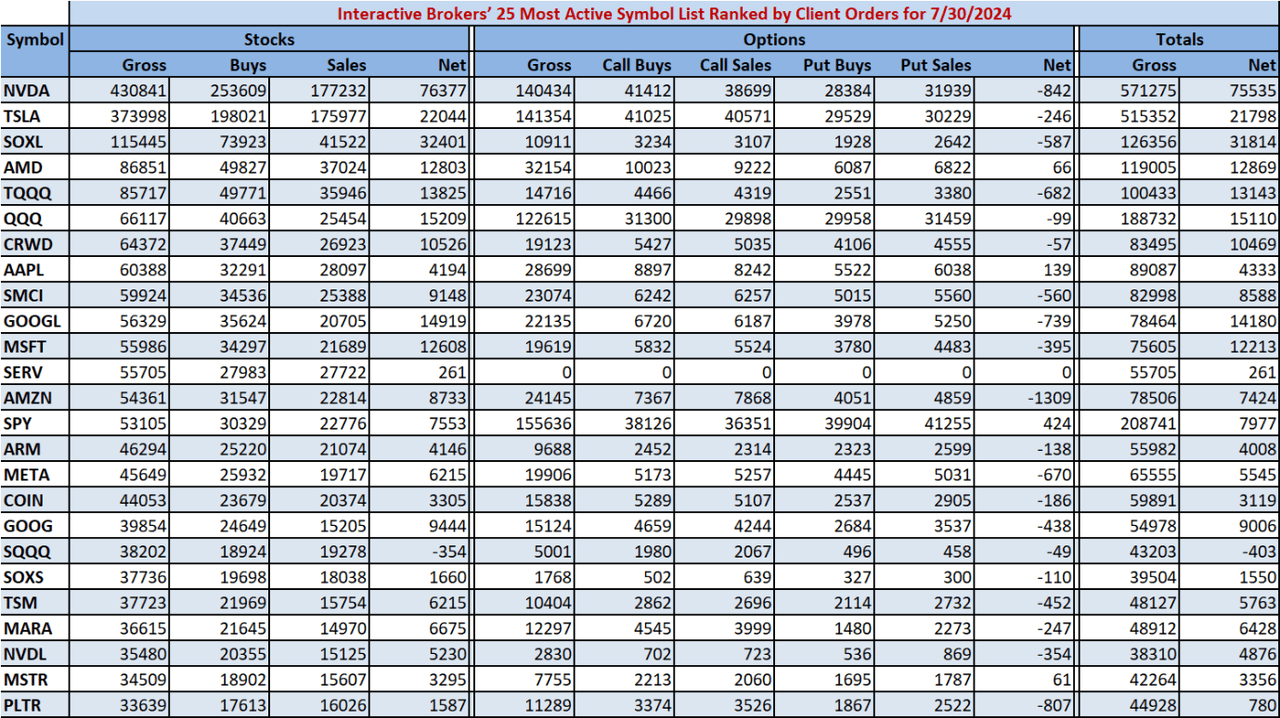

Interactive Brokers’ (IBKR) weekly list of the most-active symbols on its trading platform showed “remarkable” net stock buying activity in Nvidia (NVDA) and other tech names despite the ongoing selloff in the sector.

The Jensen Huang-led chip giant claimed the top spot on the updated list for a second straight week, while electric vehicle maker Tesla (TSLA) came in second.

The Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL) – which tracks the performance of the NYSE Semiconductor Index – along with Advanced Micro Devices (AMD) and the ProShares UltraPro QQQ ETF (TQQQ) rounded out the top five.

A major rotation out of technology stocks sparked by the June consumer price index report on July 11 has seen Nvidia (NVDA) slide more than 12% up to its last close. Meanwhile, Wall Street’s tech-heavy Nasdaq Composite (COMP:IND) has shed 5% in that same period, while the Nasdaq 100 (NDX) has fallen 5.7%.

“Our customers were a faithful bunch over the past week. The list is quite similar to the last missive we sent. Frankly, it’s not notable that the list continues to be led by NVDA and TSLA. But the net stock buying activity, particularly in NVDA, which just hit a two-month low, is remarkable. Every single stock showed net buying, sometimes quite substantial,” IBKR’s chief strategist Steve Sosnick said on Tuesday.

CrowdStrike (CRWD) fell to number seven from three on the updated most-active symbols list, as the cybersecurity company continues to remain in the spotlight following July 19’s historic worldwide IT outage.

“CRWD seems to be the victim of a more sustained problem. It is plumbing new post-crisis lows this morning. While it has fallen to 7th, down from last week’s 3rd spot, it has at least done so amidst lighter net buying activity,” Sosnick said.

“The impulse to buy dips is seemingly hard-wired into the mindsets of active traders. To be fair, it’s been a generally foolproof strategy for most of the past few years, at least when it came to high-momentum, tech-driven stocks and indices.”

“The risk, however, is that a minor blip becomes a longer-term selloff. It’s simply too early to know where this week of megacap tech earnings and central bank decisions will take us, but for better or worse, we know what our clients seem to be expecting,” IBKR’s Sosnick added.

See below for the full data on the IBKR 25 most-active list: