Justin Sullivan

The course of Nvidia’s (NVDA) stock price, after giving back a portion of its explosive surge seen over the past several months, will largely center on the AI chipmaker’s profitability, Deutsche Bank said.

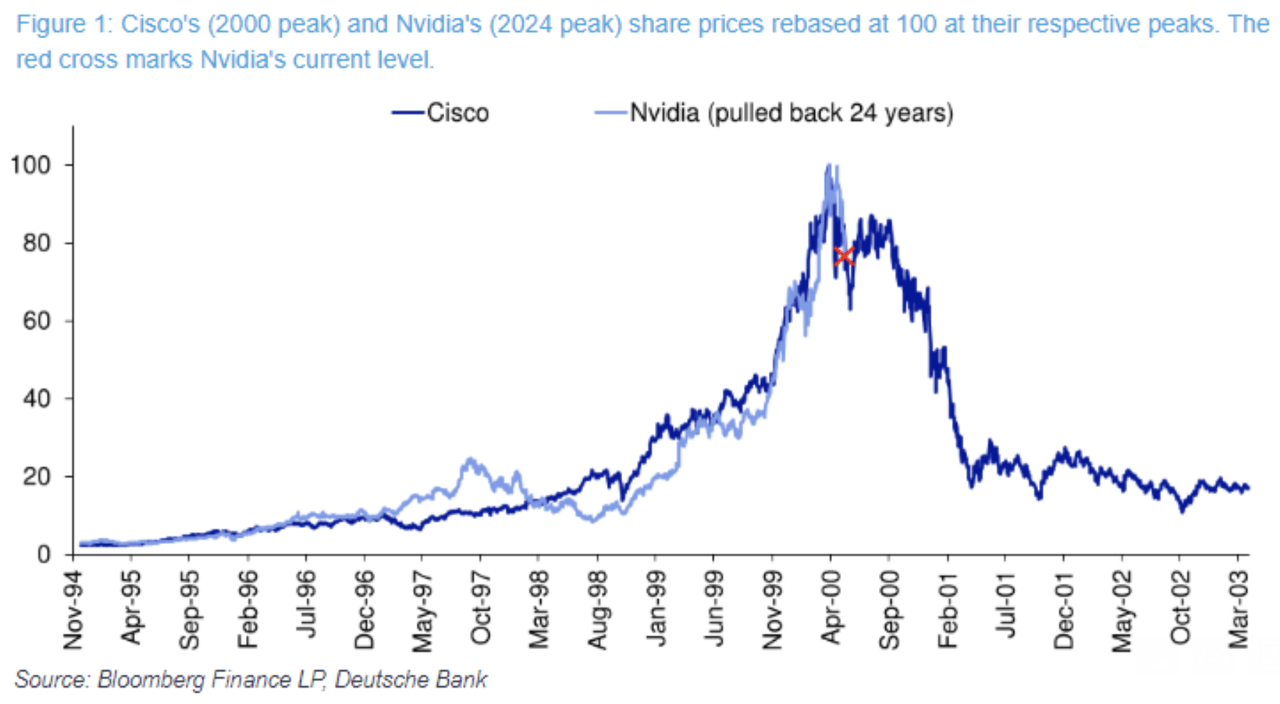

Nvidia’s (NVDA) stock is coming under more scrutiny after falling ~25% from its June peak and losing more than $800B in market cap, Deutsche Bank said Wednesday. Its Chart of the Day note explored comparisons between Nvidia (NVDA) stock and Cisco (CSCO) shares, as Nvidia is the banner name in the AI investment frenzy, much like networking equipment maker Cisco (CSCO) was the “poster child” of the tech bubble in 2000.

The “reality is that the run-ups in the two stocks have been similar but at the end of the day, the key for Nvidia (and the market’s enthusiasm for tech and AI) will be whether it can deliver sustainably strong earnings,” Deutsche Bank’s Jim Reid, head of global economics & thematic research, said. Here’s the chart:

Nvidia’s (NVDA) earnings are much higher than that of Cisco’s (CSCO) at the tech bubble’s peak, with Nvidia’s 12 months’ net profit of ~$45B outstripping Cisco’s at around $3B, DB said. In today’s money, the latter figure would only be worth double that, Reid said, also noting that Cisco (CSCO) had traded at over 200 times earnings.

“The trailing P/E ratio of Nvidia has dipped to around 60x from near 80x at the peak in recent weeks but if they can meet consensus net income forecasts over the next 4 quarters of around $65bn they will be on a trailing PE ratio of around 35x,” he said. Nvidia by 2027 is expected to earn nearly $100B of net income in the year, he said.

On the downside for Nvidia (NVDA), there’s no track record of sustainability for its exponential profit growth, Reid said. “It was only at the start of 2023 that trailing 12-month net income was less than $4.5B, lower on an inflation-adjusted basis than Cisco in 2000,” he said.

“So whether [the (NVDA) vs. (CSCO) chart] sees a big divergence going forward will likely all be about earnings and whether the recent run of spectacular beats continues,” he said.

Nvidia’s next earnings report is due on Aug. 28. Nvidia (NVDA) shares on Wednesday jumped +11% after Morgan Stanley added the semiconductor maker back to its top-picks list after the recent sell-off.

Some ETFs that include Nvidia (NVDA) include (USD), (SMH), (FFOG) and (VCAR).