Justin Sullivan

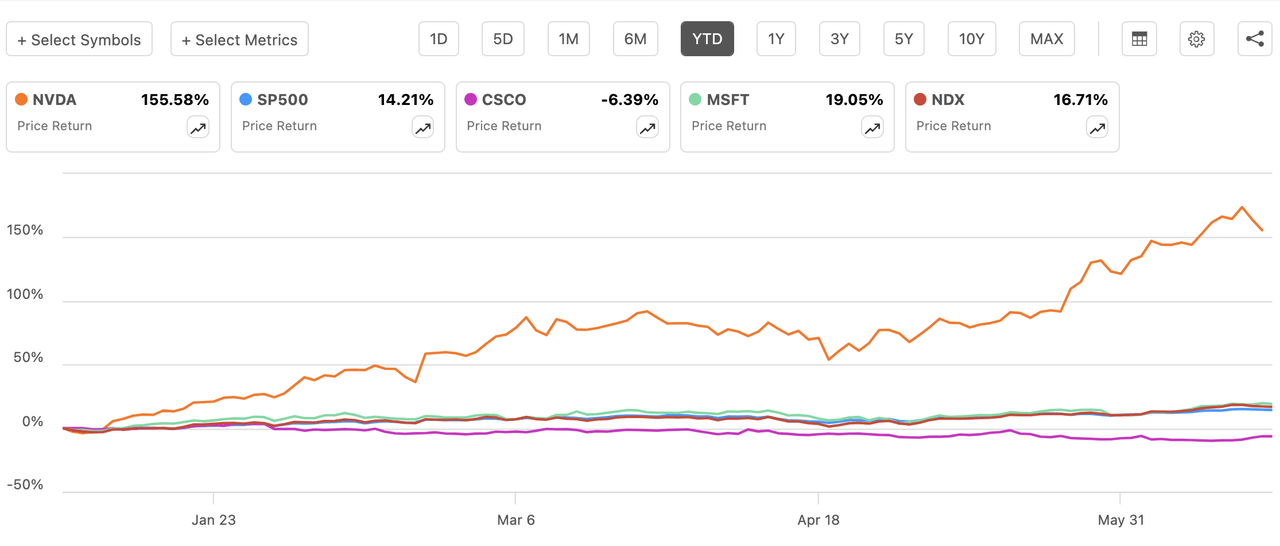

BTIG Chief Market Technician Jonathan Krinsky on Monday highlighted Nvidia’s (NASDAQ:NVDA) entrance into “unchartered territory” in becoming one of the largest U.S. companies. While Nvidia (NVDA) stock on Monday notched its third straight loss, its YTD gain remains mighty.

Nvidia (NVDA) shares lost 6.7% on Monday. The market capitalization has been cut by +$500B, pulling the company just below the $3T market cap level held by only Microsoft (MSFT) and Apple (AAPL). But the stock is still up +138% YTD, among the top S&P 500 (SP500)(SPY)(VOO) performers.

Nvidia this month briefly overtook MSFT and AAPL as the most valuable company. The AI chipmaker (NVDA) recently traded ~100% above its 200-day moving average. Krinsky said since 1990, the widest spread any U.S. company has traded above its 200-DMA while it was the largest company was 80%. Cisco (CSCO) held that distinction in March 2000, and on March 24, 2000, the networking equipment maker marked its all-time high along with the Nasdaq-100 (NDX).

“In other words, NVDA is in a league of its own,” Krinsky said. He highlighted other market data points:

- While fundamentals are much different, in the last five years, (NVDA) is up ~4,280% compared with (CSCO)’s gain of ~4,460% gain in the five years leading up to its peak.

- Over the last 18 months, (NVDA) is up 827%, double that of (CSCO)’s 18-month gain into 2000.

- More broadly, large-cap tech/growth funds including (VUG), (XLK), (SMH) and (MGK) last week had some of the biggest inflows on record. “That feels like a sign of froth after the run we have had,” Krinsky said.

- The Nasdaq-100 (NDX) has had 379 trading days without a 2.5% down day, the longest streak in history, going back to 1985.

“We remain concerned about a near-term unwind of many YTD leaders,” the strategist said. However, even within the so-called Magnificent 7 group of stocks, he said he’s seeing dispersion and charts like Amazon (AMZN) and Alphabet (GOOG)(GOOGL) are “still constructive and not overly stretched.”

The market next week will enter July trade. July is a well-known bullish month, with the Invesco QQQ Trust ETF (QQQ) not logging a losing July since 2007.

“If we don’t get a meaningful pullback this week, then we would be hard-pressed to look for further strength in July as it would appear that some of it was pulled forward,” Krinsky said.