David Becker/Getty Images News

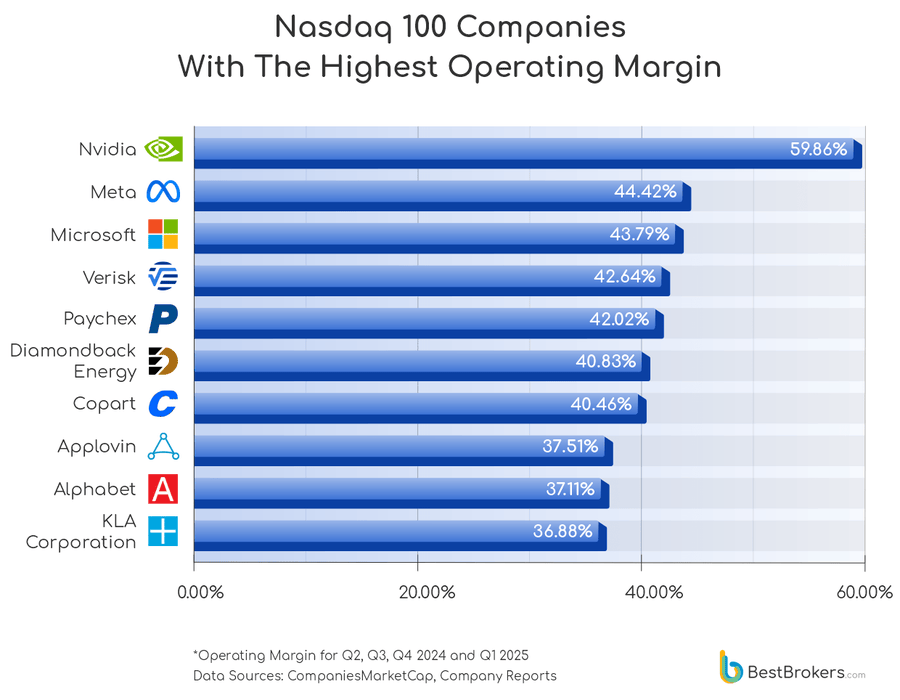

AI chip manufacturer giant Nvidia (NASDAQ:NVDA) has emerged as the most efficient among the “Magnificent 7” companies, with an operating margin of 59.86% for the past four quarters, according to recent research from BestBrokers.com.

The world’s most valuable company, with a market capitalization of $4.3T, has demonstrated exceptional operational efficiency, reflecting its dominance in high-margin markets like AI and semiconductors, while Tesla (NASDAQ:TSLA) sits at the bottom with just 8.76%.

Meta (META) follows in second place with an operating margin of 44.42% for the trailing 12 months, with Microsoft (MSFT), which recently reached a $4T in market cap, ranking third among the tech giants, the research shows.

Tesla’s (NASDAQ:TSLA) position at the bottom of the list comes amid CEO Elon Musk’s short-lived political career, protests against the company, and strong competition from China’s EV maker BYD (OTCPK:BYDDF), resulting in drops in both revenue and profits, according to the BestBrokers.com analysis.

Nasdaq companies with the highest operating margin (CompaniesMarketCap, Company Reports, BestBrokers.com)

To conduct this analysis, the team at BestBrokers gathered financial data on 1,189 companies with market capitalizations exceeding $10B across 39 major industries. The researchers calculated average operating margins for each sector using quarterly data for the last 12 months and grouped companies by country to determine regional averages.

“Nvidia’s (NASDAQ:NVDA) exceptionally high margin of 59.86% reflects its position as a market leader in GPUs for AI and gaming,” said Paul Hoffman, financial expert and editor in chief at BestBrokers.com. He added that “sustainable growth depends not only on expansion but also on disciplined cost control and strategic positioning within high-margin markets,” highlighting the importance of scalable business models and operational efficiency in driving profitability.

In addition, Port Operations (38.5%), Finances & Investments (32.4%), Tobacco (31.2%), and Railway Operations (30.1%) displayed the highest average operating margins.

Among automakers, luxury carmaker Ferrari (RACE) leads with a 28.7% operating margin, nearly double that of Toyota (TM) at 15.4%, with both far exceeding the industry average of 4.8%, the research revealed.

Ferrari’s (RACE) business model, centered on limited production of just 13,752 vehicles in 2024 and premium pricing, contrasts sharply with Toyota’s (TM) approach, which leverages production efficiency and supply chain management to achieve strong margins at scale across a wide range of vehicles, according to the BestBrokers.com findings.

At the other end of the spectrum, early-stage EV startups like Rivian (RIVN) face significant challenges, with the U.S. electric vehicle company reporting an operating margin of -70.3% due to heavy investments in R&D, manufacturing, and ongoing production challenges, the research indicated.