Alistair Berg

Stocks have been on the rise in recently, but Interactive Brokers (IBKR) said reduced net buying on its trading platform suggests clients may be feeling cautious before the Federal Reserve’s policy meeting set to conclude on Wednesday.

Large-cap equities have advanced largely as investors see the possibility of the Fed making a deep rate cut of 50 basis points on Wednesday. The benchmark S&P 500 (SP500)(NYSEARCA:SPY)(NYSEARCA:IVV) on Tuesday hit a new intraday high of 5,670.81, and last week’s 4% gain during volatile September trade marked its week since October 2023.

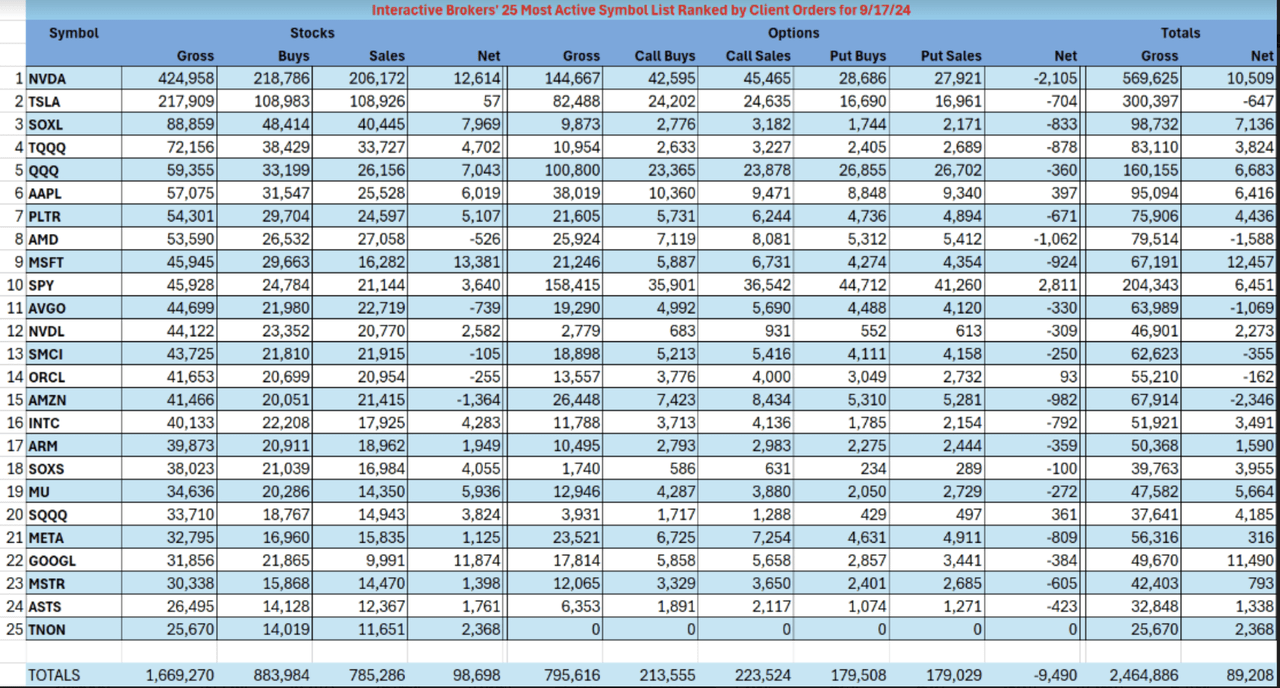

Tech sector behemoths Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA) occupied familiar first and second spots on IBKR’s weekly list of the 25 most-active symbols. But “somewhat surprising” about the list was net buying coming in “quite modest” compared with recent reports, IKBR’s Chief Strategist Steve Sosnick said in a note accompanying the list Tuesday.

In Nvidia (NVDA), net buying of shares was 12.6K in the week ended Tuesday versus 107.7K in the week ended Sept. 10, and 92.6K in the run ended Sept. 2.

“Considering that we have seen stocks rally quite consistently over the past few days, it indicates that our customers are not buying into the latest rise,” Sosnick said. “Perhaps they are displaying some risk aversion ahead of the upcoming FOMC meeting.”

There was an “even greater preponderance of leveraged products” among symbol leaders this week, Sosnick said. Among the “bullish variety” were exchange-traded funds Direxion Daily Semiconductor Bull 3X Shares (NYSEARCA:SOXL), ProShares UltraPro QQQ (NASDAQ:TQQQ), and GraniteShares 2x Long NVDA Daily (NASDAQ:NVDL).

For the bears, the Direxion Daily Semiconductor Bear 3X Shares ETF (NYSEARCA:SOXS), and the ProShares UltraPro Short QQQ (NASDAQ:SQQQ) were in the top 25 list.

See below for the full data on the IBKR 25 most-active list: