Antonio Bordunovi/iStock Editorial via Getty Images

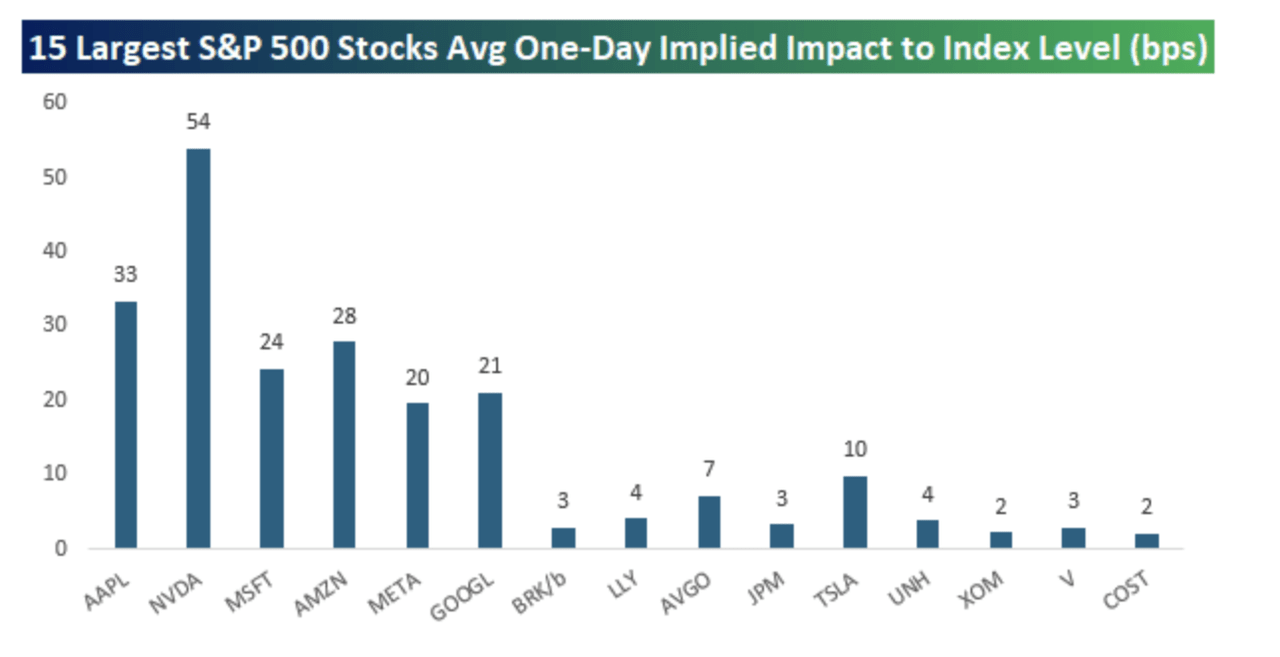

In one of many ways to illustrate Nvidia’s (NASDAQ:NVDA) market influence, Bespoke Investment Group shared a chart showing the tech behemoth’s impact on the S&P 500 (SP500) after its earnings reports “towers” over all other stocks delivering financial results.

The “average” reaction to Nvidia (NVDA) earnings coupled with its market cap translates into a one-day impact of 54 basis points, or 0.5%, on the S&P 500 (SP500), the firm said Wednesday before the AI chipmaker released its Q2 report. Heading into the report, Nvidia (NVDA) had a $3.2T market cap and 6.7% weight in the S&P 500 (SP500).

Apple (AAPL), the world’s most-valuable company, has a 33bp one-day impact on the benchmark (SP500) after its quarterly figures, and Amazon (AMZN) is the only other stock with an impact of more than 25 bps, Bespoke said on its blog:

Bespoke said Nvidia stock (NVDA) itself averages a one-day move of +/- 8.1% when investors react to its earnings reports, tying Meta (META) for second in a ranking of the 15 most heavily weighted S&P 500 (SP500) stocks. Amazon (AMZN) is first, with an 8.3% average move in the online retailer’s stock following quarterly updates.

Nvidia’s (NVDA) impact on the benchmark doesn’t mean the S&P 500 (SP500) is locked-in for a 0.54% move on Thursday, Bespoke said. “There have been plenty of quarters where NVDA’s one-day reaction to earnings has been well less than 8%, including four of the last eight quarters where the one-day reaction to earnings was less than half of the average,” it said.

But history also shows there have been three quarters during that same span where NVDA’s (NVDA) one-day move tied to earnings was more than 10%, including a 24% jump in May 2023 in the session following its blowout Q1 report.

“Based on its current market cap, a 24% move in NVDA would equate to a 1.6% move in the S&P 500 – for just one stock,” Bespoke said Wednesday.