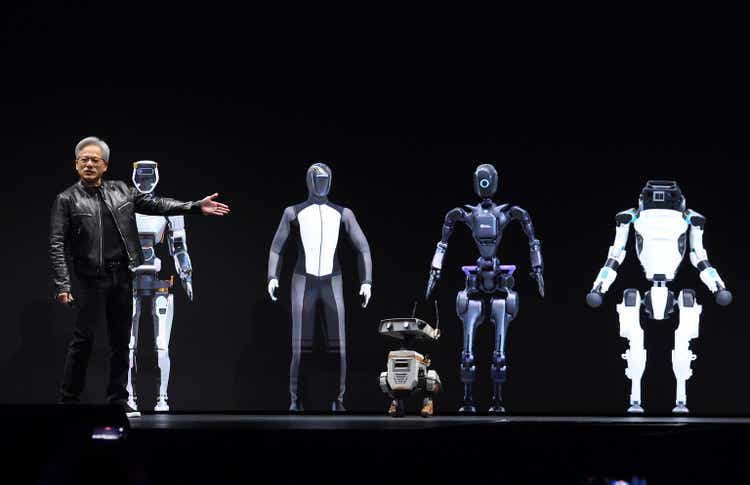

Justin Sullivan

Bank of America (BofA) suggested a way to hedge against the risk of a potential miss by Nvidia (NASDAQ:NVDA) when the world’s second-most valuable company releases its Q2 report this week.

Investors “may be underpricing the risk of disappointment,” and the “more attractive” avenue to hedge that risk is to buy puts on the S&P 500 (SP500)(SPY) than on Nvidia (NVDA) itself, Gonzalo Asis, vice president of BofA’s equity derivatives research team, said in a Sunday note. BofA saw the risk emerge with the early-August market selloff and volatility explosion (VIX), and with investors now keying in on upcoming interest rate cuts by the Federal Reserve.

“We think S&P put spreads offer better protection than NVDA-based hedges against this risk and its impact on the broader market (e.g. SPY 6-Sep 555-545 put spreads for over 5x max payout),” Asis said, and offered a few reasons:

- NVDA options imply a 10% move around earnings, but the stock hasn’t sold off more than 8% on the day of reporting since 2018

- The VIX (VIX) 65 episode of 5-Aug highlights the return of fragility for the broader equity market, and the S&P (SP500) has often remained fragile after such large shocks

- S&P puts offer protection from macro drivers such as next week’s release of the U.S. August jobs and ISM PMI reports, and investors “don’t need poor NVDA results to pay off.”

- S&P options are “cheap” relative to NVDA options, Asis said, and published this chart:

The $3.1T valued AI chipmaker (NVDA) is expected late Wednesday to post a surge to $0.64 in adjusted Q2 EPS on revenue that more than doubled to $28.67B.

Underscoring its market influence, BofA said Nvidia (NVDA) has added ~5ppts to the S&P 500’s (SP500) returns this year, and reaction to its earnings reports over the past six quarters have been highly correlated with the performance of stock indexes (SP500)(COMP:IND).

ETFs that hold Nvidia include (XLK), (USD), (SMH), and (VCAR).