BING-JHEN HONG

Oppenheimer Asset Management holds a bullish view on Nvidia (NASDAQ:NVDA) and lists the chip giant as a buy, highlighting specific support and resistance levels that investors should be aware of.

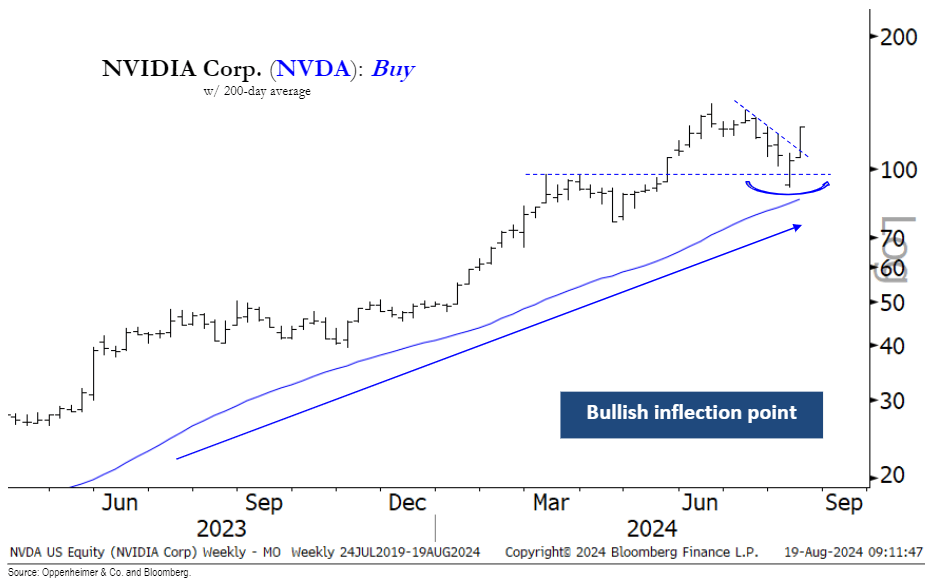

“Key positives for NVDA remain the stock’s bullish trend, high-momentum score, and portfolio tailwinds from a relatively strong Technology sector. In terms of trading, NVDA has inflected positively above the bullish slope of its 200-day average indicating a resumption of the stock’s uptrend, in our view,” Oppenheimer Asset Management said in an investor note on Monday.

Currently, shares of NVDA trade at $130 and are 7.6% away from the chipmaker’s all-time trading high of $140.76 which was recorded back on June 20.

Furthermore, as for key levels of support and resistance, Oppenheimer Asset Management noted a handful of important trading areas that traders and investors should watch for.

Support: The investment firm sees support at $120 which is the stock’s 50-day moving average. Also, $106, which is NVDA’s 100-day moving average, and $90, which is the stock’s August low.

Resistance: As for resistance, Oppenheimer is observing $125 which is the July 17 gap, $136 (July peak), and $141 (June peak).

See the below chart provided by Oppenheimer Asset Management:

For broader exposure towards Nvidia, investors can also look towards exchange-traded funds, as 526 ETFs hold positions in the chipmaker. Highlighted below are the five funds that have the largest portfolio allocation towards shares of Nvidia. Not included are single stock focused funds.

- ProShares Ultra Semiconductors ETF (USD) has a 30.69% allocation towards NVDA.

- Strive U.S. Semiconductor ETF (SHOC) has a 26.85% allocation towards NVDA.

- Simplify Volt TSLA Revolution ETF (VCAR) has a 20.74% allocation towards NVDA.

- AXS Esoterica NextG Economy ETF (WUGI) has a 19.65% allocation towards NVDA.

- VanEck Semiconductor ETF (SMH) has a 19.61% allocation towards NVDA.