Jonathan Kitchen

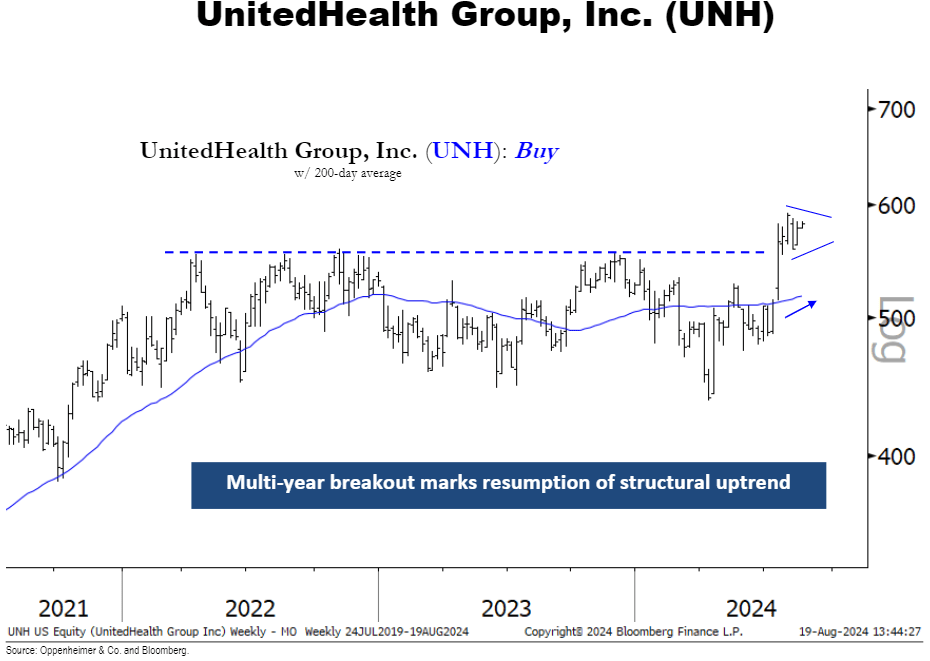

Oppenheimer Asset Management is bullish on UnitedHealth (NYSE:UNH) stock and says the company “exhibits the strongest trend in the managed care sub-industry.” The financial institution also noted that the Dow 30 component can push up to $650 and rated its shares Buy.

“UNH’s rally above $550 marks a multi-year breakout in trend and a resumption of the stock’s structural uptrend, in our view. This breakout point is now support and, by our analysis, measures towards $650; this is the height of the prior range projected from breakout point,” Oppenheimer Asset Management said.

Currently, UNH trades at $582 a share and is above its 10-, 50-, 100-, and 200-day moving averages and is just 1.5% away from its all-time trading high of $591.54 a share which was recorded back on August 2.

Moreover, over the course of the 2024 trading year, UNH has been able to advance by 10.6% while also gaining 16.8% over the longer 1-year timeframe.

See the chart below provided by Oppenheimer Asset management:

For broader exposure towards UnitedHealth (UNH), investors can also look towards exchange-traded funds, as 356 ETFs hold positions in the health care firm. Highlighted below are the five funds that have the largest portfolio allocation towards shares of UNH.

- iShares U.S. Healthcare Providers ETF (IHF) has a 24.16% allocation towards UNH.

- Global X Dow 30 Covered Call ETF (DJIA) has a 9.31% allocation towards UNH.

- Health Care Select Sector SPDR Fund (XLV) has a 9.31% allocation towards UNH.

- Global X Dow 30 Covered Call & Growth ETF (DYLG) has a 9.30% allocation towards UNH.

- SPDR Dow Jones Industrial Average ETF Trust (DIA) has a 9.28% allocation towards UNH.