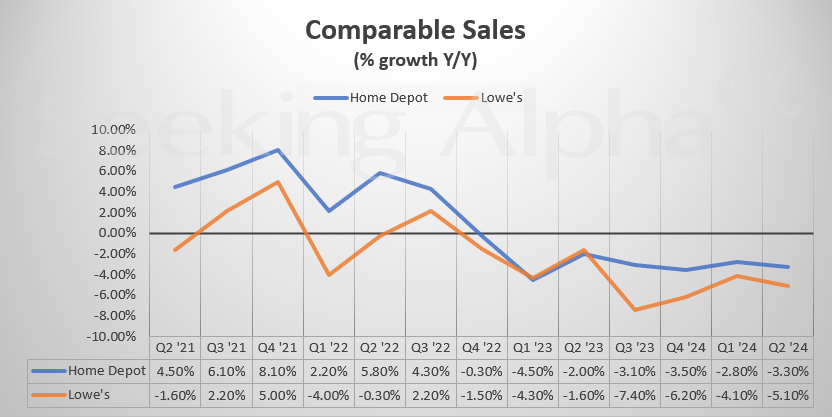

In 2Q24, both Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) reported declining comparable sales, reflecting ongoing challenges in the home improvement retail sector.

Home Depot (HD) saw a comparable sales decrease of 3.3%, and Lowe’s (LOW) experienced an even steeper decline, with a comparable sales drop of 5.1%, continuing a trend of declining sales over the past seven few quarters, indicating a slowdown in consumer spending on home improvement projects.

While both companies have faced headwinds such as inflation, rising interest rates, and a cooling housing market, Lowe’s has been hit harder than Home Depot. This could be due to differences in customer demographics, product mix, or operational strategies.

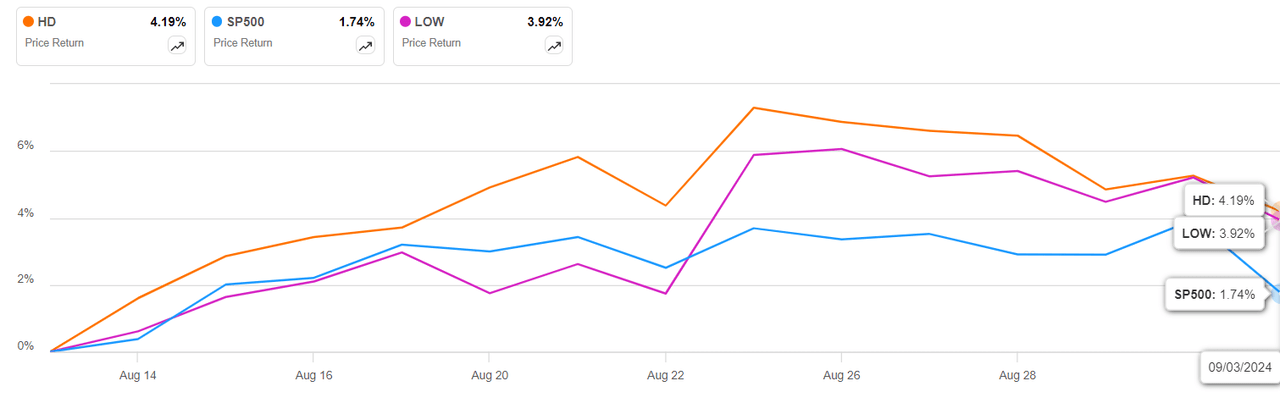

Interestingly, since Home Depot reported upbeat results and reduced its guidance on August 13th, and Lowe’s announced mixed results and a guidance cut on August 20th, both the stocks have managed to outperform the broader market index. This suggests that investors may be more optimistic about their ability to navigate the current economic environment and potentially recover in the future.