Walter Bibikow

Barclays downgraded the retail sector as a whole to Neutral from Positive. Analyst Adrienne Yih warned of an erosion of inventory margin recapture as promotional activity intensifies and demand weakens. Yih said that in a leverage phase of margin expansion, only a minority of companies with company-specific drivers can accelerate sales growth faster than fixed cost growth.

“We believe that promotions are eating into the still-high average unit retails and margins of many companies. From this point in the recovery cycle, the only way to drive further margin expansion is leverage from accelerating sales above fixed-cost growth. We now believe that the majority of forward outlooks have far less upside opportunity and, in fact, potential risk to sales and margins in 2H24.”

Amid Barclays’ negative assessment of the retail sector, the firm pointed to some specific potential outperformers and underperformers. Despite the slowing consumer backdrop, Yih and her team still favor companies that stand to benefit from the denim-based silhouette shift. That list includes Gap (GPS), American Eagle Outfitters (AEO), and Urban Outfitters (URBN). The firm also sees upside for companies that stand to benefit from a restocking of brands that have strong momentum with the consumer, such as Dick’s Sporting Goods (DKS). Retailers that Barclays is extra cautious on include Bath & Body Works (BBWI), Victoria’s Secret & Co. (VSCO), Lululemon Athletica (LULU), and Ulta Beauty (ULTA). Those retailers are seen being in harm’s way of more share price pressure.

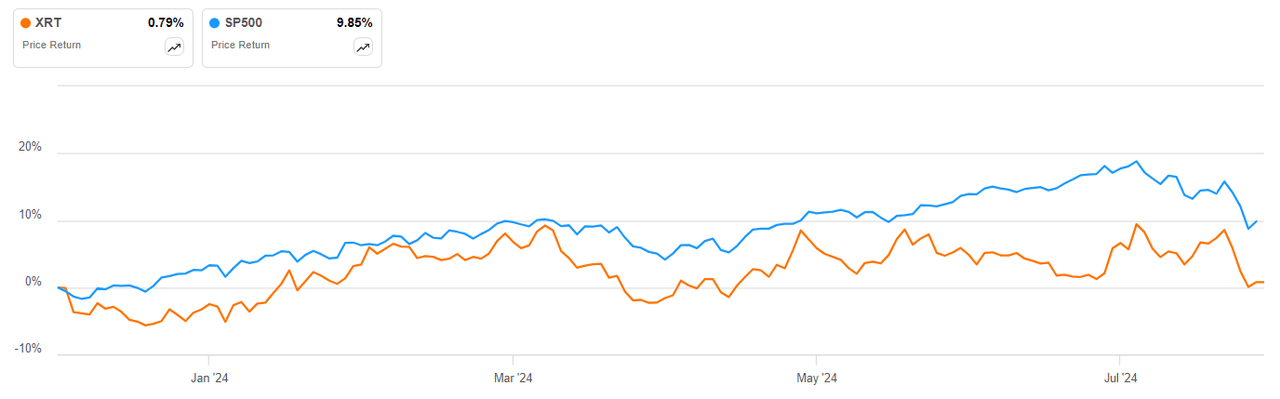

The retail sector has already underperformed the broad market this year, despite the heavy lifting by Amazon (AMZN), Walmart (WMT), and Costco (COST). If the dark days do arrive for the retail sector, Walmart (WMT) has a long history of outperforming the sector.