Speculation over the future of Warner Bros. Discovery (WBD) has intensified after Netflix (NFLX) moved to formalize its interest, setting the stage for a high-stakes contest in the media and entertainment sector.

In a regulatory filing released Tuesday, Netflix disclosed an updated proposal to acquire key parts of Warner Bros. Discovery in an all-cash transaction valued at $27.75 per share. The bid targets the company’s core studios and streaming operations, while its traditional television networks would be separated into a standalone entity under Discovery Global.

The revised offer places Netflix in direct competition with a rival proposal backed by Paramount Skydance (PSKY). That group has put forward a higher headline price of $30 per share, but its bid encompasses the entirety of Warner Bros. Discovery, including its legacy TV assets—an approach that carries greater structural complexity and execution risk.

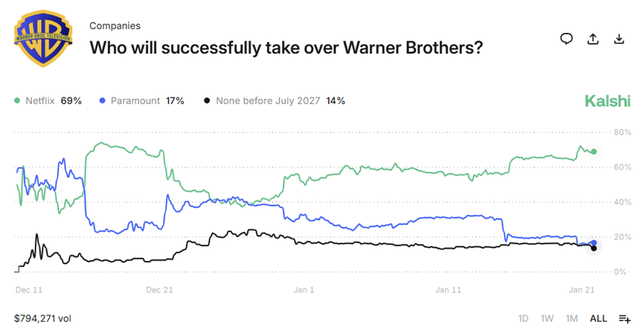

Prediction markets suggest investors see Netflix as the frontrunner. Data from Kalshi shows a 69% implied probability that Netflix ultimately prevails, compared with a 17% chance for Paramount Skydance. Another 14% of market participants are betting that no transaction is completed before July 2027.

See the below visual chart:

Kalshi (WBD Takeover)