G0d4ather

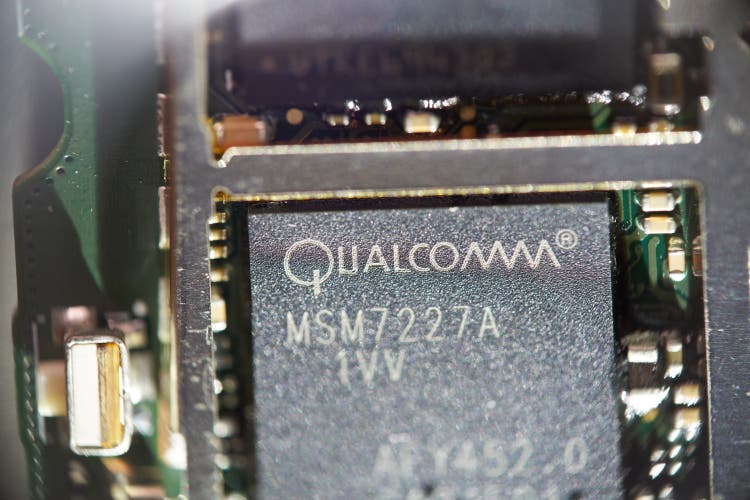

- Qualcomm (NASDAQ:QCOM) and Synaptics (NASDAQ:SYNA) were downgraded by KeyBanc Capital Markets on Tuesday after the research firm concluded what it called a “mixed” supply chain check in the semiconductor space.

- Qualcomm shares fell 1.2% in premarket trading, while Synaptics was off 1%.

- Analyst John Vinh cut Qualcomm to Sector Weight from Overweight amid increased competition worries from Apple (AAPL), more competition in the smartphone market and the belief that it would emerge as a leader in the edge AI leader, which has not played out as previously thought.

- Synaptics was also cut to Sector Weight from Overweight on the belief that it will underperform its internet of things counterparts, amid “limited” catalysts in the enterprise and automotive markets. As such, it will be “extremely difficult” for Synaptics to reach its 57% gross margin target, Vinh added.

- The supply chain check also showed continued strength in the server and artificial intelligence markets, with Nvidia’s (NVDA) Blackwell line of GPUs on track to launch in the fourth quarter. That should bode well for AMD (AMD), Vinh said. Conversely, the checks were mixed for Broadcom (AVGO) and negatives for Monolithic Power Systems (MPWR), Marvell (MRVL) and Intel (INTC), Vinh added.

- Vinh also tweaked his estimates on Arm Holdings (ARM).

- Analysts are largely bullish on Qualcomm (QCOM). It has a BUY rating from Seeking Alpha authors, while Wall Street analysts rate it a BUY. Conversely, Seeking Alpha’s quant system, which consistently beats the market, rates MSFT a HOLD.