Real estate stocks outperformed the broader markets in January.

The S&P 500 Real Estate Index Sector (SP500-60) added 2.89% in the first month of 2026, against the benchmark S&P 500’s 0.89% gain. The accompanying State Street Real Estate Select Sector SPDR ETF (XLRE) was up 2.70%.

Comparatively, the Dow Jones REIT Indx Equity REIT Total Return Index (REIT:IND) rose 2.75% and the FTSE Nareit All Equity REITs index added 2.66%.

In January, tech-related selloff, geopolitical developments concerning Venezuela and Greenland, labor market and inflation data, beginning of the earnings season, the Federal Reserve’s pause in its interest rate cutting cycle, and President Trump’s nomination of Kevin Warsh to be the next Fed chair shaped the broader market gains.

Real estate stocks were the beneficiaries of soft inflation data and a strong start to the quarterly Wall Street earnings season. The sector was moderately able to retain the momentum through the remaining part of the month.

For the first week of February, the sector will see the quarterly earnings season pick up pace. Company news on profitability, revenue, and industry-specific challenges, and out-of-the-way announcements can impact stock prices.

Investor sentiment may also be affected by the January jobs report due for release on Friday.

Weekly Winners & Losers

Among largecap stocks, Digital Realty Trust (DLR) led the weekly gainers. The stock gained 4.27% from the prior week to close at $165.95 despite a tech-led selloff.

The Dallas-based data center REIT is set to report its fourth-quarter earnings next week, and analysts expect a year-over-year rise in numbers.

Equinix (EQIX) (+3.75% to $820.93) and Simon Property Group (SPG) (+3.56% W/W to $191.31) were the next on the list. The data center REIT and the retail REIT were also gaining ahead of their quarterly results announcement amid higher earnings expectations.

In the category, CoStar Group (CSGP) led the weekly losers. The Arlington-based company was gaining after activist hedge fund Third Point unveiled plans to start a campaign to push for new directors and restructure operations at the real estate services provider.

In response, CoStar announced board changes, a new $1.5B stock buyback program, and a redesigned executive compensation program for 2026. Nevertheless, the stock ended the week 6.25% lower at $61.50.

Healthpeak Properties (DOC) followed, losing 4.65% over the course of the week to close at $17.24.

The healthcare REIT is set to announce its Q4 earnings next week, and analysts estimate a marginal decline in funds from operations.

Mortgage REITs AGNC Investment (AGNC) (-3.80% W/W to $11.40) and Annaly Capital Management (NLY) (-3.64% W/W to $23.01) were the next on the list.

This week, AGNC reported a slowdown in Q4 interest income, while NLY signaled a capital shift toward non-agency strategies.

Among midcap stocks, Newmark Group (NMRK) (+4.33% to $17.83) and The St. Joe Company (JOE) (+3.58% to $66.19) were among the top weekly gainers.

Opendoor Technologies (OPEN) (-14.31% to $5.15), Fermi (FRMI) (-11.02% to $8.72), and Alexandria Real Estate Equities (ARE) (-8.46% to $54.64) led the losers.

For the smallcaps, Gladstone Land (LAND) (+15.90% W/W to $11.15) and Uniti Group (UNIT) (+12.43% W/W to $8.32) led the weekly gainers.

Two Harbors Investment (TWO) (-14.21% W/W to $11.47) and PennyMac Mortgage Investment Trust (PMT) (-11.78% W/W to $11.83) led the losers.

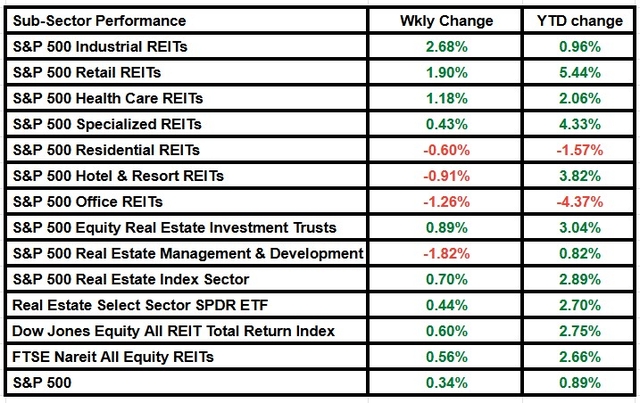

Here is a look at the subsector performances for the week:

Percentage-wise price change across real estate indices