asbe/iStock Unreleased via Getty Images

Energy drink sales accelerated to 7.7% year-over-year for a four-week period of retail sales tracked by Nielsen that ended on November 30. Monster Beverage (NASDAQ:MNST) saw energy drink sales increase 3.6% Y/Y, while Celsius Holdings (NASDAQ:CELH) saw its sales growth slow to 5.9% and its market share retreat back to 8.8% after being as high as 9.7% in September.

Notably, Monster Beverage (MNST) saw a price/mix increase of 5.2% during the tracked period to offset a 1.6% drop in volume, while Celsius Holdings (CELH) saw its 10.1% volume growth help to offset a 4.1% decline in price/mix.

Weighing in on the energy drink market, Evercore ISI analyst Robert Ottenstein said 2024 has to be considered the year of Red Bull. He highlighted that Red Bull’s dollar market share fell to 35.0% in 2023 from 36.9% in 2022, with most of the share losses going to Celsius, which saw its own share leap from 5.3% to 10.1%. However, Red Bull was noted to have fought back hard this year with its Red Edition and Amber Edition sugar-free innovations, which ramped in June and then the Winter Edition sugar-free in October. “These line extensions not only blunted Celsius’ growth, but also bit into Monster, which experienced share losses in 2023 and again in 2024 YTD,” maintained Ottenstein.

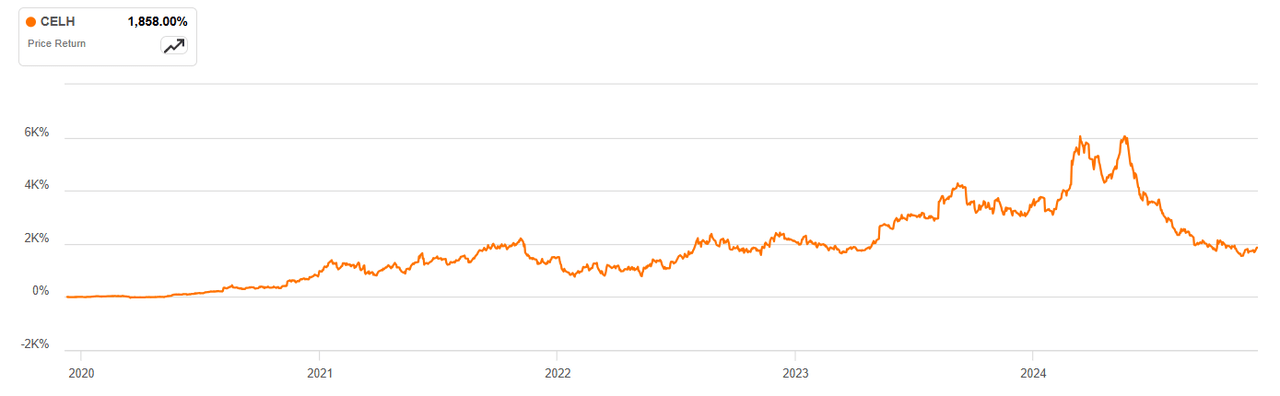

Shares of Celsius Holdings (CELH) have skyrocketed over a five-year period, but got ahead of themselves in early 2024 as investors bet on the company to see even higher sales growth and market share.

Those expectations were impacted when distribution partner PepsiCo (PEP) reduced its orders to optimize its own inventory level. In addition, the energy drink market faced heightened competition from brands such as Keurig Dr Pepper’s (KDP) Ghost Energy, Zoa Energy, and C4 Energy.

Monster Beverage (MNST) and Celsius Holdings (CELH) were both down about 1% in early afternoon trading on Wednesday.