Alexander Farnsworth

Citi is the latest firm to give Walmart (NYSE:WMT) credit for its “winning position” in the retail sector. It’s been a popular theme during 2024 as consumers have gravitated toward the world’s largest retailer by revenue.

Walmart (WMT) was noted to be been taking U.S. market share in food and grocery over the past several years, helped by its “mindshare” for value in an inflationary environment and breadth of convenience offerings.

Analyst Paul Lejuez and his team think the Bentonville giant’s Walmart Marketplace program will help drive higher sales and EBIT margins in the years ahead. Walmart’s W(MT) fulfillment services, data services, and advertising businesses were also noted to be humming along.

Citi boosted its price target on Walmart (WMT) to a Street-high $98.

The flip side of the Citi Walmart (WMT) trade is Dollar General (DG), which was cut to Sell from Neutral. Lejuez highlighted that Walmart (WMT) is being hurt competitively by Walmart’s (WMT) value and convenience propositions.

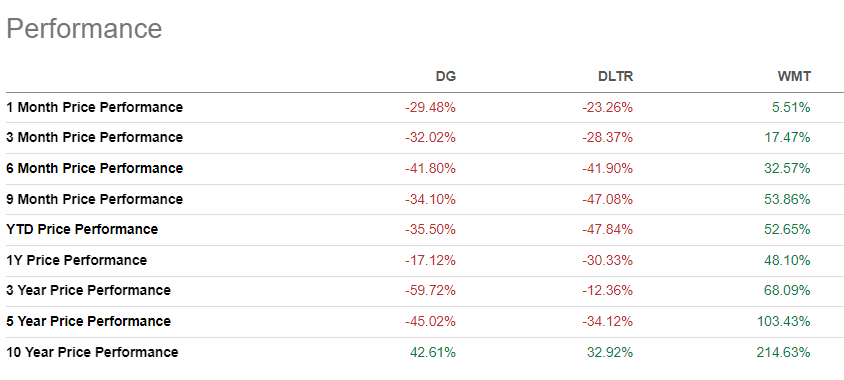

Shares of Walmart (WMT) moved up 0.33% in Friday morning trading and have rallied more than 50% on a year-to-date basis. Meanwhile, Dollar General (DG) is up 0.87% in early action, but has peeled off 30% in just six weeks.

Of course, Walmart’s W(MT) outperformance vs. the dollar store sector is nothing new.