Alexander Farnsworth

Dollar General Corporation (NYSE:DG) traded 29.7% lower on Thursday after a crushing Q2 earnings report that included a sharp drop in full-year guidance. The stock is heading for its worst trading day ever after the company warned on “financially constrained” customers.

The view from Wells Fargo is that the Dollar General (DG) turnaround efforts have clearly run into problems. “We believe the macro, competition, and underinvestment are taking a toll,” noted analyst Edward Kelly. While Dollar General (DG) management seems prepared to take more aggressive action, Kelly warned that the challenges remain. Specifically, Kelly thinks the retailer needs to make a large investment in labor (hours/rate) to restore confidence in the chain.

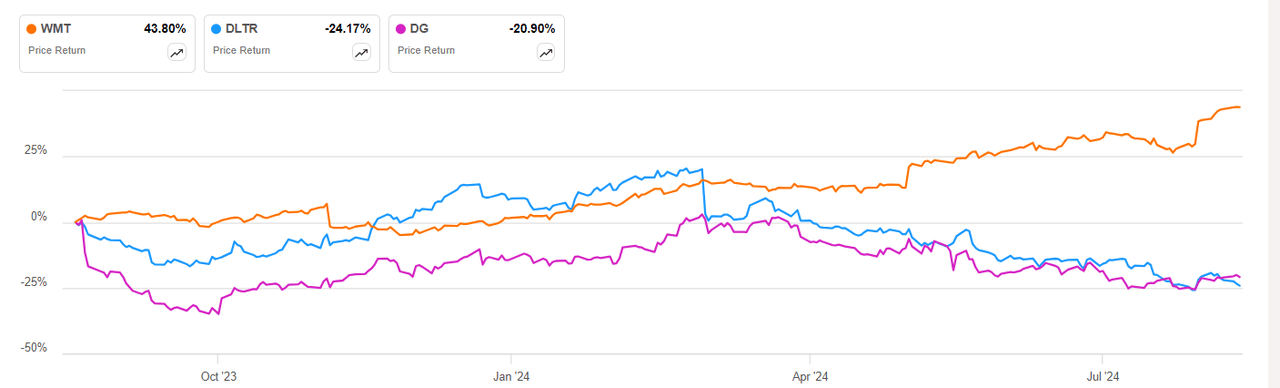

Clearly, the macroeconomic backdrop and pressure on lower-income consumers has been a factor in DG’s tough stretch, but Kelly also highlighted that intensified competition, especially from Walmart (NYSE:WMT), is also a consideration.

Evercore ISI analyst Michael Montano also said Dollar General’s (DG) results show the challenge of maintaining market share with Walmart (WMT) winning in a slower growth environment.

On Seeking Alpha, Investing Group Leader Leo Nelissen said Walmart, Aldi, and ultra-low-cost brands such as Temu are all disrupting Dollar General’s (DG) business model by providing even more lower-priced items to consumers and value at scale.

Within the broad discounter sector, Dollar Tree (NASDAQ:DLTR) was down 9.85%, Ollie’s Bargain Outlet Stores (OLLI) was 5.52% lower after its own Q2 report weighed, BJ’s Wholesale Club (BJ) moved down 2.50%, and Target (TGT) peeled off 2.15%. Big Lots (BIG) was in even worse shape, with a decline of 37.5% amid bankruptcy rumors. Meanwhile, Walmart (WMT) only shed 0.20% on Thursday and still traded very close to its all-time high.