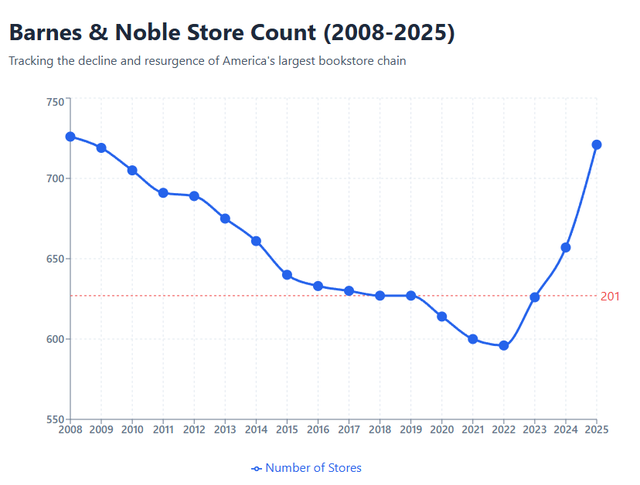

Barnes & Noble’s retail comeback is one of the most surprising turnarounds in the retail sector, as the chain defied predictions that physical bookstores were destined for extinction.

Just 25 years ago, the company seemed headed for the same fate as Borders, Book World, BookPeople, WaldenBooks, and B. Dalton after closing locations due to the rise of Amazon (AMZN) and e-commerce book buying. While Barnes & Noble survived, for years the company cycled through CEOs and struggled to find its identity.

The turning point came in 2019 when Elliott Advisors acquired Barnes & Noble and brought in James Daunt. The chain reverted to its bookstore roots, and Daunt gave individual store managers unprecedented autonomy to curate their own inventory based on local tastes. Barnes & Noble also became a more inviting space to relax or hold a small meeting during the same time period that certain Starbucks (SBUX) and Panera (PANERA) started to resemble a mosh pit of pick-up orders. Barnes & Noble has also benefited from the BookTok phenomenon on TikTok (TIKTOK), as the social media movement made book buying feel participatory and social rather than solitary.

After bottoming out around 600 stores, Barnes & Noble opened approximately 30 new stores in 2023, 61 in 2024, and 67 in 2025. As of November 25, there were 721 Barnes & Noble locations. The company plans to open 60 additional stores in 2026.

Seeking Alpha

The Barnes & Noble revival is also seen by some analysts as representing a broader cultural shift. Physical books have proven surprisingly resilient against digital alternatives, with print book sales consistently outperforming e-books in recent years. Younger generations, despite being digital natives, have shown strong interest in physical books, vinyl records, and other tangible media. Recent surveys indicate that a large percentage of Generation Z (currently aged 13 to 28) prefer to read print books, while Millennials (currently aged 29 to 44) have displayed a surge of nostalgia for chains such as Barnes & Noble and GameStop (GME). The potential takeaway for investors is that Barnes & Noble’s story demonstrates that even in the digital age, physical retail can thrive when it offers genuine value.

Barnes & Noble is widely expected to come back to the public markets in 2026 through a combined IPO with UK bookstore chain Waterstones.