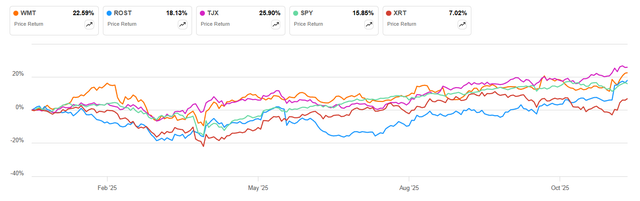

Three of the biggest outperformers in the retail sector in 2025 are Walmart (WMT), Ross Stores (ROST), and TJX Companies (TJX). While Walmart (WMT) operates a global omnichannel discount and grocery network that is a retail juggernaut, TJX (TJX) and Ross (ROSS) run off-price chains offering branded apparel and home goods at significant discounts to traditional department stores.

The trio have carved out more market share this year in an environment in which consumers are trading down to high prices in certain categories. A string of solid earnings reports and raised guidance has also boosted investor sentiment that the three retailers will continue to be the go-to value destinations for shoppers.

Seeking Alpha

Walmart (WMT) is up 23.4% on a year-to-date basis and carved out a new all-time high of $111.66 earlier in the session. Walmart (WMT) has the 9th best share price return out of Dow 30 stocks over the last year, notably outpacing Amazon (AMZN). Analysts on Wall Street have Walmart (WMT) slotted with a consensus Strong Buy rating, while Seeking Alpha analysts are collectively more cautious with a Hold rating.

Ross Stores (ROST) has gained 18.0% this year and swapped hands at an all-time high of $178.78 in afternoon trading. Following the company’s Q3 earnings report, Jefferies analyst Corey Tarlowe highlighted that Ross Stores (ROST) is winning on traffic, not ticket, which sets it apart from retail peers and positions it for strong holiday comparable sales growth. “Under the new CEO, an aggressive marketing refresh and strong new store performance (including a new NYC location) are driving momentum,” wrote Tarlowe.

TJX Companies (TJX) traded at its all-time high on November 26 and is up more than 26% in 2025. Analyst Robert Drbul noted that TJX (TJX) sees itself as successful with its pricing strategy. “Importantly, TJX doesn’t lead the pricing strategy, the company waits for the market to move,” updated Drbul.