Rosenblatt Securities began coverage of quantum computing stocks Rigetti Computing (RGTI) and Quantum Computing (QUBT) with Buy ratings.

Shares of Quantum Computing jumped about 3%, while Rigetti Computing climbed around 1% premarket on Thursday.

Quantum Computing (QUBT)

Rosenblatt initiated QUBT with a Buy rating and a $22 price target.

“Quantum Computing Inc. (QCi) has legitimate quantum assets across photonics, compute, security and sensing as well as burgeoning thin film lithium niobate (TFLN) fabs that could supply both their and industry needs for integrated quantum photonics, nonlinear optics and optical waveguides,” said analysts led by John McPeake.

The analysts noted that the company is also in the process of acquiring fabs (LSI) from Luminar for less than five times revenue that should improve the P&L optics and further diversify their business into another key laser market. With a total of $1.6B in cash (no debt), the company’s interest income is currently more than their operating expenses, according to the analysts.

“We like the risk-reward here with an immediate opportunity to participate in quantum computing, a fab-driven chance to see their current products put on chips and acquire customers in the fast growth optical communication sector, a view into developing a photonic gate-based quantum computer, and finally the possibility to drive quantum security deep into everyday consumer edge devices,” said McPeake and his team.

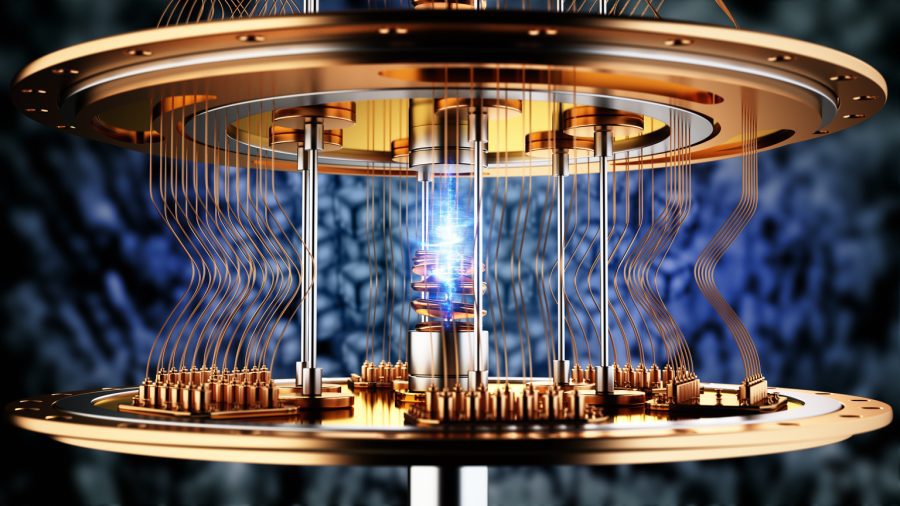

Rigetti Computing (RGTI)

The firm started coverage of Rigetti with a Buy rating and a $40 price target.

“We like Rigetti’s modular approach to qubit scaling and their internal fab approach. Although error rates and timelines are a bit of an issue right now, we are giving them the benefit of the doubt relative to the postponed Cepheus 99.5% two qubit gate fidelity target in 1Q. Last week, the company announced that their modular 108 physical qubit Cepheus-1-108Q system would be a few months late as they were having issues with their two-qubit gate error rate of 99.0% vs. their target of 99.5%, but the company just (1/13/26) reiterated their ability to resolve the issue by the end of 1Q,” said McPeake and his team.

The analysts noted that superconducting peers IBM (IBM) and privately held IQM have reported 99.92% and 99.85% two-qubit gate error rates respectively, so Rigetti does need to get its error rates down to be more competitive.

In addition, the analysts said that, though still in development, superconducting peer D-Wave (QBTS) is heading towards potentially even lower error rates after the acquisition of Quantum Circuits.

The analysts said that Rigetti has its own quantum processing unit (QPU) fab, an installed base of 18 machines (6 at customers and 12 internally and exposed on the cloud), and a compelling way to network multiple QPUs together via tunable couplers.

“Finally, the company’s work with leading quantum error correction (QEC) partner Riverlane is promising over the medium to long term,” said McPeake and his team.