Amanda Wayne

The Industrial Select Sector SPDR Fund ETF (XLI) jumped +3.72% for the week ended Sept.13, while the SPDR S&P 500 Trust ETF (SPY) soared +4.01%, amid expectations of a Federal Reserve interest rate cut next Wednesday.

Industrials was among the 10 of the 11 S&P 500 sectors which ended the week in the green. Year-to-date, or YTD, XLI has risen +14.55%, while SPY has surged +18.24%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +16% each this week. YTD, 4 out of these 5 stocks are in the green.

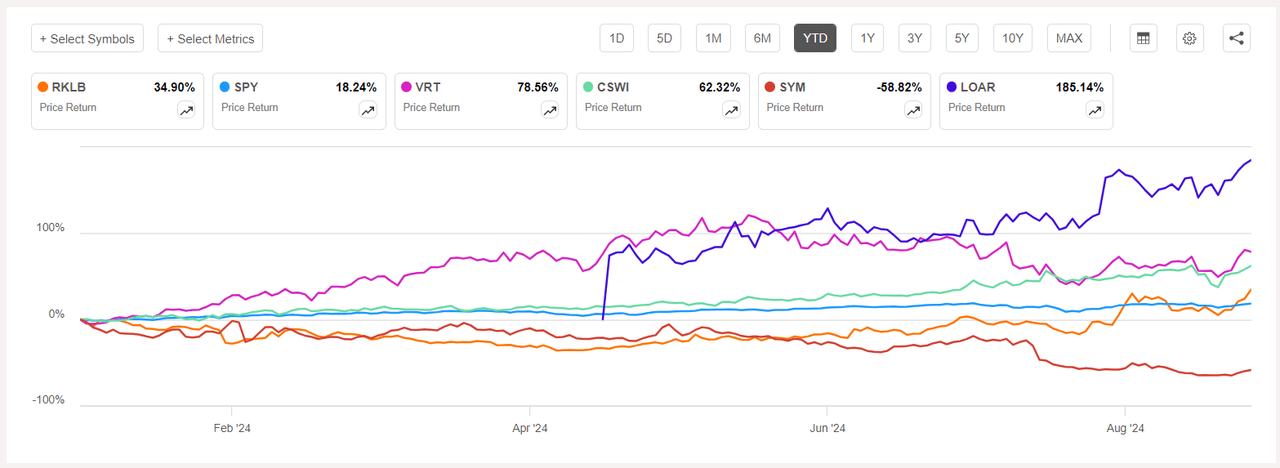

Rocket Lab USA (NASDAQ:RKLB) +28.40%. The shares of the space company soared the most on Friday (+8.75%) amid the backdrop of the first-ever private spacewalk conducted by civilian astronauts Jared Isaacman and Sarah Gillis, who had boarded the SpaceX spacecraft. YTD, +34.90%.

RKLB has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of D- for Profitability and A- for Growth. The average Wall Street Analysts’ rating differs and has a Buy rating, wherein 7 out of 13 analysts tag the stock as Strong Buy.

Vertiv (VRT) +19.49%. The Westerville, Ohio-based company — which makes products for data centers and communication networks — saw its stock rise the most on Wednesday (+9.17%) this week. YTD, +78.56%.

The SA Quant Rating on VRT is Hold, with a score of F for Valuation but A+ for Momentum. The average Wall Street Analysts’ Rating disagrees and has a Strong Buy rating, wherein 11 out of 14 analysts see the stock as such.

The chart below shows YTD price-return performance of the top five gainers and SPY:

CSW Industrials (CSWI) +18.13%. The Dallas-based building products maker’s stock jumped +9.93% on Monday. The stock is set to join S&P SmallCap 600 from Sept. 23. YTD, +62.32%. The SA Quant Rating on CSWI is Hold, while the average Wall Street Analysts’ (2 in total) Rating is Buy.

Symbotic (SYM) +17.51%. Shares of the automation technology company, which serves warehouses, saw its stock climb the most on Wednesday (+8.51%). The stock was the top decliner two weeks ago. YTD, -58.82%. The SA Quant Rating on SYM is Strong Sell, which is in contrast to the average Wall Street Analysts’ Rating of Buy.

Loar (LOAR) +16.61%. The company — which makes components for aircraft, and aerospace and defense systems — saw its stock increase throughout the week, with the most on Monday (+6.81%). The stock has swung between being in the top five gainers and decliners in the past one month. YTD, +63.61%. The average Wall Street Analysts’ Rating on LOAR is Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -3% each. YTD, 3 out of these 5 stocks are in the red.

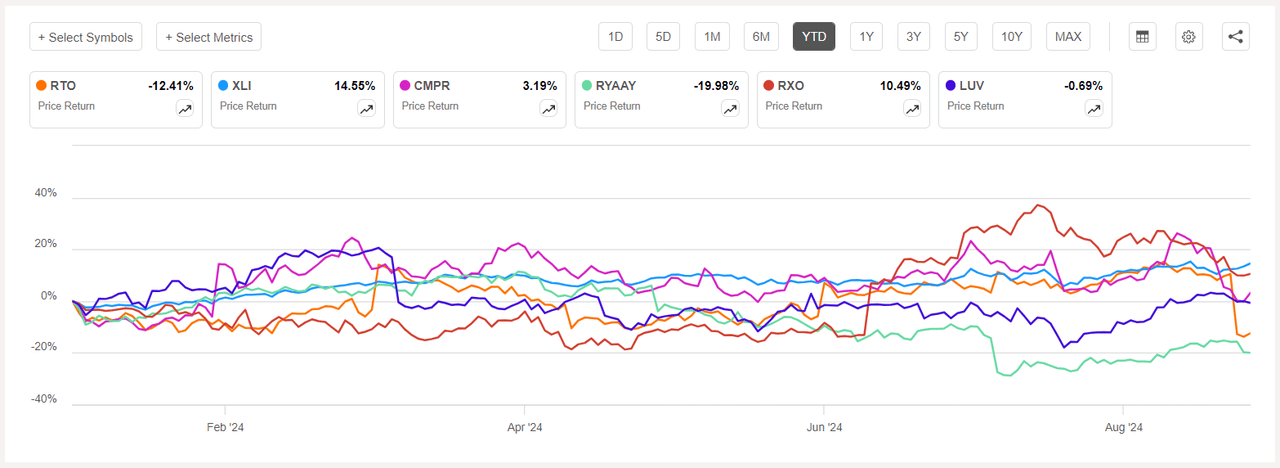

Rentokil Initial (NYSE:RTO) -18.98%. The U.K.-based company’s stock slumped -21.04% on Wednesday after the pest control firm gave a profit warning, hit by a slowdown in North America. YTD, -12.41%.

The SA Quant Rating on RTO is Hold, with a factor grade of D for Growth and B for Profitability. The average Wall Street Analysts’ Rating disagrees and has a Buy rating, wherein 2 out of 4 analysts view the stock as such.

Cimpress (CMPR) -8.99%. Shares of the Irish company, which provides customization of printing and related products, fell -7.02% on Monday. Later in the week, the company announced an offering of $525M of senior notes due 2032. YTD, +3.19%.

The SA Quant Rating on CMPR is Hold, with a score of C+ for Momentum and A- for Valuation. The average Wall Street Analysts’ (2 analysts in total in this case) Rating differs and has a Strong Buy rating.

The chart below shows YTD price-return performance of the worst five decliners of the week and XLI:

Ryanair (RYAAY) -5.04%. The Irish airline’s stock dipped the most on Thursday -4.85%. YTD, -19.98%. The SA Quant Rating on RYAAY is Hold, which is in contrast to the average Wall Street Analysts’ Rating of Strong Buy.

RXO (RXO) -3.82%. The trucking company’s stock fell -4.52% on Tuesday after pricing an upsized $500M common stock offering. YTD, +10.49%. The SA Quant Rating on RXO is Buy, which is in contrast to the average Wall Street Analysts’ Rating of Hold.

Southwest Airlines (LUV) -3.43%. On Tuesday, the company announced major board changes after meeting with Elliott Investment Management. YTD, -0.69%. The SA Quant Rating on LUV is Hold, and the average Wall Street Analysts’ Rating concurs with a Hold rating of its own.