Alistair Berg

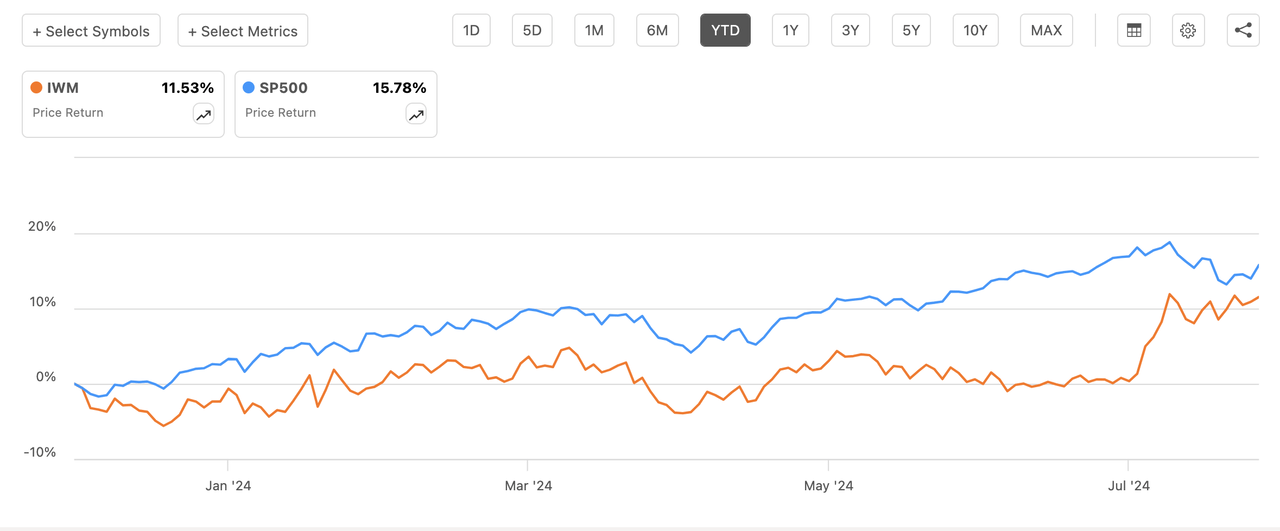

Cooling inflation sparked a jump in small-cap stocks in July, leaving their key index with its best performance in eight months.

The Russell 2000 (RTY) climbed 10.4% in July, and drew the iShares Russell 2000 ETF (NYSEARCA:IWM) up 10.3%, with each gauge finishing with their strongest monthly advances since November 2023.

“Rotation” was the market’s buzzword in July, as investors snapped up small-cap stocks and other sectors of the equity market that have lagged strong gains in tech stocks, including mega-cap AI bellwether Nvidia (NVDA). Softer June CPI inflation data prompted investors to revive prospects of the Federal Reserve delivering multiple rate cuts this year.

Traders in the fed funds futures market were pricing in cuts in September, November and December. Federal Reserve Chair Jerome Powell on Wednesday said there’s a possibility the rate-easing cycle will start in September.

Here’s a list of the top 5 best- and worst-performing stocks in the iShares Russell 2000 ETF (IWM) in July:

Top 5 (IWM) July percentage gainers:

- Lumen Technologies (NYSE:LUMN) – Monthly rise: +186.4%

- Q32 Bio (NASDAQ:QTTB) – Monthly rise: +112.1%

- CommScope (NASDAQ:COMM) – Monthly rise: +110.6%

- Humacyte (NASDAQ:HUMA) – Monthly rise: +97.1%

- G1 Therapeutics (NASDAQ:GTHX) – Monthly rise: +88.2%

Top 5 (IWM) monthly percentage decliners: