Tanaonte/iStock via Getty Images

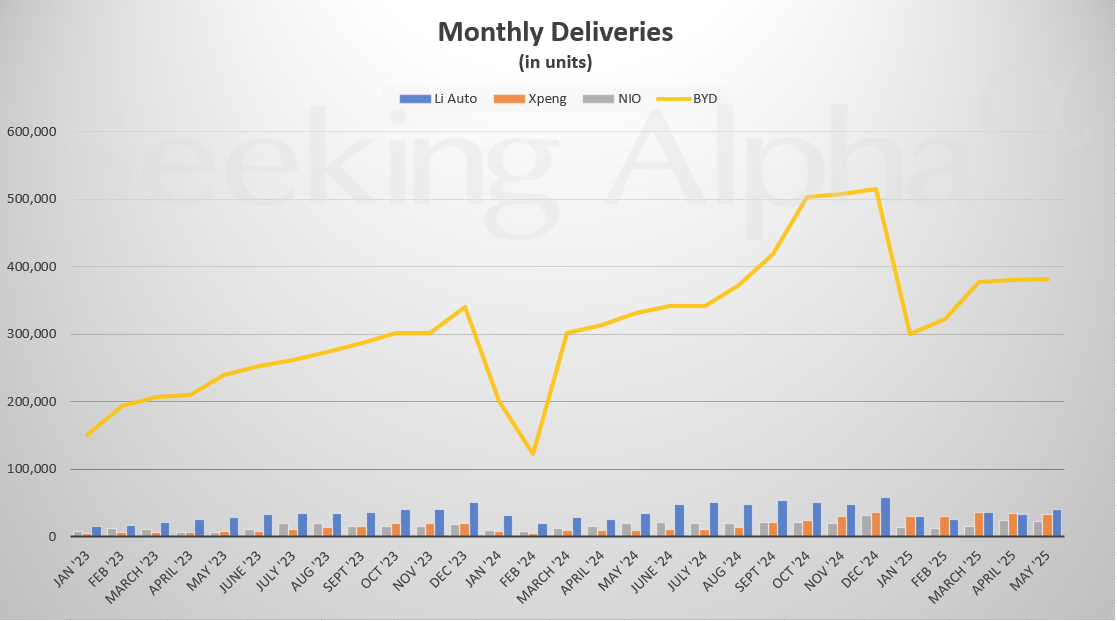

The race for supremacy in China’s electric vehicle (EV) market never slows down, and May’s delivery figures offer a compelling snapshot of who’s accelerating and who’s navigating new challenges. From the continued dominance of industry giants to notable shifts among key competitors, the numbers reveal a dynamic landscape.

Li Auto posted a solid rebound, XPeng continued its explosive Y/Y growth, NIO remained relatively stable, and BYD held its lead in volume.

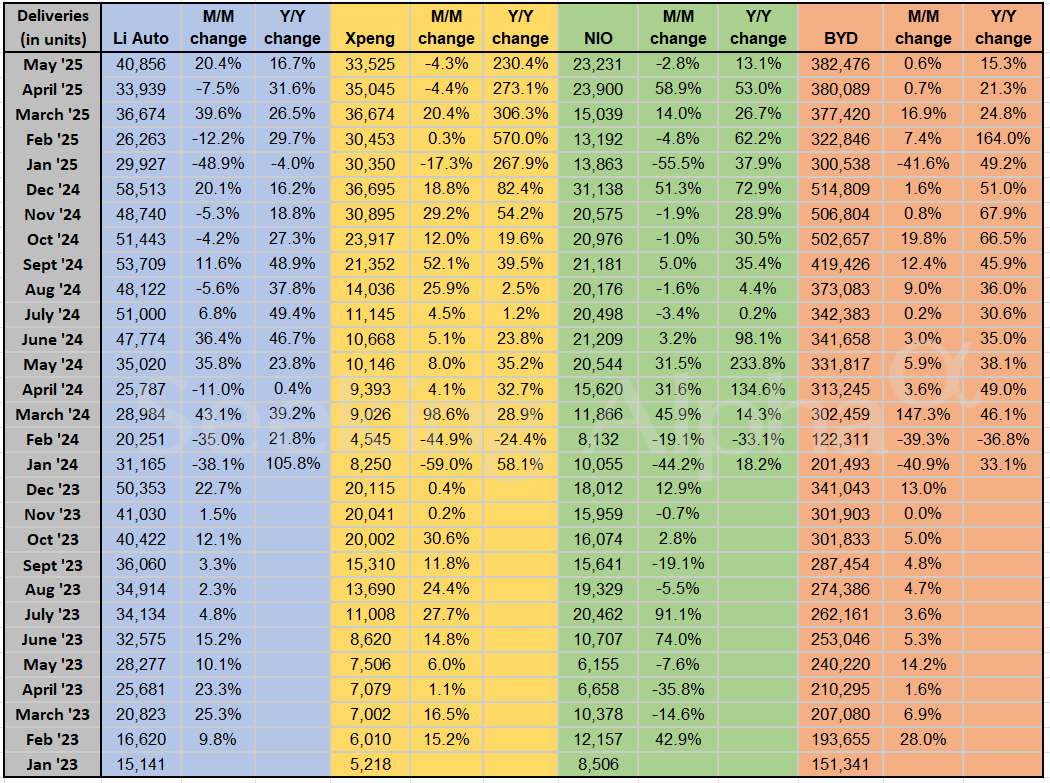

Here’s the monthly delivery data from BYD, Li Auto, XPeng, and NIO, highlighting key trends:

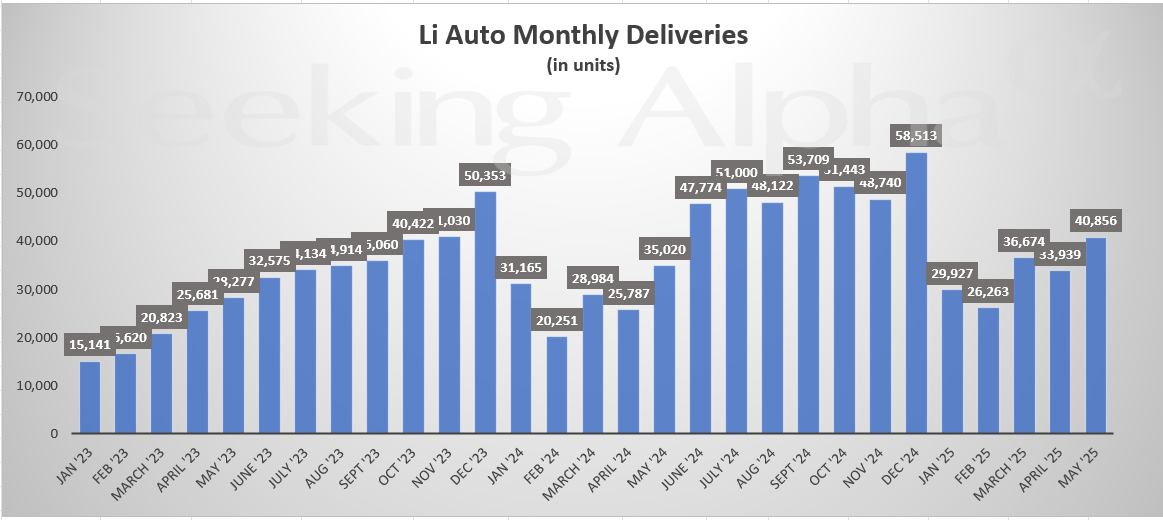

Li Auto (NASDAQ:LI)

- May Deliveries: 40,856

- M/M Change: +20.4%

- Y/Y Change: +16.7%

- Li Auto saw a healthy 20% sequential rise, regaining traction after a subdued April. Y/Y growth also stayed in double digits.

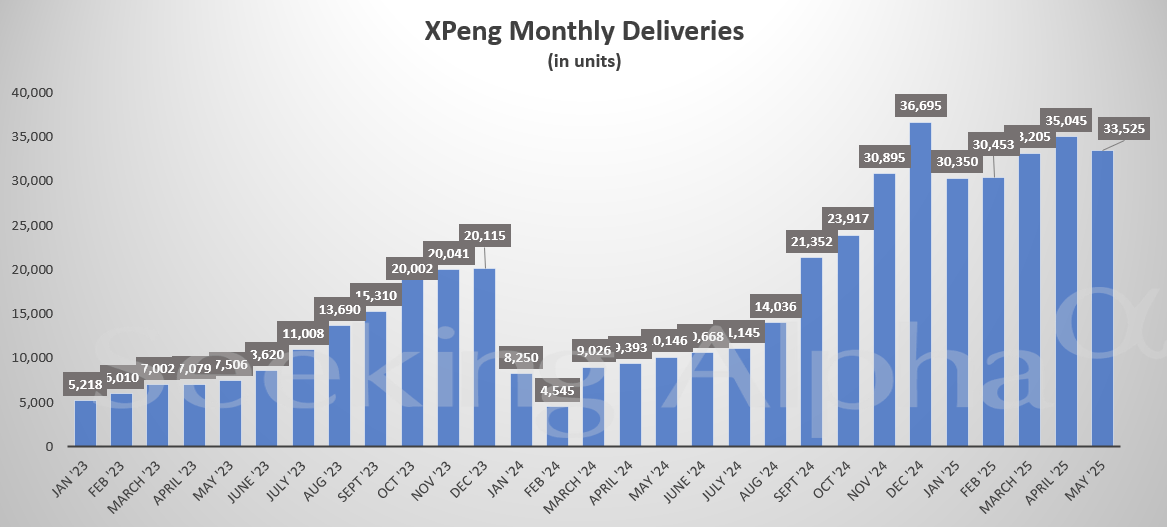

XPeng (NYSE:XPEV)

- May Deliveries: 33,525

- M/M Change: -4.3%

- Y/Y Change: +230.4%

- While slightly lower M/M, XPeng’s delivery volume has more than tripled from May last year, one of the strongest annual growth rates among peers.

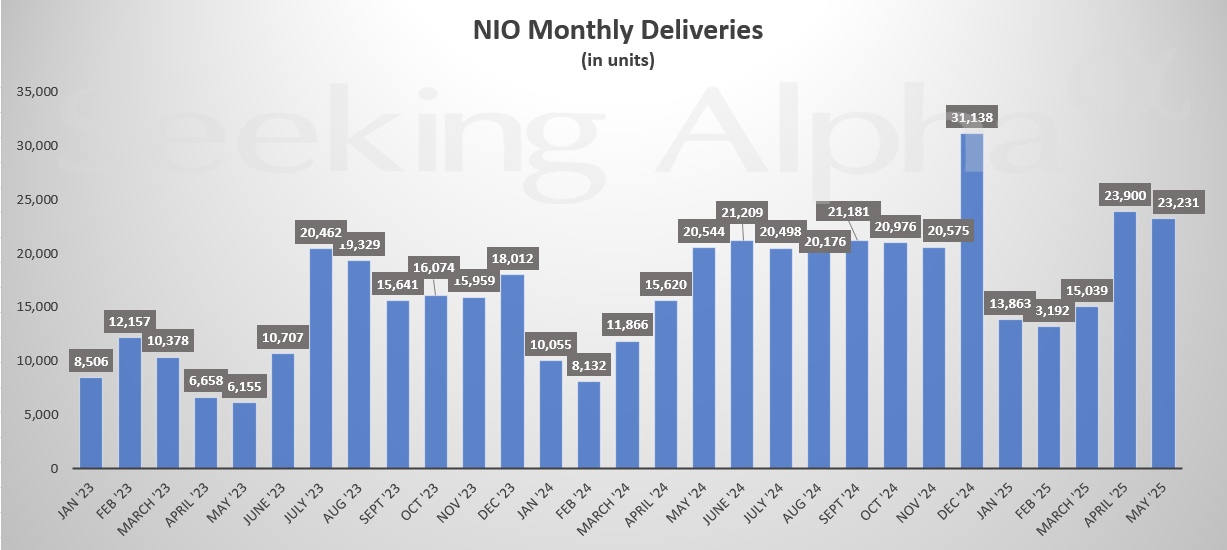

NIO (NYSE:NIO)

- May Deliveries: 23,231

- M/M Change: -2.8%

- Y/Y Change: +13.1%

- NIO’s May deliveries dipped slightly vs. April, but it held on to modest Y/Y growth. The company’s pace suggests cautious but steady progress.

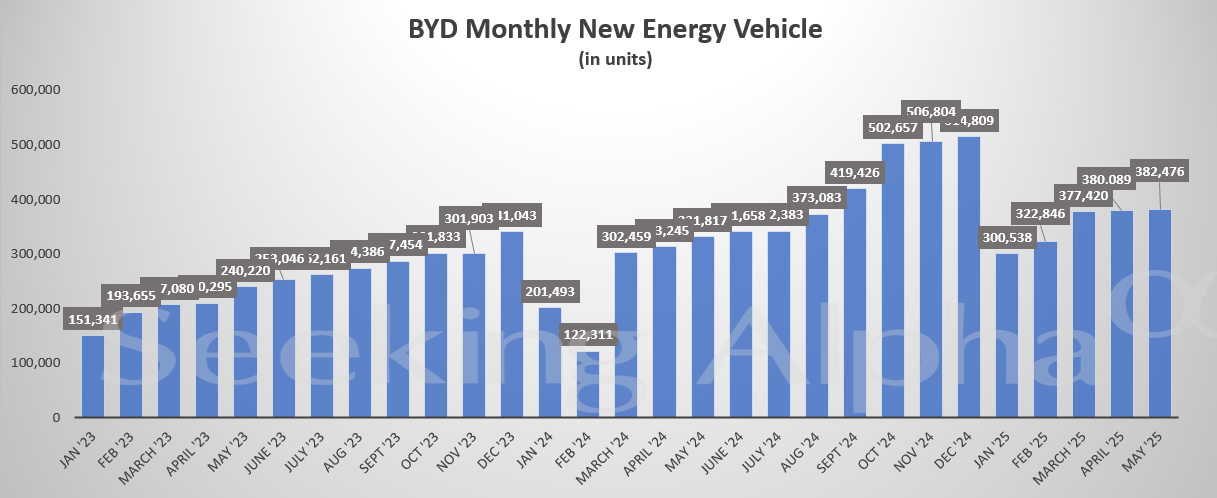

BYD (OTCPK:BYDDF)

More on Chinese EVs:

- Li Auto: A Top Growth Pick For 2025

- BYD’s Ultra-Fast Chargers Will Supercharge Growth While Price Wars Could Sink Rivals

- BYD: A Good Chance To Take Market Share Internationally

- BYD announces May production-sales results; Pure EV tops hybrid sales

- Earnings week ahead: NIO, LULU, AVGO, DOCU, CRWD, MDB, FCEL, DG, DLTR, HPE, and more