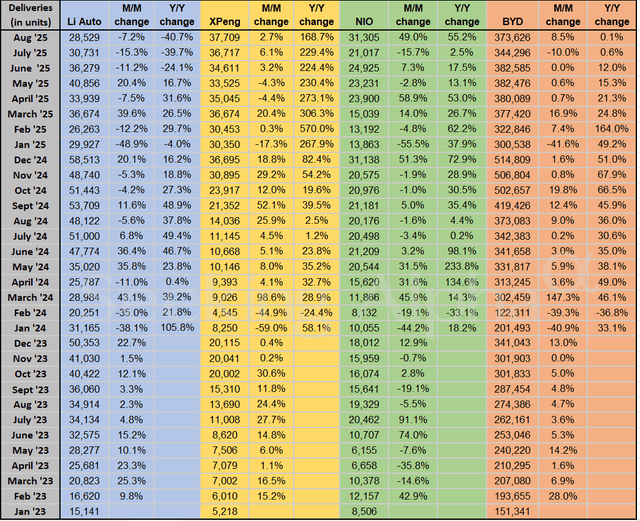

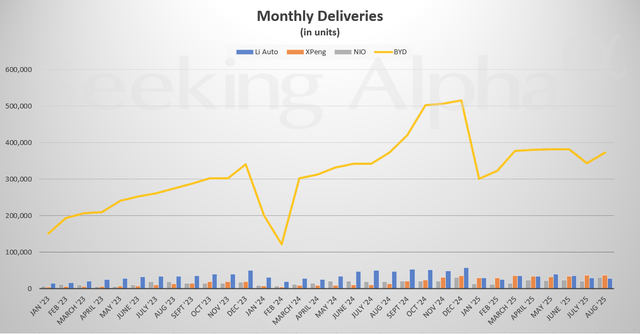

China’s electric vehicle (EV) market remained dynamic in August 2025, with performance diverging sharply among leading automakers. While some players continued to ride strong momentum, others faced meaningful slowdowns. XPeng and NIO emerged as relative bright spots, while Li Auto’s deliveries slumped again and BYD’s Y/Y growth nearly stalled, reflecting a more mature phase at its massive scale.

China’s electric vehicle (EV) market remained dynamic in August 2025, with performance diverging sharply among leading automakers. While some players continued to ride strong momentum, others faced meaningful slowdowns. XPeng and NIO emerged as relative bright spots, while Li Auto’s deliveries slumped again and BYD’s Y/Y growth nearly stalled, reflecting a more mature phase at its massive scale.

Key Takeaways

- Li Auto (NASDAQ:LI) faces ongoing headwinds with deliveries down 41% Y/Y, signaling prolonged softness.

- XPeng (NYSE:XPEV) sustains standout growth (+169% Y/Y), with modest but steady monthly gains keeping momentum alive.

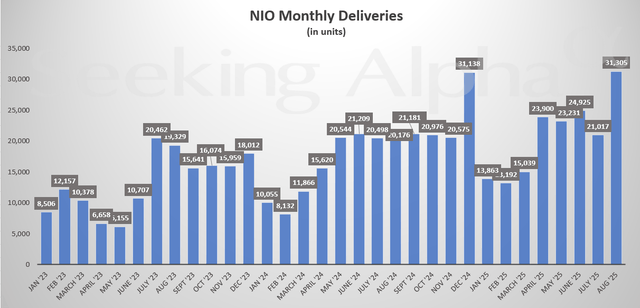

- NIO (NYSE:NIO) rebounds strongly, up 49% M/M and 55% Y/Y, after weakness in July.

- BYD (OTCPK:BYDDF) (OTCPK:BYDDY) remains dominant in volume but growth plateaus, with Y/Y expansion flat (+0.1%).

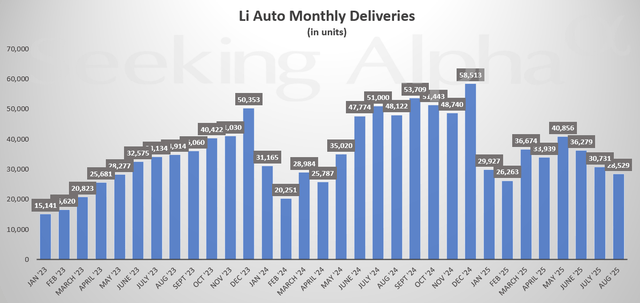

Li Auto (LI)

- August Deliveries: 28,529

- M/M Change: -7.2%

- Y/Y Change: -40.7%

Li Auto continued to struggle in August, with deliveries slipping another 7% sequentially. The bigger concern is the steep 41% Y/Y drop, marking its weakest showing in the recent months. While product transitions and competition remain factors, the sustained decline signals deeper demand headwinds.

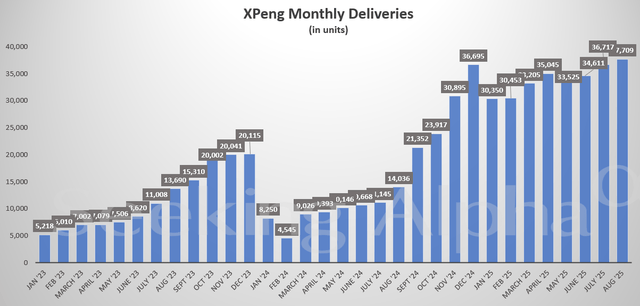

XPeng (XPEV)

- August Deliveries: 37,709

- M/M Change: 2.7%

- Y/Y Change: 168.7%

XPeng extended its strong momentum with deliveries nearing 38K, up modestly M/M but nearly tripling compared to last year. Even as the pace has moderated from earlier explosive gains, XPeng remains the standout in Y/Y growth, driven by new model traction and steady scale-up.

NIO (NIO)

- August Deliveries: 31,305

- M/M Change: +49.0%

- Y/Y Change: +55.2%

NIO posted a sharp rebound in August, with deliveries jumping almost 50% from July and up 55% Y/Y. The turnaround reflects improving order flow and normalization after a weak July. Still, the challenge remains sustaining this pace consistently against peers with stronger upward trends.

BYD (OTCPK:BYDDF)

- August Deliveries: 373,626

- M/M Change: +8.5%

- Y/Y Change: +0.1%

BYD delivered over 373.6K units in August, edging higher M/M. However, growth flattened on a Y/Y basis, underscoring the maturing scale of China’s largest EV maker. While volume leadership is intact, the near-zero Y/Y growth suggests that BYD’s expansion phase is slowing compared to nimble upstarts like XPeng.