Key Takeaways

-

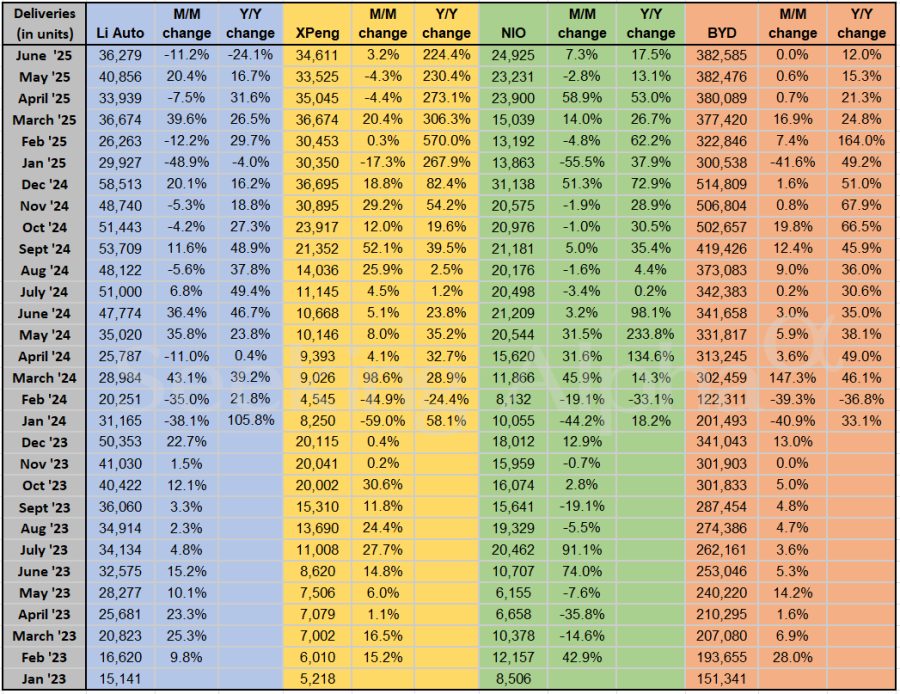

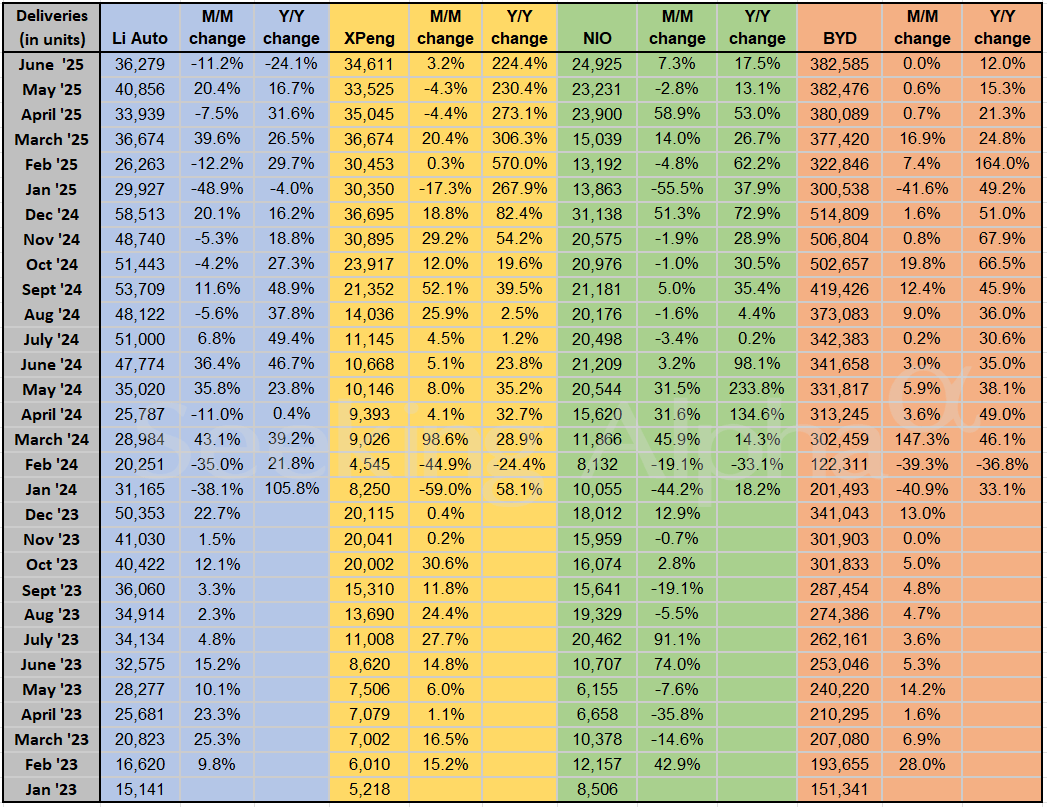

Li Auto retreats 11% M/M after May’s rebound, with Y/Y growth turning negative.

-

XPeng sustains robust Y/Y momentum (+224%) with a modest M/M rise.

-

NIO rebounds 7.3% M/M, extending its Y/Y gain to 17.5%.

-

BYD remains flat sequentially, but Y/Y growth cools to 12%.

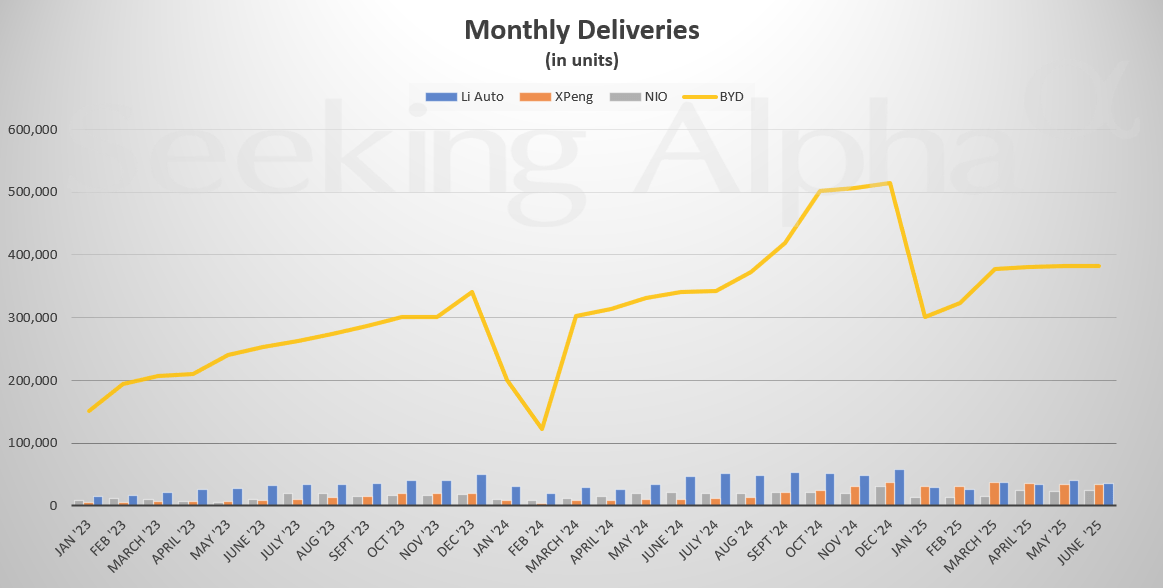

The race for dominance in China’s electric vehicle (EV) market remains intense, and June’s delivery figures reflect the ever-shifting dynamics among top players. From declining volumes at Li Auto to the continued strength of Xpeng’s year-over-year growth, the landscape is far from static.

June 2025 brought a mix of pullbacks and progress. Li Auto saw a notable monthly dip, Xpeng held firm with one of the strongest Y/Y growth rates in the segment, NIO posted a healthy rebound from May, and BYD maintained its delivery lead, though growth continued to normalize. Here’s a closer look at the data from each EV player.

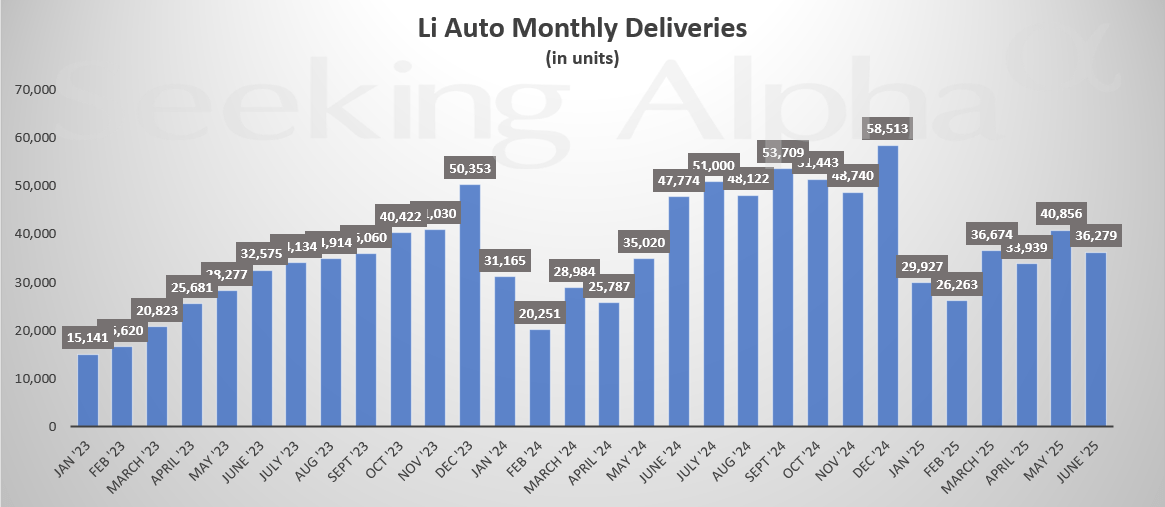

Li Auto (NASDAQ:LI)

-

June Deliveries: 36,279

-

M/M Change: -11.2%

-

Y/Y Change: -24.1%

Li Auto saw a double-digit drop from May and fell below June 2024’s level, its first Y/Y decline in over a year. The June pullback erases some of the gains made in the prior month’s rebound.

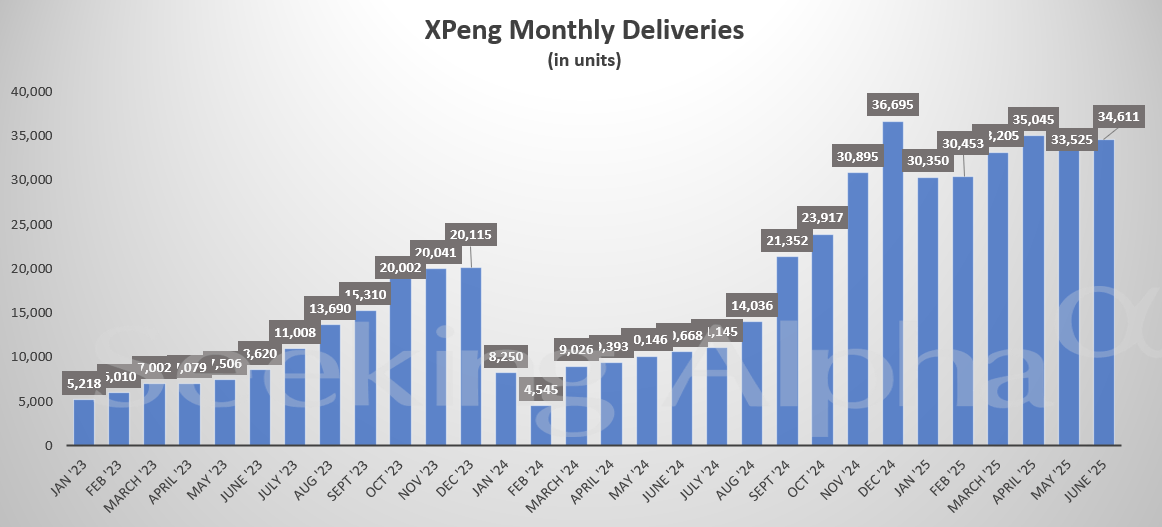

Xpeng (NYSE:XPEV)

-

June Deliveries: 34,611

-

M/M Change: 3.2%

-

Y/Y Change: +224.4%

With a modest sequential rise, XPeng continues to outpace peers on annual growth. The company more than tripled deliveries from a year ago, reinforcing its sharp upward trajectory.

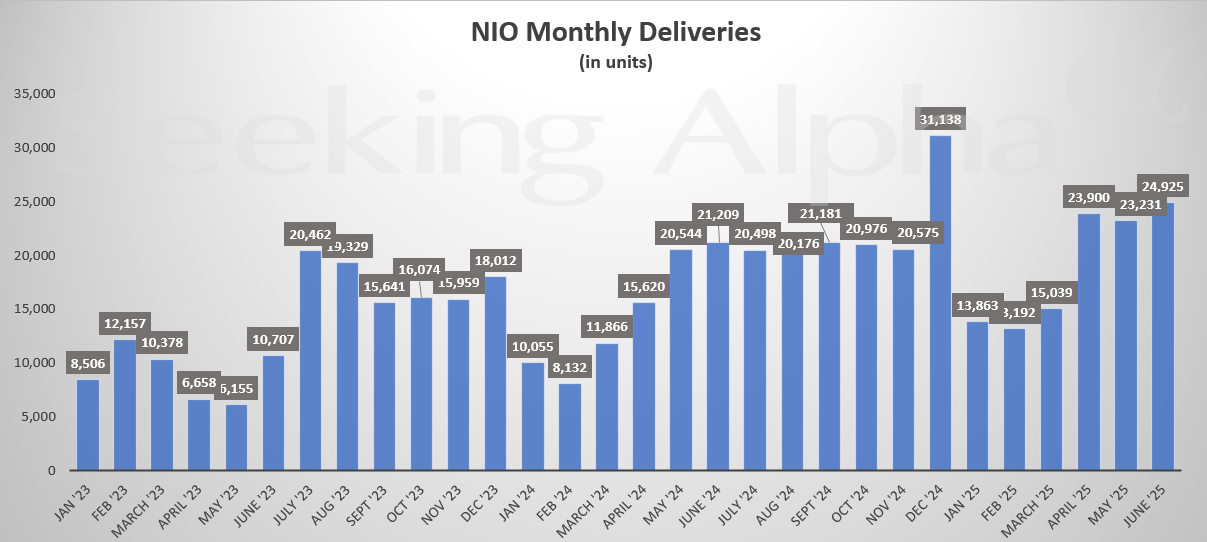

NIO (NYSE:NIO)

-

June Deliveries: 24,925

-

M/M Change: +7.3%

-

Y/Y Change: +17.5%

NIO reversed its May decline with a solid monthly gain in June. Deliveries also improved compared to last year, reflecting a steadier performance in recent months.

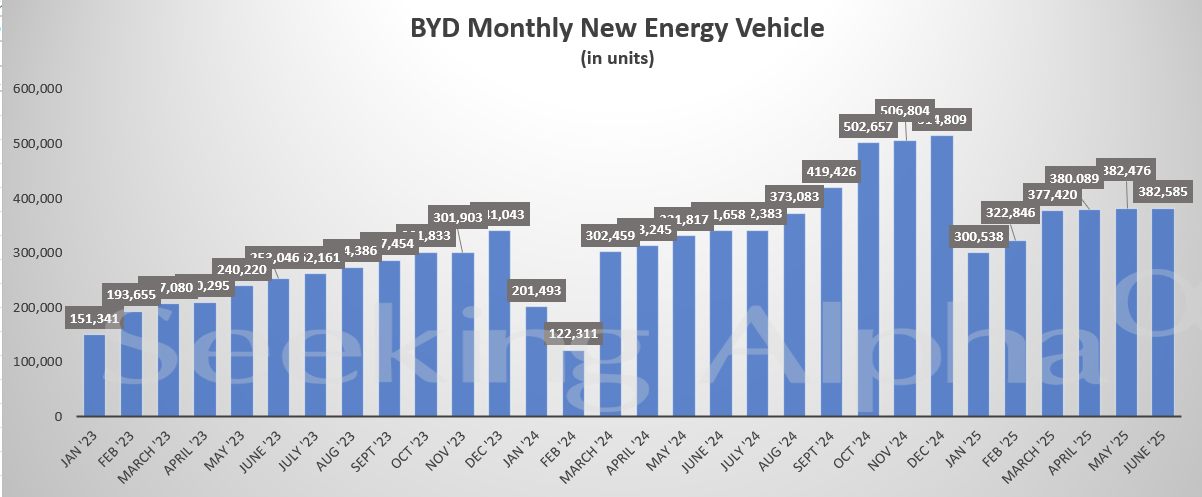

BYD (OTCPK:BYDDF)

-

June Deliveries: 382,585

-

M/M Change: 0.0%

-

Y/Y Change: +12.0%

BYD held delivery volumes steady in June, remaining far ahead of rivals. However, growth has slowed to its lowest Y/Y pace in over a year, signaling possible saturation or seasonal effects.

More on Chinese EVs:

- BYD Downgrade From “Buy” To “Hold” Due To Short Term Pressures

- Despite Outperforming Tesla, Multiples Suggests BYD Remains Ignored

- XPENG’s June deliveries jump 224% Y/Y to 34,611, exceeds 30K units for 8th straight month

- BYD Company hits its highest EV deliveries tally of the year in June

- NIO’s Q2 deliveries rise over 25% Y/Y

- Li Auto’s June deliveries fall 24% Y/Y, Q2 total hits 111,074