Nikada

September is already living up to its reputation as a weak month for stocks, but that may not derail the benchmark S&P 500 (SP500) from cementing a win for the full year, BMO Capital Markets said.

With September trade starting this week, the S&P 500 (SP500) lost 2.3% in its first two sessions and was on course to end lower again on Thursday. A drop in heavyweight Nvidia’s (NVDA) shares and weak manufacturing sector and labor-market data have been pressure points for stocks in September so far.

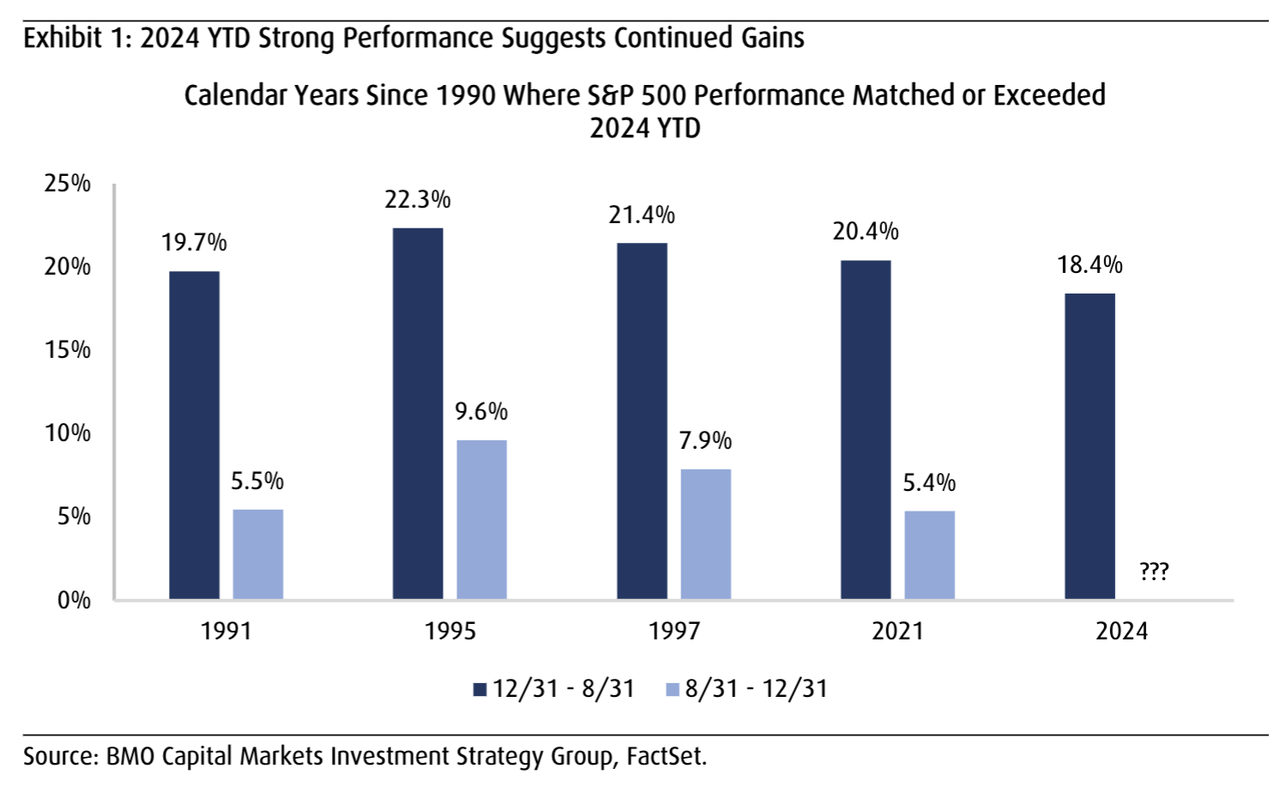

“To be clear, we never like when investors lose money, but at the same time we are not totally surprised by the latest weakness given the lack of a meaningful pullback YTD,” Brian Belski, chief investment strategist at BMO Capital Markets, said in a note Wednesday. “Nonetheless, we remain optimistic for the rest of the year since history suggests that YTD gains of this magnitude tend to lead to further gains through year-end.”

That history includes the S&P 500’s (SP500) strong 18.4% increase during the first eight months of the year, a performance in the 85th percentile for all years from 1950.

There have been only four other years with stronger performances since 1990 — 1991, 1995, 1997 and 2021 — and the S&P 500 (SP500) served further gains through the year-end in each of those years, Belski said, sharing this chart:

The strategist did flag that pullbacks in September and during the last four months of a year are common even with strong market performances.

BMO has a 5,600 year-end price target on the S&P 500 (SP500). The benchmark on Thursday was ~5,513.

S&P ETFs include: (SPY), (VOO), (IVV), (UPRO) and (SDS).