iQoncept/iStock via Getty Images

The average short interest for the S&P 500 Health Care Index Sector (NYSEARCA:XLV) experienced an increase in April, moving from 1.81% in March to 1.95%, indicating a collective rise in negative bets against the broader healthcare industry. Notably, Moderna maintained its status as the stock with the highest level of short interest within the sector during this period.

The Health Care Select Sector SPDR® Fund ETF (NYSEARCA:XLV), carrying a 12.12% weight in the S&P 500, has seen its underlying healthcare sector decline by 4.14% year-to-date. This contrasts with the broader S&P 500 index (SP500), which has posted a 0.08% gain over the same period.

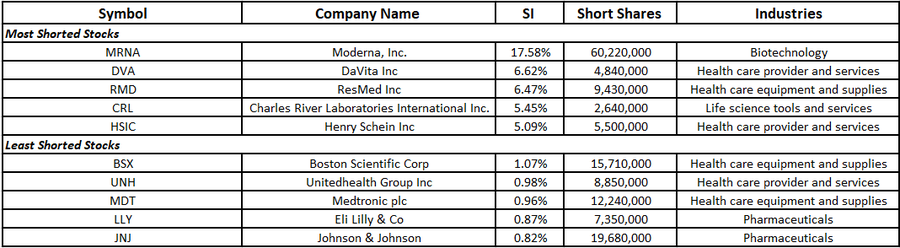

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

Seeking Alpha (Seeking Alpha)

As the most shorted stock, Moderna (NASDAQ:MRNA) experienced a rise in short interest to 17.58% in April, up from 14.58% in March. This bearish sentiment aligns with Seeking Alpha’s Quant Rating of “Strong Sell,” which gives the mRNA therapeutics and vaccines developer a score of 1.11 out of 5.

The COVID vaccine maker (NASDAQ:MRNA) is intensifying its cost-cutting measures, projecting lower GAAP operating costs for 2026 ($5.4B-$5.7B, down from $5.9B) and further reductions by 2027 ($4.7B-$5B), aiming for a $1.4B-$1.7B decrease compared to its 2025 estimate. This announcement coincided with its Q1 financial release, which revealed continued losses ($1B net loss, -$2.52 GAAP loss per share, beating estimates) despite a 35.3% year-over-year revenue decline to $108M due to lower product sales ($86M). While reiterating its 2025 revenue guidance of $1.5B-$2.5B (with ~$0.2B expected in the first half), this still falls short of the $2.13B analyst consensus.

Following the most shorted stock, DaVita (NYSE:DVA) held the second-highest short interest in April at 6.62%, with ResMed (NYSE:RMD) ranking third at 6.47%.

In contrast, Johnson & Johnson (NYSE:JNJ) saw the least short selling interest at 0.82%, closely followed by Eli Lilly (NYSE:LLY) at 0.87% and Medtronic (NYSE:MDT) at 0.96%.

Industry Analysis

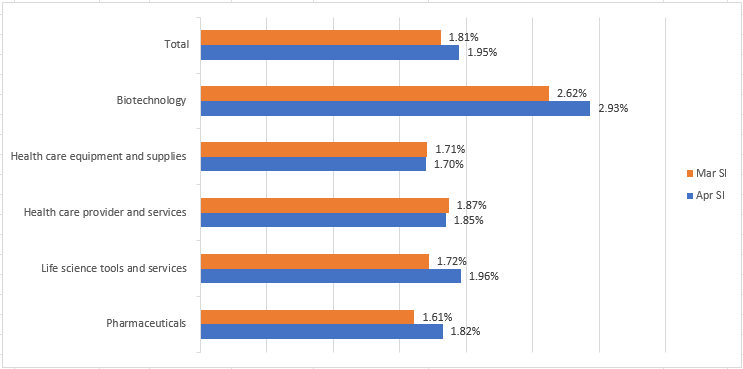

Average short interest as a percentage of floating shares

Seeking Alpha (Seeking Alpha)

In April, biotechnology maintained its position as the most shorted industry within the healthcare index for the thirteenth consecutive month. Short interest in the biotechnology sub-sector grew to 2.93%, a rise from the 2.62% recorded in March. The healthcare equipment and supplies sector registered the second-highest short interest at 1.70%. Conversely, the pharmaceuticals’ industry demonstrated the lowest short interest among healthcare sub-sectors in April, with a short percentage of 1.82%.

Related ETFs: Health Care Select Sector SPDR Fund (NYSEARCA:XLV), SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH), VanEck Pharmaceutical ETF (NASDAQ:PPH), iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), iShares U.S. Pharmaceuticals ETF (NYSEARCA:IHE), and Invesco Nasdaq Biotechnology ETF (NASDAQ:IBBQ).

More on Health Care Select Sector SPDR® Fund ETF

- XLV: Trump’s Drug Price Talk Revives Old Headlines, Not New Risks

- XLV Vs. VHT: I Prefer XLV For Its Better Downturn Resilience

- XLV: My Method For Navigating These Pullbacks

- Drugmakers rebound after White House eases fears over Trump’s drug pricing order

- Trump vows to cut drug prices by up to 80% in U.S.