Eoneren

The short interest on 13 out of 38 consumer staple stocks—part of the Consumer Staples Select Sector SPDR Fund (NYSEARCA:XLP)—dropped in June vs. the previous month, while short interest for 1 stock was flat. The remaining 24 stocks saw a rise in their short interest.

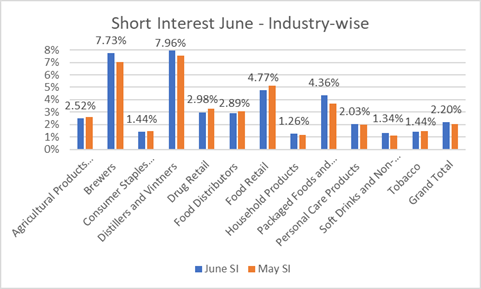

Short bets fell for 6 out of 13 industries in the consumer staples sector. However, the average grand total short interest increased to 2.20% in June from 2.05% in May for defensives.

Industry Analysis:

Short interest for consumer staples in June (Seeking Alpha)

In the consumer defensive/staples sector, Distillers and Vintners remained the most shorted industry, with an average short interest of 7.96% vs. the previous month’s 7.55%.

Brewers were the second-most shorted industry and had the second-highest short interest of 7.73% in June, vs. 7.05% last month.

Short interest in Household Products segment was lowest at 1.26% vs. 1.19% prior. Followed by the Soft Drinks and Non-alcoholic Beverages segment that was the second-lowest segment, with a short interest of 1.34% vs. 1.13%.

Short interest, which could potentially be an indicator of pessimism, calculates the number of shares sold against the company’s float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float). To note, consumer staples often underperform in rising markets but beat the falls.

Least shorted stocks:

- Procter & Gamble (NYSE:PG): 0.67% vs. 0.75% last month

- Philip Morris International (NYSE:PM): 0.74% vs. 0.72%

- Coca-Cola (NYSE:KO): 0.83% vs. 0.75%

- Walmart (NYSE:WMT): 0.84% vs. 0.95%

- Costco Wholesale (NASDAQ:COST): 1.28% vs. 1.23%

Most shorted stocks:

- Campbell Soup (NASDAQ:CPB): 11.95% vs. 9.72%

- Brown-Forman (NYSE:BF.B): 9.79% vs. 9.78%

- Molson Coors Beverage (NYSE:TAP): 7.73% vs. 7.05%

- Dollar Tree (NASDAQ:DLTR): 6.92% vs. 6.51%

- Hershey Foods (NYSE:HSY): 6.69% vs. 5.81%

The S&P 500’s consumer staples sector ETF (NYSEARCA:XLP) lost 2.3% in June, compared to broader S&P 500 ETF Trust (NYSEARCA:SPY) gain of 4.53%.

ETFs to tab consumer staples: (NYSEARCA:VDC), (NYSEARCA:IYK), (NYSEARCA:FSTA), (NYSEARCA:KXI), (NYSEARCA:FXG), (NYSEARCA:RSPS).

More on consumer staples

- Coca-Cola: Warning Signs Are Flashing Red For Shareholders

- Costco: Not Yet A Meme Stock – Decelerating Growth Triggers Valuation Risks

- Costco: Suddenly Underperforming Amid Softer Sales Growth, 200 DMA Tested

- Weekly consumer staple gainers/losers: Dollar Tree tops, while Conagra Brands bottom

- Quant check for consumer staple stocks before Q2 earnings