iQoncept/iStock via Getty Images

The negative sentiment towards the S&P 500 Health Care Index Sector (NYSEARCA:XLV) softened in May as average short interest dipped to 1.90% from 1.95% in April. Moderna (NASDAQ:MRNA), however, notably retained its position as the sector’s most heavily shorted stock.

The healthcare sector, represented by the Health Care Select Sector SPDR® Fund ETF (NYSEARCA:XLV) and holding a weightage of 12.12% in the S&P 500 index, has slipped 0.55% year-to-date. This underperforms the broader S&P 500 index (SP500), which has risen 2.78% over the same period.

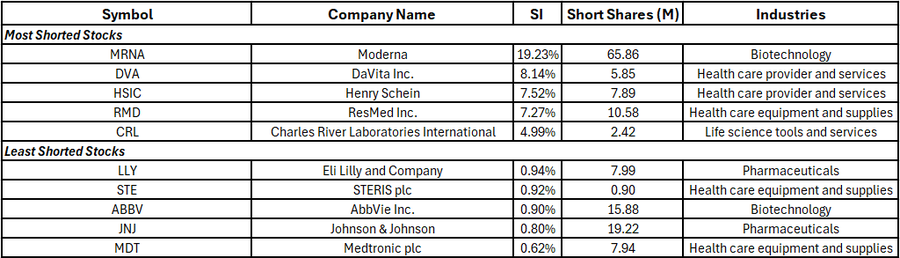

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

Seeking Alpha (Seeking Alpha)

Moderna (NASDAQ:MRNA)—most shorted—with a short interest representing 19.23% of the float, up from 17.58% the prior month. This bearish sentiment aligns with Seeking Alpha’s Quant Rating of “Strong Sell,” which gives the mRNA therapeutics and vaccines developer a score of 1.19 out of 5. The COVID vaccine maker has shed over a third of its value this year, following reduced COVID-19 vaccine sales, and the recent withdrawal of its flu/COVID vaccine candidate, and a $700 million funding loss for its human bird flu vaccine development.

In May, DaVita (NYSE:DVA) claimed the second spot for highest short interest at 8.14%, just ahead of Henry Schein (NASDAQ:HSIC) at 7.52%.

On the other end, Medtronic (NYSE:MDT) had the lowest short interest at 0.62%, followed by Johnson & Johnson (NYSE:JNJ) at 0.80% and AbbVie (NYSE:ABBV) at 0.90%.

Industry Analysis

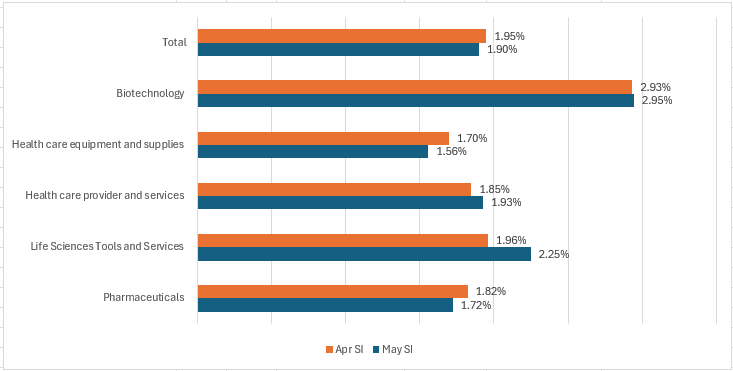

Average short interest as a percentage of floating shares

Seeking Alpha (Seeking Alpha)

Biotechnology remained the most shorted industry within the healthcare index for the 14th straight month in May, with short interest slightly increasing to 2.95% from April’s 2.93%. The healthcare equipment and supplies sector saw the second-highest short interest at 1.56%.

In contrast, the pharmaceuticals industry had the lowest short interest among healthcare sub-sectors in May, at 1.72%.

Related ETFs: Health Care Select Sector SPDR Fund (NYSEARCA:XLV), SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH), VanEck Pharmaceutical ETF (NASDAQ:PPH), iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), iShares U.S. Pharmaceuticals ETF (NYSEARCA:IHE), and Invesco Nasdaq Biotechnology ETF (NASDAQ:IBBQ).

More on Health Care Select Sector SPDR® Fund ETF

- The HealthCare Sector: A Look At Sector Earnings Trends

- XLV: Trump’s Drug Price Talk Revives Old Headlines, Not New Risks

- XLV Vs. VHT: I Prefer XLV For Its Better Downturn Resilience

- Notable healthcare headlines for the week: Bristol Myers Squibb, Novo Nordisk and Sanofi in focus

- Notable healthcare headlines for the week: AstraZeneca, Eli Lilly, Bristol Myers in focus