The S&P 500 Healthcare sector (XLV) experienced a slight rise in average short interest during October, moving from 1.91% to 2.00%. Within this sector, Moderna (MRNA) remains the most heavily shorted stock.

The Health Care Select Sector SPDR® Fund ETF (XLV), representing the healthcare sector and holding a 12.12% weight in the S&P 500, has seen an 11.09% year-to-date increase, lagging the broader S&P 500 index (SP500) which rose 16.48% during the same period.

iQoncept/iStock via Getty Images

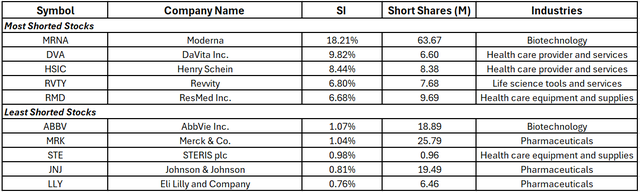

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

Seeking Alpha (Seeking Alpha)

Even though short interest in Moderna (MRNA) remains the highest in the sector at 18.21% of its float, down from 18.66% last month, the company is garnering a strong vote of confidence from Seeking Alpha’s Quant Rating, which assigns a 4.02 out of 5 “Buy” score.

In late October 2025, Moderna’s (MRNA) stock surged due to reports of talks with a large biopharma for a potential partnership or buyout provided a major boost to the stock, which had been trading at multi-year lows.

Recently, the company reported Q3 2025 financials that exceeded Wall Street forecasts, despite overall revenue declining sharply year-over-year due to waning COVID vaccine sales. Q3 2025 revenue was $1.0 Billion, beating the consensus, with $971 Million coming from COVID vaccine sales (mainly $781 Million from the U.S.).

The renewed investor optimism is driven by promising cancer vaccine data and surprising findings that the mRNA COVID vaccines may boost cancer survival rates in patients receiving immunotherapy. The company maintains a strong cash position and a commitment to reduced costs and a robust drug pipeline,” a Seeking Alpha analyst wrote.

The second-most shorted stock in October was DaVita (NYSE:DVA) at 9.82%, while Henry Schein (NASDAQ:HSIC) was third at 8.44%.

On the other hand, several major companies had very low short interest, including Eli Lilly and Company (LLY) at 0.76%, Johnson & Johnson (NYSE:JNJ) at 0.81%, STERIS plc (NYSE:STE) at 0.98%, and Merck & Co. (MRK) at 1.04%.

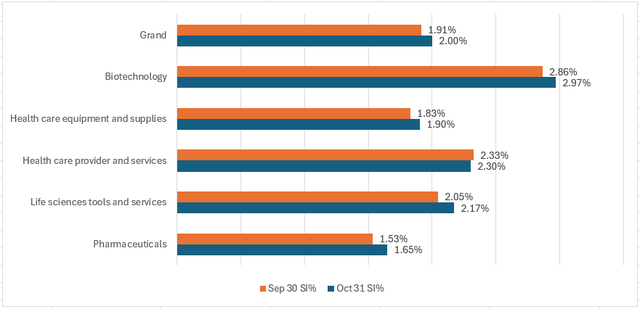

Industry Analysis

Average short interest as a percentage of floating shares

Seeking Alpha (Seeking Alpha)

For the nineteenth consecutive month, the biotechnology industry held the distinction of being the most shorted in the healthcare sector, with short interest rising to 2.97% from 2.86% in October. The healthcare provider and services sector followed with a short interest of 2.30% at the end of October, down from 2.33% in the prior month.

In contrast, the pharmaceuticals’ industry recorded the lowest short interest among the healthcare sub-sectors in October, with a short percentage of 1.65% for the month, up from 1.53% in the prior month.

Related ETFs: Health Care Select Sector SPDR Fund (NYSEARCA:XLV), SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH), VanEck Pharmaceutical ETF (NASDAQ:PPH), iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), iShares U.S. Pharmaceuticals ETF (NYSEARCA:IHE), and Invesco Nasdaq Biotechnology ETF (NASDAQ:IBBQ).