bjdlzx

Short sellers have increased their bets against S&P 500 oil and gas stocks, with the prospect of the ongoing decline in crude oil and other energy prices.

Short interest in the S&P 500 energy sector reversed to 2.13% after falling for four months.

Crude continues to extend losses in the second month, ending 6% lower in August. Oil prices are down another 8% in September.

The short bets, in which traders sell borrowed shares of companies with the aim of buying them back later at a lower price, rose to 434.36M from 424.47M in July.

Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers, who seek to profit from a stock’s decline by borrowing shares to sell at a high price, then repurchasing them after a drop and pocketing the difference.

The S&P 500 Energy sector (NYSEARCA:XLE) was down 2% in August, compared to the 0.45% rise in the S&P benchmark index.

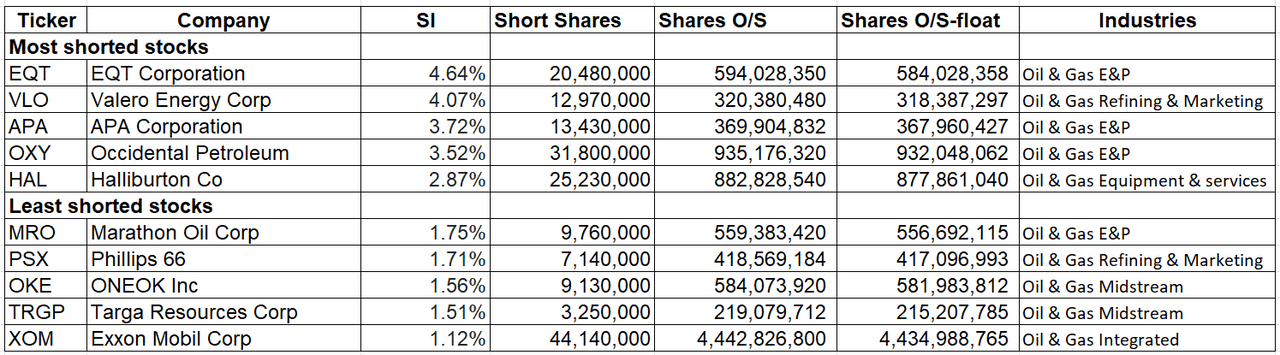

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

EQT (NYSE:EQT) continues to be the most-shorted energy stock, with 20.48 million shares short as of August 31st, or 4.64% of the total float.

Valero Energy (NYSE:VLO) was the second most shorted energy stock at 4.07% of shares float, followed by APA Corp. (NASDAQ:APA) with short interest of 3.72%.

Exxon (NYSE:XOM) was the least shorted stock, followed by Targa Resources (NYSE:TRGP), with short interest of 1.12% and 1.51%, respectively.

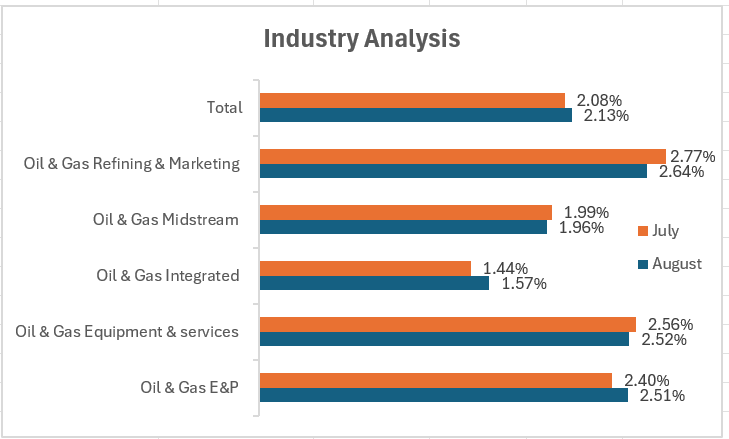

Energy sector in detail

Short interest decreased in 3 industries out of a total 5 industries.

Oil & Gas Refining & Marketing was the most shorted industry within the sector, with 2.64% short interest as of August-end, down from 2.77% during July-end.

Oil & Gas Integrated was the least shorted industry within the energy sector, with 1.57% short interest as of August-end, an increase of 13 bps from July.