fotofrog/E+ via Getty Images

The short-interest on 13 out of 38 consumer staple stocks, which are part of the Consumer Staples Select Sector SPDR Fund (NYSEARCA:XLP), increased at the end of October compared to last month. The remaining 25 stocks saw a decline in short interest.

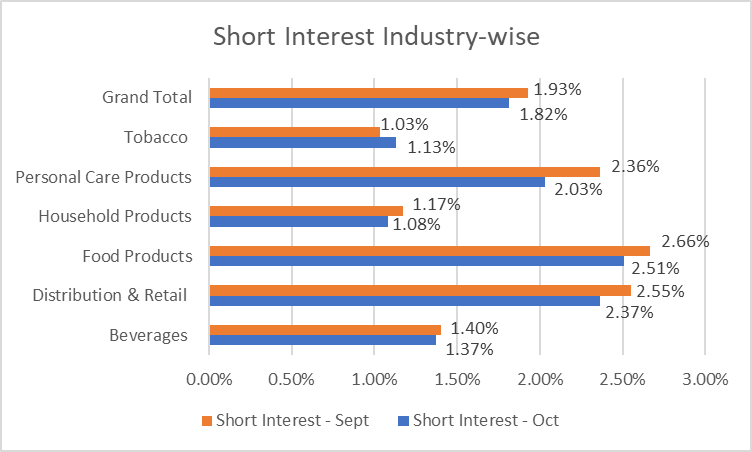

Industry-wise, short interest bets moved lower for five out of six sub-sectors, and the grand total of short interest decreased to 1.82% in September from 1.93% in September.

Industry Analysis:

In the consumer defensive/staples sector, Food Products remained the top most shorted industry, like the last few months, with an average short interest of 2.51% vs. the previous month’s 2.66%, steadily declining.

The Distribution & Retail industry had the second-highest short interest of 2.37% during the October end, vs. 2.55% during the September end.

Short interest in Personal Care Products lowered to 2.03%, compared to 2.36% previously. Tobacco was the only industry that saw a rise in short interest to 1.13% from 1.03% in September.

Short interest, which could be an indicator of pessimism, calculates the number of shares sold against the company float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float)

Most shorted stocks:

- Walgreens Boots Alliance (WBA): 12.32% vs. 13.3% last month

- Campbell Soup (CPB): 7.6% vs. 7.6%

- Dollar Tree (DLTR): 5.61% vs. 5.48%

- Lamb Weston (LW) 5.23% vs. 4.17%

- Molson Coors Beverage (TAP): 4.28% vs. 4.26%

Least shorted stocks:

- Brown-Forman (BF.B) 0.77% vs. 7.55% last month

- Philip Morris International (PM): 0.54% vs. 0.66%

- Walmart (WMT): 0.73% vs. 0.39%

- Procter & Gamble (PG): 0.80% vs. 0.87%

- Coca-Cola (KO): 0.80% vs. 0.79%

The S&P500’s consumer staples sector ETF (XLP) declined about 3.47% in October, compared to a broader S&P 500 Index (SP500) drop of 0.99%.