Short-selling activity increased notably in S&P 500 industrial stocks during November, coinciding with a decline in the sector’s performance.

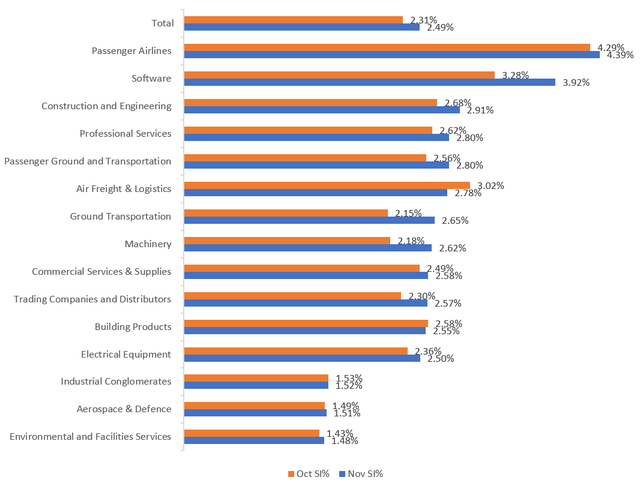

By the end of the November month, the average short interest across the S&P 500 industrial sector climbed to 2.49%, an 18-basis-point rise from 2.31% in October.

The S&P 500 Industrial ETF (XLI) slipped 0.88% in November, even as the broader S&P 500 edged up 0.13% over the same period.

Short interest, which could be an indicator of pessimism, calculates the number of shares sold against the company float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float).

Most shorted stocks:

Old Dominion Freight Line (ODFL) – 7.73% vs 6.02% last month.

Generac Holdings (GNRC) – 7.05% vs 6.08%.

Southwest Airlines (LUV) – 6.28% vs 6.56%.

C.H. Robinson Worldwide (CHRW) – 6.27% vs 6.33%.

Lennox International (LII) – 5.59% vs 4.95%.

Least shorted stocks:

RTX (RTX) – 0.82% vs 0.93% last month.

General Dynamics (GD) – 0.87% vs 0.85%.

AMETEK (AME) – 1.03% vs 0.97%.

Parker-Hannifin (PH) – 1.06% vs 1.15%.

Northrop Grumman (NOC) – 1.17% vs 0.84%.

Industry Analysis:

Source: Seekingalpha.com

Short sellers increased their positioning across most corners of the Industrial sector, with the sharpest activity concentrated in transportation, machinery, engineering, and industrial software, while passenger airlines (SP500-20302010) continue to draw the highest bearish interest in the group.

Passenger Airlines continued to be the most heavily shorted industry in the industrial sector, with short interest rising to 4.39% in November from 4.29% in October. Software ranked second, with short interest climbing to 3.92% from 3.28% the month prior. At the other end of the spectrum, Environmental and Facilities Services (SP500-20201050) remained the least shorted industry, holding a 1.48% short-interest level at November’s close.