iQoncept/iStock via Getty Images

The average short interest for S&P 500 Consumer Discretionary Select Sector SPDR Fund ETF (NYSEARCA:XLY) was marginally higher by 3 basis points to 2.66% at the end of June, from 2.63% interest at the end of May.

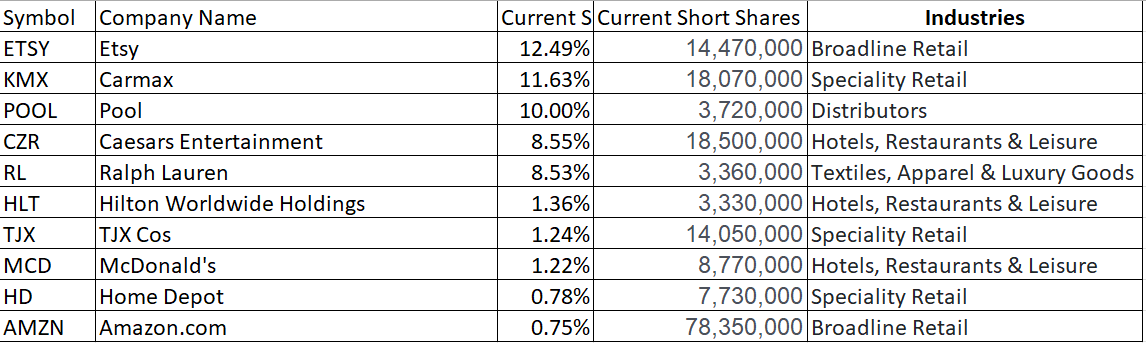

Stocks with the largest and least short positions

Etsy (ETSY) was the most shorted stock at 12.49%, followed by Karmax (KMX) with a short interest of 11.63% and Pool (POOL) 10.00%. Etsy (ETSY) and Carmax (KMX) short interest was down by 47 bps and 97 bps, while Pool (POOL) short interest went up by 35 bps over a month.

Amazon.com (AMZN) continued to be the least shorted stock, with 78.35M shares sold short or 0.75% of the shares float, followed by Home Depot (HD) and McDonald’s (MCD) with short interest of 0.78% and 1.22%, respectively.

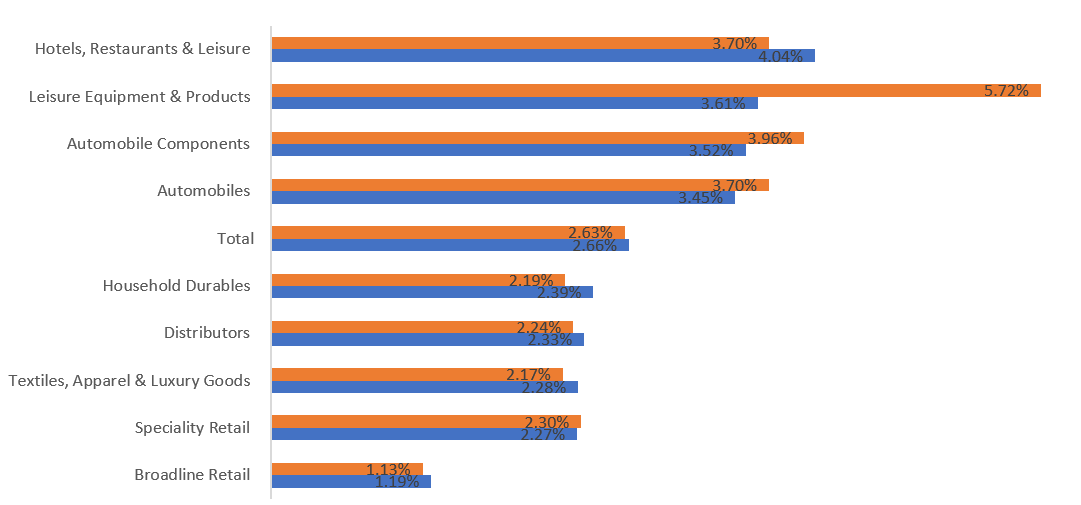

Industry Analysis

Hotels, Restaurants & Leisure were the most shorted industries within the sector, with 4.04% short interest as of the end of June, which increased from 3.70% at the end of May.

Leisure Equipment & Products at second spot with 3.61% short interest as of June 30, compared to 5.72% a month ago.

Hotels, Restaurants & Leisure stood at second spot with 5.41% short interest as of June 30, compared to 5.14% a month ago.

Automobile components stocks took the third spot with 3.52% short interest as of June 30, compared to 3.96% a month ago.

What Quantitative Measures say

Seeking Alpha’s Quant Rating system gives Consumer Discretionary Select Sector SPDR Fund ETF (XLY) a Buy rating, with 3.62 score.

The ETF has a strong liquidity grade of A+, Expenses grade of A, Dividends and momentum grade of B+. Notably, the ratings system sees risk as a threat and assigns the ETF a D grade in this category.