primeimages/E+ via Getty Images

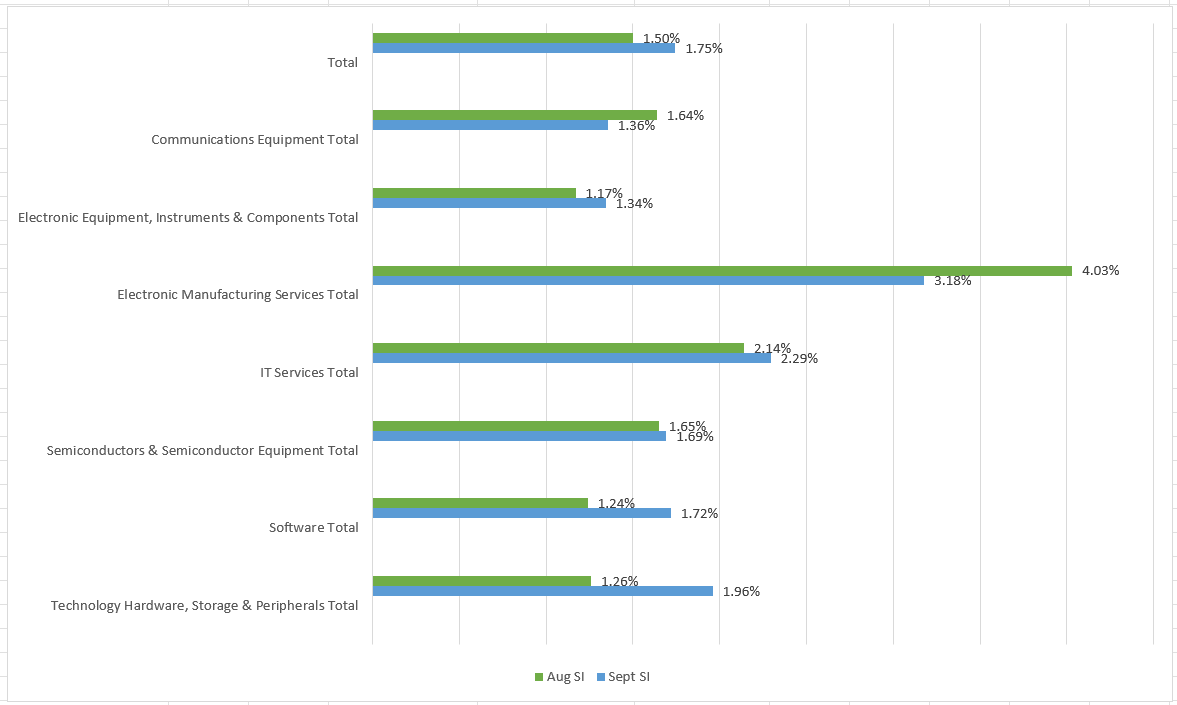

Bets against the information technology sector, which holds the highest weightage on the S&P rose in September. The average short-interest for S&P 500 Technology Select Sector SPDR Fund ETF (NYSEARCA:XLK) rose to 1.75% of shares float in September, up from 1.50% in August.

This month, there were four new additions to the S&P 500 Technology sector as part of its quarterly rebalance.

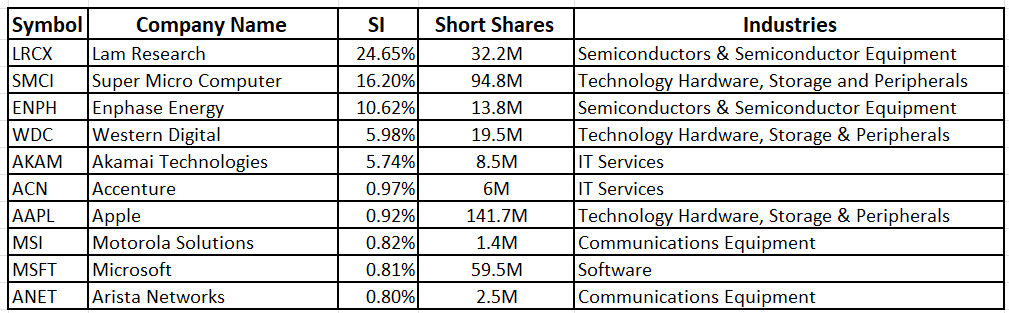

Lam Research (LRCX) was the most shorted stock in the information technology sector in September, with a short interest of 24.65%, followed by Super Micro Computer (SMCI) at 16.2%, and Enphase Energy (ENPH) at 10.62%.

Short interest in Super Micro (SMCI), which was the most shorted stock last month after a disclosure by Hindenburg Research that it was short the company’s stock, rose by 54 basis points this month. The short-seller’s report has raised doubts among investors about the company’s underlying business.

Short interest in Enphase Energy (ENPH) which has been one of the most shorted stocks for the past two months, fell by 56 basis points in September.

Arista Networks (ANET) continued to be the least shorted stock in the sector with 2.5 million shares sold short or 0.8% of its share float, followed by Microsoft (MSFT) and Motorola (MSI) with short interest of 0.81% and 0.82% respectively.

Industry Analysis:

Electronic Manufacturing Services continued to be the most shorted industry within the information technology sector, with 3.18% short interest in September, down from 4.03% in August.

IT Services was the second most shorted industry with 2.29% short interest as of September 30, compared to 2.14% at the end of August 31.

Electronic Equipment, Instruments & Components was the least shorted industry in the sector with a short interest of 1.34%.