Silver has experienced a stellar rally in 2025. While demand remains strong, it’s the limited supply that is truly pushing the market higher.

Last week, silver (XAGUSD:CUR) surged past $65 per ounce for the first time, significantly surpassing its 1980 peak, and has risen 128% year-to-date.

In this context, UBS said it remains bullish on silver, largely due to the bank’s expectation that gold should continue to make new highs in the coming year.

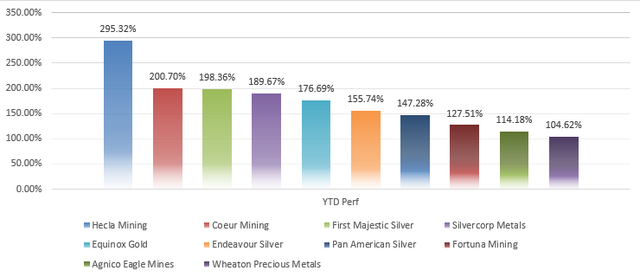

And with the metal on track for an eighth straight month of gains, mining stocks aren’t far behind—Hecla Mining (HL) leads with nearly a 300% rise, followed by Coeur Mining (CDE) and First Majestic Silver (AG) at roughly 200%.

Year-to-date, here are the top-performing silver mining stocks, illustrated in charts:

Seeking Alpha

Here are the mining stocks that have joined the rally, along with their Seeking Alpha Quant Ratings:

Hecla Mining (HL) — +295.32% YTD | Quant Rating: 3.49Coeur Mining (CDE) — +200.70% YTD | Quant Rating: 4.95First Majestic Silver (AG) — +198.36% YTD | Quant Rating: 3.49Silvercorp Metals (SVM) — +189.67% YTD | Quant Rating: 4.94Equinox Gold (EQX) — +176.69% YTD | Quant Rating: 4.96Endeavour Silver (EXK) — +155.74% YTD | Quant Rating: 4.45Pan American Silver (PAAS) — +147.28% YTD | Quant Rating: 4.94Fortuna Mining (FSM) — +127.51% YTD | Quant Rating: 4.84Agnico Eagle Mines (AEM) — +114.18% YTD | Quant Rating: 4.84Wheaton Precious Metals (WPM) — +104.62% YTD | Quant Rating: 3.44

Silver and Silver Mining ETFs: (SLV), (SIVR), (AGQ), (ZSL), (PSLV), (SIL), (SILJ), and (SLVP)