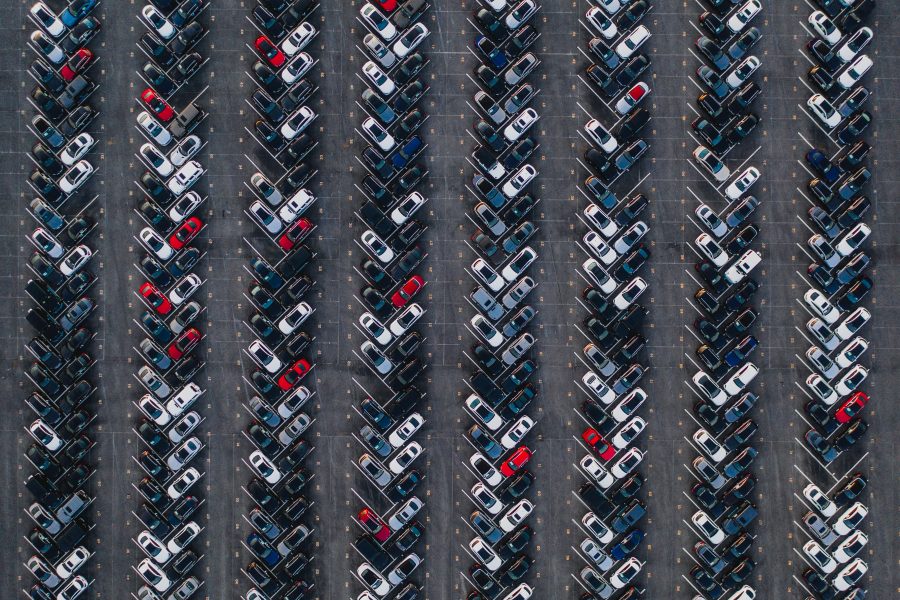

S&P Global Mobility forecasts U.S. auto sales will fall 2.5% year-over-year in 2026 to 15.89 million units. “An already cautious consumer combined with potential OEM price adjustments translates to expectations that 2026 auto sales will decline from the 2025 level,” warned S&P Global’s Chris Hopson

The firm highlighted that after a surge earlier in the year, the battery-electric vehicle segment is experiencing a notable downshift. Following many electric vehicle sales being pulled forward to Q3 to get in before the expiration of the EV tax credit, a significant decline in BEV sales was observed in Q4, with BEV market share estimated at just 6% for December. That softness is expected to continue through the first half of 2026 as the market adapts to post-incentive conditions.

Aside from the EV slowdown, S&P said the primary factor tempering sales momentum remains vehicle affordability. According to the firm’s analysis, these issues have pushed against sustained growth over the past two years and remain “entrenched,” creating an environment of uncertainty for both consumers and manufacturers entering 2026.

Auto stocks: Toyota (TM), Tesla (TSLA), General Motors (GM), Honda (HMC), Ferrari (RACE), Ford (F), Hyundai (HYMTF), Nissan (NSANY), Mercedes-Benz (MBGAF), Volkswagen (VLKAF), BMW (BMWYY), Stellantis (STLA), Rivian Automotive (RIVN), and Subaru (FUJHY).

Auto supplier stocks: Adient (ADNT), Allison Transmission (ALSN), American Axle & Manufacturing (AXL), Aptiv (APTV), Autoliv (ALV), BorgWarner (BWA), China Automotive Systems (CAAS), Cooper-Standard (CPS), Dana (DAN), Douglas Dynamics (PLOW), Garrett Motion (GTX), Gentex (GNTX), Gentherm (THRM), Johnson Controls (JCI), Lear (LEA), LKQ (LKQ), Modine Manufacturing (MOD), Monro (MNRO), Motorcar Parts of America (MPAA), Standard Motor Products (SMP), Superior Industries (SUP), Visteon (VC), Voxx International (VOXX), and Westport Fuel Systems (WPRT).