da-kuk

UBS Global Wealth Management said it now has an attractive view on U.S. equities, supported in part by growing adoption of artificial intelligence technology, and the investment bank has listed its top picks in the market.

The firm sees further gains ahead of the market, whose benchmark, the S&P 500 (SP500), has risen +22% this year, including 46 record-high closes. UBS previously had a neutral view on U.S. stocks, but favorable domestic and global factors, such as China’s recent stimulus measures, prompted UBS’s upgrade.

“From a macro perspective, the combination of slowing but durable economic growth, healthy earnings growth, and continued Fed rate cuts are all supportive,” David Lefkowitz, head of equities Americas at UBS GWM, said in its Equity Compass note released this week. While economic growth is slowing, the country’s labor market is “healthy,” with real wages rising, he said.

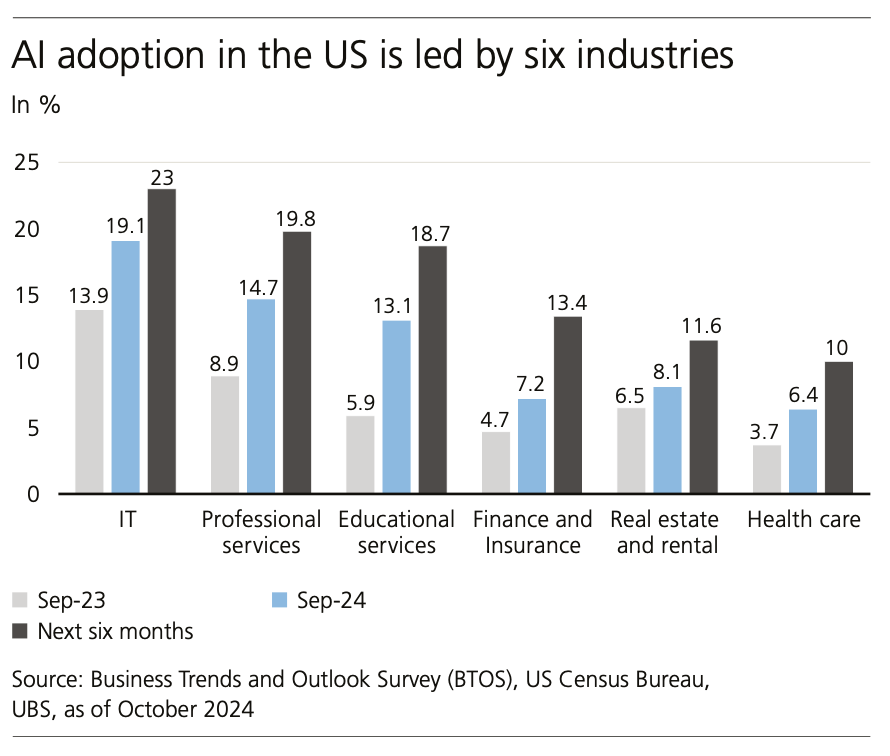

AI adoption is broadening, with 5.9% of companies reporting using AI as of Q3, up from 3.7% in Q3 2023, UBS said, citing the U.S. Census Bureau. “From a single stock perspective, we think many of the large U.S. tech companies offer appealing long-term upside, especially those that have leading positions in the AI value chain, including Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), and Meta Platforms (NASDAQ:META),” the firm said.

But risks facing the U.S. equity market include potential restrictions of U.S. semiconductor exports, eroding pricing power in the Consumer Staples sector and likely range bound oil prices for the Energy sector.

Here are UBS’s top U.S. market picks by sector. Accompanying S&P 500 (SP500) SPDR Select Sector ETFs are listed.

- Communication Services (XLC)

- Meta Platforms (META)

- Consumer Discretionary (XLY)

- Home Depot (NYSE:HD)

- Ralph Lauren (NYSE:RL)

- Yum! Brands (NYSE:YUM)

- Consumer Staples (XLP)

- Coca-Cola (NYSE:KO)

- Colgate-Palmolive (NYSE:CL)

- Energy (XLE)

- ConocoPhillips (NYSE:COP)

- ExxonMobil (NYSE:XOM)

- Suncor Energy (NYSE:SU)

- Financials (XLF)

- Bank of America (NYSE:BAC)

- Truist Financial (NYSE:TFC)

- Health Care (XLV)

- Abbott Laboratories (NYSE:ABT)

- Merck & Co. (NYSE:MRK)

- Thermo Fisher Scientific (NYSE:TMO)

- Industrials (XLI)

- AECOM (NYSE:ACM)

- Boeing (NYSE:BA)

- Norfolk Southern Corp. (NYSE:NSC)

- Information Technology (XLK)

- Adobe Systems (NASDAQ:ADBE)

- Microsoft (MSFT)

- Salesforce.com (NYSE:CRM)

- Materials (XLB)

- Air Products & Chemicals (NYSE:APD)

- Corteva (NYSE:CTVA)

- Freeport-McMoRan (NYSE:FCX)

- Real Estate (XLRE)

- American Tower (NYSE:AMT)

- Equity Residential (NYSE:EQR)

- ProLogis (NYSE:PLD)

- Utilities (XLU)

- Entergy (NYSE:ETR)

- NextEra Energy (NYSE:NEE)

- Sempra Energy (NYSE:SRE)

Here are some S&P 500 ETFs: (IVV), (RSP), (SH), (SPY) and (VOO).