MarioGuti

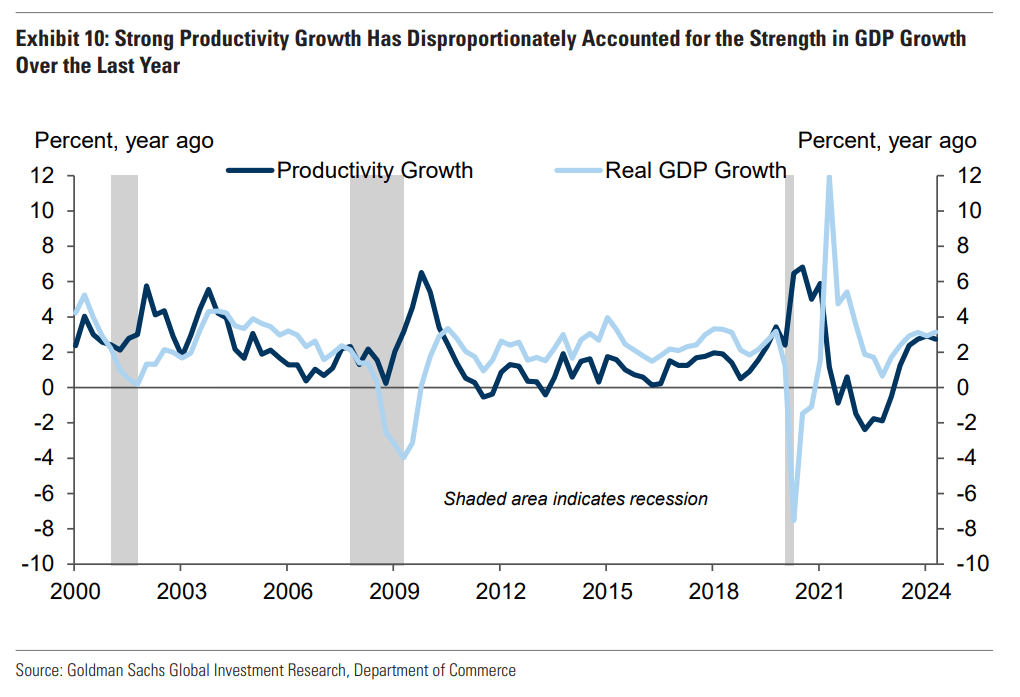

Strong productivity growth has disproportionately accounted for the strength in GDP growth over the last year, said Jan Hatzius, chief economist and head of Global Investment Research at Goldman Sachs, in a note.

Year-over-year productivity growth rebounded from -0.5% early last year to 2.7% in the second quarter of 2024, well above the recent historical average of 1.5%, he said.

Goldman Sachs analysts said that pandemic-related technology investment, remote work, and high job-to-job transitions post-pandemic may have generated some efficiency gains in the labor market and boosted productivity growth. This strong productivity growth may have supported solid GDP growth in the U.S. over the last year.

In addition, the sharp slowdown in job growth from around 290,000 at the start of 2024 and around 210,000 at the start of 2024 “appears somewhat puzzling” since it coincides with GDP growth acceleration, said Hatzius.

Now, “contracting profit margins, which are partly due to rising interest expense, have likely flipped from a 20,000 boost to a 15,000 drag on monthly job growth since the start of last year,” he said.

“While the end of catch-up hiring will weigh modestly further on job growth, margins are expanding again, election-related uncertainty will abate, and, though uncertain, we would expect productivity growth to moderate from its elevated pace, which should support job growth,” he concluded.

The following are buy-rated and high quant rated stocks with profit margins greater than 50%, and market cap larger than $50B.

- Taiwan Semiconductor Manufacturing Company (TSM) – Profit margin: 53.36%; Seeking Alpha quant rating: 4.98

- Tencent Holdings Limited (OTCPK:TCEHY) – Profit margin: 51.37%; Seeking Alpha quant rating: 4.95

- American Express Company (AXP) – Profit margin: 55.83%; Seeking Alpha quant rating: 4.94

- T-Mobile US (TMUS) – Profit margin: 63.60%; Seeking Alpha quant rating: 4.94

- Iberdrola SA ADR (OTCPK:IBDRY) – Profit margin: 51.78%; Seeking Alpha quant rating: 4.85

- Iberdrola SA (OTCPK:IBDSF) – Profit margin: 51.78%; Seeking Alpha quant rating: 4.85

- Interactive Brokers Group (IBKR) – Profit margin: 90.43%; Seeking Alpha quant rating: 4.70

- Adobe (ADBE) – Profit margin: 88.66%; Seeking Alpha quant rating: 4.64

- L’Air Liquide SA (OTCPK:AIQUY) – Profit margin: 61.54%; Seeking Alpha quant rating: 4.49

- Realty Income Corp. (O) – Profit margin: 92.75%; Seeking Alpha quant rating: 4.23

- Southern Copper Corp. (SCCO) – Profit margin: 55.83%; Seeking Alpha quant rating: 4.20

- PepsiCo Inc. (PEP) – Profit margin: 54.65%; Seeking Alpha quant rating: 4.01

- Anheuser-Busch InBev (BUD) – Profit margin: 54.48%; Seeking Alpha quant rating: 4.01

- Emerson Electric Co. (EMR) – Profit margin: 51.62%; Seeking Alpha quant rating: 3.96

- Keurig Dr. Pepper Inc. (KDP) – Profit margin: 55.82%; Seeking Alpha quant rating: 3.83

- Canadian Natural Resources Limited (CNQ) – Profit margin: 51.51%; Seeking Alpha quant rating: 3.77

- AutoZone Inc. (AZO) – Profit margin: 53.18%; Seeking Alpha quant rating: 3.69