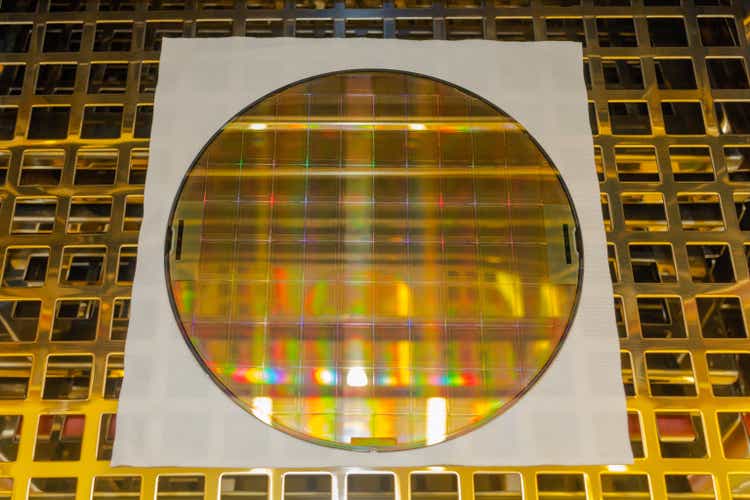

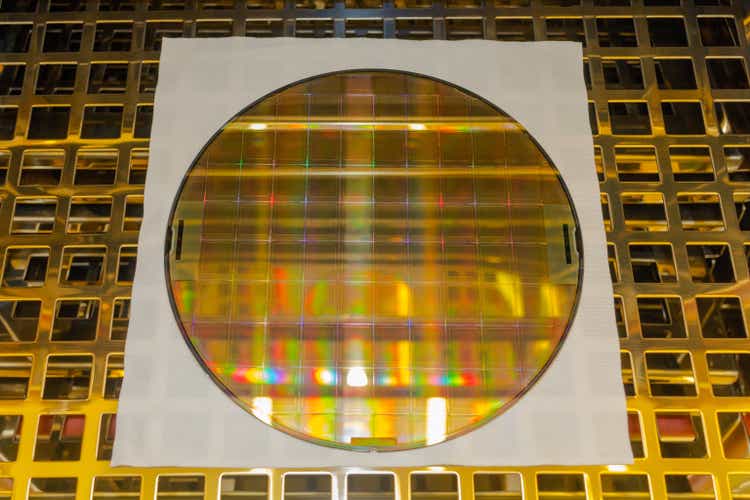

Anatoly Morozov/iStock via Getty Images

Taiwan Semiconductor (NYSE:TSM) is the undisputed leader in semiconductor manufacturing, thanks to its leading edge capabilities, especially in artificial intelligence.

Despite perception, Samsung (OTCPK:SSNLF) may not be losing out completely.

“Unlike its peers, TSMC got incredibly better at focusing its R&D with such intense efficiency that it was able to pack in more transistors on chips that were getting smaller with each passing year, and TSMC was doing it at a rate that was unmatched by any of its peers,” Seeking Alpha Analyst Uttam Dey said. “This allowed TSMC to keep competing on what is called ‘the leading edge’ or process node technology that many fabs [chip plants] like TSMC’s peers strive to achieve.”

Apple (NASDAQ:AAPL) uses TSM’s chips to make its processors for iPhones. The iPhone 16 models have a 3-nanometer A18 chip made by TSM. The phones, along with the iPhone 15 line, can utilize Apple’s AI tool, Apple Intelligence, with the first features coming next month.

TSM is currently in full volume production on the 3nm process, and is set to start mass production on 2nm nodes in 2025. The company is also more advanced than its peers in terms of semiconductor packaging.

“That’s the whole reason why companies that are known for making some of the best computing chips in the world – Apple, Nvidia, Broadcom, Qualcomm & AMD are all clients of TSMC and account for over half of TSMC’s revenue,” Dey said. It’s also why they’ll keep securing TSM’s manufacturing capacity over the next two to three years, he added.

Samsung revival?

Despite Taiwan Semiconductor’s prowess, Samsung is not that far behind, at least in terms of technology.

The South Korean technology giant intends to use its latest 3nm chip processing technology to make its next Galaxy line-up of smartphones and smartwatches. Samsung is expected to use a home-grown 3nm Exynos W1000 AP chip for Galaxy S25 smartphone, anticipated early next year.

The Galaxy Watch7, unveiled in July, features the Exynos W1000, Samsung’s first wearable application processor to use the 3-nm gate-all-around process. Samsung’s current Galaxy S24 Ultra’s AI features are powered by Qualcomm’s (QCOM) Snapdragon 8 Gen 3 processor chipset.

“But it’s not like fabs like Samsung & SK Hynix are completely losing out,” Dey stated. “These fabs have taken a larger share of the memory market. It just doesn’t get that much traction because it’s more cyclical commoditized than the overall chip production market.”

In addition, more money is spent on the leading-edge side of production, which is why fabs like TSM and its clients command such high operating margins — “these companies operate their business in excess of 40% GAAP margins, which is just incredible,” Dey explained.

Nonetheless, Samsung’s foundry is behind Taiwan Semiconductor. TSM’s market share was 62% in the second quarter of 2024, compared to 13% for Samsung Foundry, according to data from Counterpoint Research.

“I would not say Samsung is well behind,” said Lucas Ma of Envision Research, Investing Group Leader for Envision Early Retirement. “However, I am certainly more bullish on TSM. The foundry business is where experience matters a lot.”

By having a larger market share and working with leading clients such as Apple and Nvidia, TSM gets to experience a wider range of manufacturing processes and customer needs and thus is more likely to stay ahead, Ma added.

Samsung is not a pure foundry player such as TSM, and its other segments may not see the same margin and growth potential like its foundry division, Ma said, adding potential investors should not like Samsung automatically because of its much lower price-to-earnings ratio.