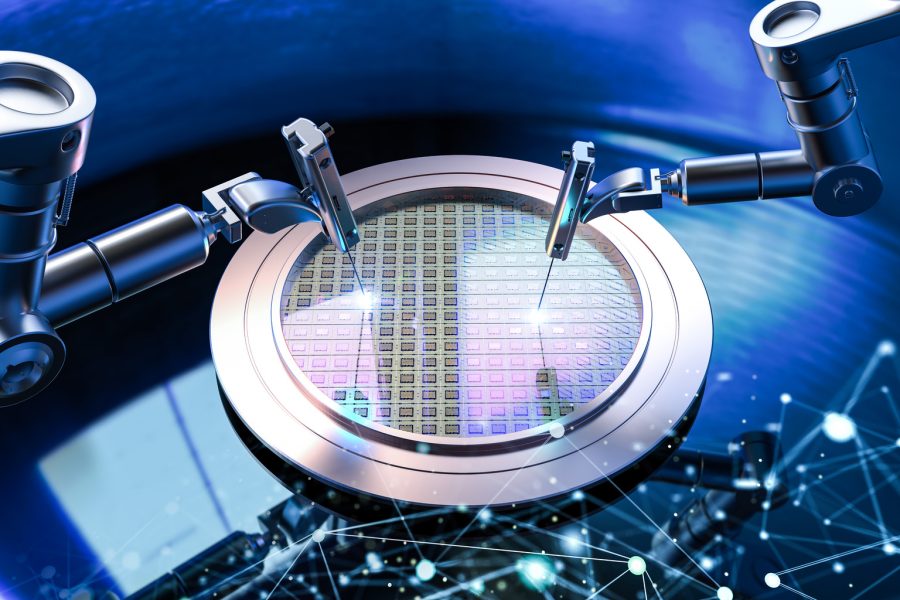

PhonlamaiPhoto/iStock via Getty Images

Shares of Taiwan Semiconductor Manufacturing Company (NYSE:TSM) were on track for their seventh consecutive session of gains on Tuesday, as the stock rose more than 2.3% to $211.80 in afternoon trade.

The Taiwanese semiconductor manufacturer, which is the primary chip supplier to Nvidia (NVDA) and Apple (AAPL), gained more than 6% in the past six trading sessions. The stock closed 0.89% higher, at $207 on Monday.

The stock has grown more than 7% so far this year, compared to an over 2% gain in the broader benchmark index. TSM is up 20% over the past one month.

TSMC’s stock saw a sharp uptick on Tuesday after the company reported a 39.6% year-over-year rise in May revenue as clients rushed to stockpile chips amid growing trade tensions.

The company generated NT$320.5 billion ($10.7 billion) in revenue last month. Looking ahead, analysts project a 50.3% Y/Y increase in TSMC’s second-quarter sales, signaling continued robust demand despite month-over-month volatility.

TSMC chief executive and chairman C.C. Wei said last week that the demand for the company’s AI chips continues to outweigh supply.

Last week, Bank of America reiterated its Buy rating on the stock after the company’s annual shareholder meeting.

“In addition to supporting AI development, TSMC is also utilizing AI in manufacturing to improve operating efficiency and ROI. TSMC is well positioned to benefit from the industry megatrends of 5G, AI, and HPC with TSMC’s tech leadership in both advanced nodes/packaging and global expansions,” analyst Brad Lin wrote in a note to clients.

Seeking Alpha’s Quant rating system and sell-side analysts see TSMC stock as a STRONG BUY, while SA authors rate it as a BUY.

Seeking Alpha analyst, Simple Investment Ideas argued in a recent analysis that TSMC’s AI-driven demand is structural, not cyclical, supporting robust margins and revenue growth despite broader chip market uncertainty.

“Geographic diversification with new fabs in the US, Japan, and Germany strengthens the ‘silicon shield’ and mitigates geopolitical risks,” the analyst added.