DKart

It’s been a roller-coaster of a year for Elon Musk’s Tesla (NASDAQ:TSLA), to say the least. With the final fortnight of 2024 commencing, the electric vehicle (EV) giant’s stock finds itself up more than +75% on the year.

The EV maker began 2024 on a high note, having more than doubled its share price in 2023 to $248.48 and sitting at a valuation of about $790B. The stock then hit its lowest intraday point of the year in April at $138.80, marking a -44.1% YTD decline at that point.

But it was in October that the stock really took off after the EV maker’s Q3 results, followed by another supersized boost from former U.S. President Donald Trump’s election victory. Since that third quarter report, shares of Tesla (TSLA) have advanced a whopping +104.2% YTD.

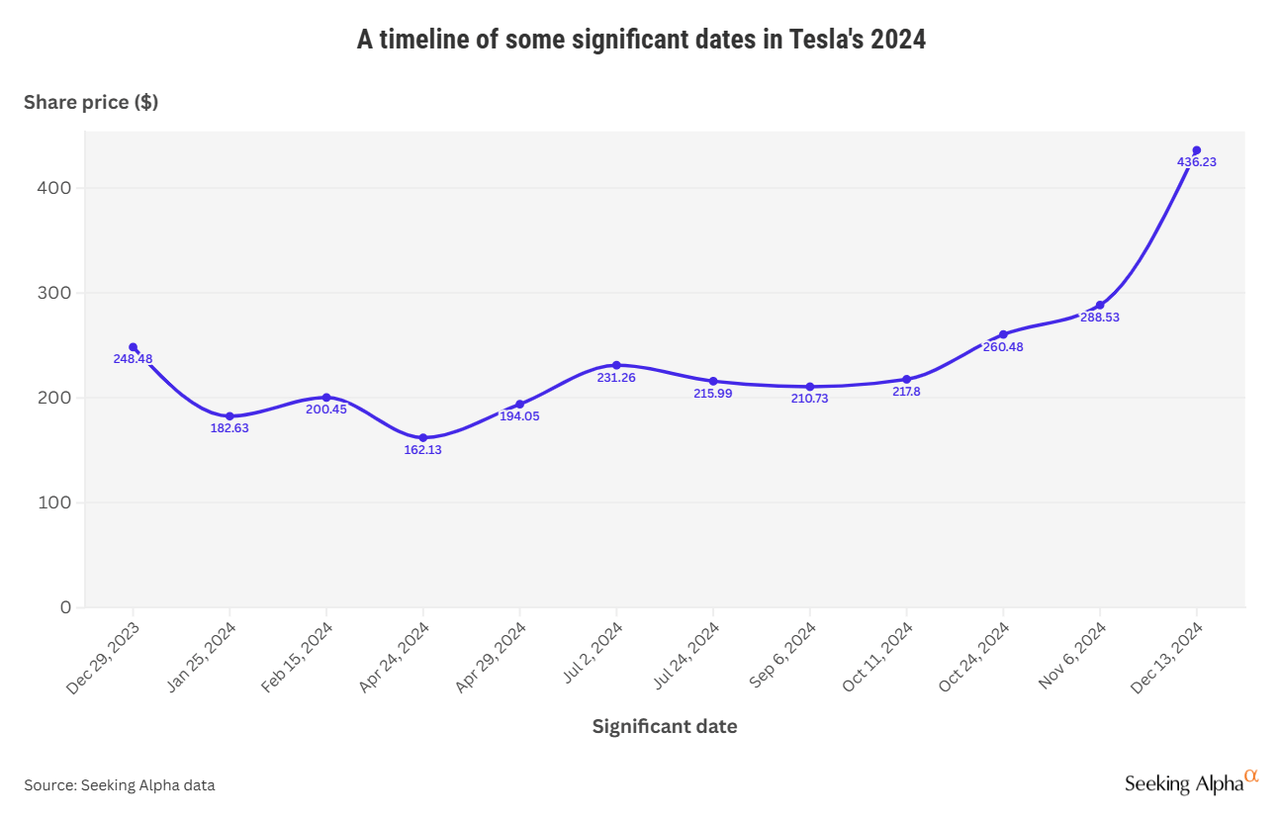

See below for a chart showcasing some significant dates in Tesla’s 2024 and the stock’s closing price on that day:

- December 29, 2023: Tesla (TSLA) closes out the year with a +101.7% climb to end at $248.48/share.

- January 25, 2024: The stock slides -12.1% in reaction to the company’s Q4 2023 results. Analysts bemoan the EV maker’s lack of details in terms of outlook.

- February 15, 2024: Musk discloses a 20.5% stake in Tesla (TSLA), sending shares up +6.2%.

- April 24, 2024: The stock jumped +12.1%, as investors looked past the car manufacturer’s weak Q1 2024 results and focused on top boss Elon Musk’s remarks about valuing Tesla (TSLA) as more than an auto company and as an artificial intelligence (AI) robotics firm instead.

- April 29, 2024: Tesla (TSLA) stock swelled +15.3% after Musk made a surprise visit to China and announced an expansion of the company’s partnership with search engine provider Baidu (BIDU).

- July 2, 2024: Shares soar +10.2% after its Q2 deliveries beat expectations.

- July 24, 2024: TSLA slumps -12.3% after the company’s Q2 2024 results sparked concerns over a slowdown in its core EV business. Adding to the worry was the delaying of its highly anticipated robotaxi event.

- September 6, 2024: The stock slips -8.5%, a day after Donald Trump laid out his economic vision for the U.S. at an event at the Economic Club of New York. Trump at that event said he would make Tesla (TSLA) chief executive Musk the head of a newly established government efficiency commission.

- October 11, 2024: TSLA sheds -8.8%, a day after the EV maker’s hugely hyped “We, Robot” event at a Warner Bros. studio in Calif. The company showed off a Cybercab that had no steering wheel or pedals, a 20-person autonomous robovan prototype, and the next version of the Optimus humanoid robot. But analysts pointed to a lack of data and details to support the company’s vision.

- October 24, 2024: Tesla (TSLA) stock saw its best day in over a decade, accelerating +21.9% after the company’s Q3 2024 results. The EV manufacturer posted one of its best earnings reports in a while, topping expectations on several key metrics despite seeing lower average selling prices. Moreover, Musk projected 20% to 30% growth in deliveries in 2025.

- November 6, 2024: TSLA ripped a +14.8% gain after Donald Trump won the U.S. presidential election against Vice President Kamala Harris. Musk, who emerged as a major supporter of Trump during his campaign, was seen to be one of the major beneficiaries from Trump’s win, which in turn boosted investor hopes for Tesla (TSLA).

- December 13, 2024: The stock closes at $436.23, marking a +75.6% YTD advance. The company’s valuation stands at $1.40T.

With 2024 now coming to its close, only time will tell where Tesla (TSLA) stock will go from here.

Here are some exchange-traded funds of interest with exposure to Tesla (TSLA): (VCAR), (NITE), (XLY), (TSLT), (FDIS), (ARKQ), and (ARKK).

More on Tesla

- Why Tesla’s Stock Can Keep Soaring (Upgrade)

- Tesla Stock: Big Potential, Bigger Risks, And Better Alternatives

- Tesla: 4 Reasons I’m Selling In 2025 After Years Of Buying And Holding (Downgrade)

- Trump transition team recommends significant changes to Biden-era EV incentives

- Full speed ahead: Tesla lands higher price targets from Wedbush