DNY59

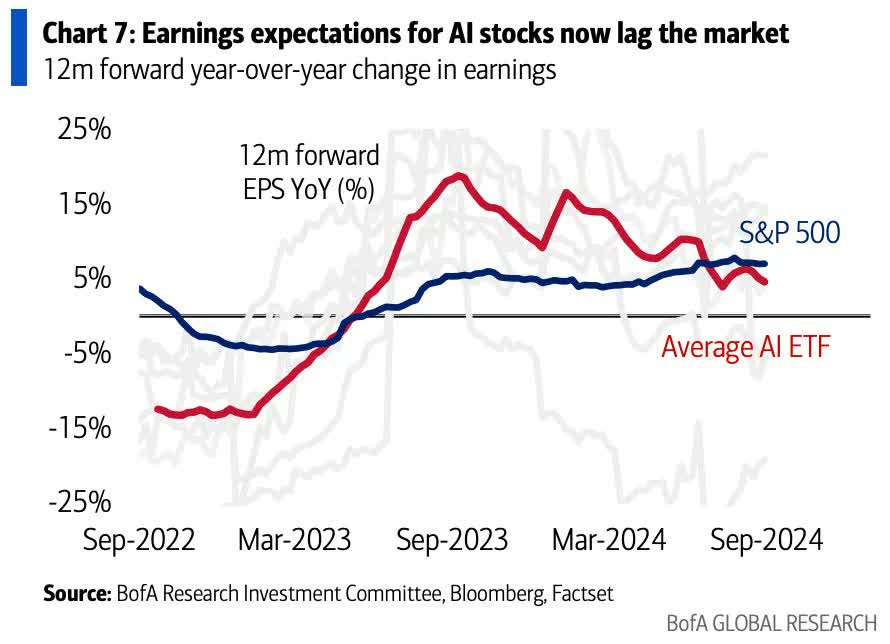

The average EPS growth rate among artificial intelligence ETF constituents (NYSEARCA:AIEQ), (ARTY), (IGPT) has gone from 18% down to just 5%, below the S&P 500 (SP500).

As of September, the average AI ETF year-over-year EPS has fallen behind the S&P 500 EPS, after surpassing it in 2023.

These are the major AI stocks with their quant grades for earnings revisions, and the number of upward or downward revisions for the upcoming quarter:

- Nvidia (NVDA) – Quant grade for earnings revisions: B+; 41 up revisions and 5 down revisions in the last 90 days.

- CrowdStrike (CRWD) – Quant grade for earnings revisions: D-; 0 up revisions and 45 down revisions in the last 90 days.

- Arista Networks (ANET) – Quant grade for earnings revisions: A+; 24 up revisions and 0 down revisions in the last 90 days.

- Microsoft (MSFT) – Quant grade for earnings revisions: C-; 12 up revisions and 31 down revisions in the last 90 days.

- Salesforce (CRM) – Quant grade for earnings revisions: B+; 45 up revisions and 1 down revision in the last 90 days.

- Amazon.com (AMZN) – Quant grade for earnings revisions: B+; 40 up revisions and 9 down revisions in the last 90 days.

- Alphabet (GOOGL) – Quant grade for earnings revisions: B; 32 up revisions and 17 down revisions in the last 90 days.

- Meta Platforms (META) – Quant grade for earnings revisions: A-; 54 up revisions and 2 down revisions in the last 90 days.

- Taiwan Semiconductor Manufacturing Co. (TSM) – Quant grade for earnings revisions: A; 8 up revisions and 0 down revisions in the last 90 days.

- ASML Holding NV (ASML) – Quant grade for earnings revisions: C-; 8 up revisions and 20 down revisions in the last 90 days.

- Adobe Inc. (ADBE) – Quant grade for earnings revisions: B+; 31 up revisions and 2 down revisions in the last 90 days.

- International Business Machines (IBM) – Quant grade for earnings revisions: B; 14 up revisions and 2 down revisions in the last 90 days.

- Procept BioRobotics Corp. (PRCT) – Quant grade for earnings revisions: A+; 7 up revisions and 0 down revisions in the last 90 days.

- SoundHound AI Inc. (SOUN) – Quant grade for earnings revisions: D+; 1 up revision and 5 down revisions in the last 90 days.

- Intuitive Surgical Inc. (ISRG) – Quant grade for earnings revisions: A-; 24 up revisions and 0 down revisions in the last 90 days.

- AeroVironment Inc. (AVAV) – Quant grade for earnings revisions: C; 1 up revision and 3 down revisions in the last 90 days.

- Pegasystems Inc. (PEGA) – Quant grade for earnings revisions: B-; 8 up revisions and 3 down revisions in the last 90 days.

- Faro Technologies Inc. (FARO) – Quant grade for earnings revisions: A+; 2 up revisions and 0 down revisions in the last 90 days.