P_Wei/iStock via Getty Images

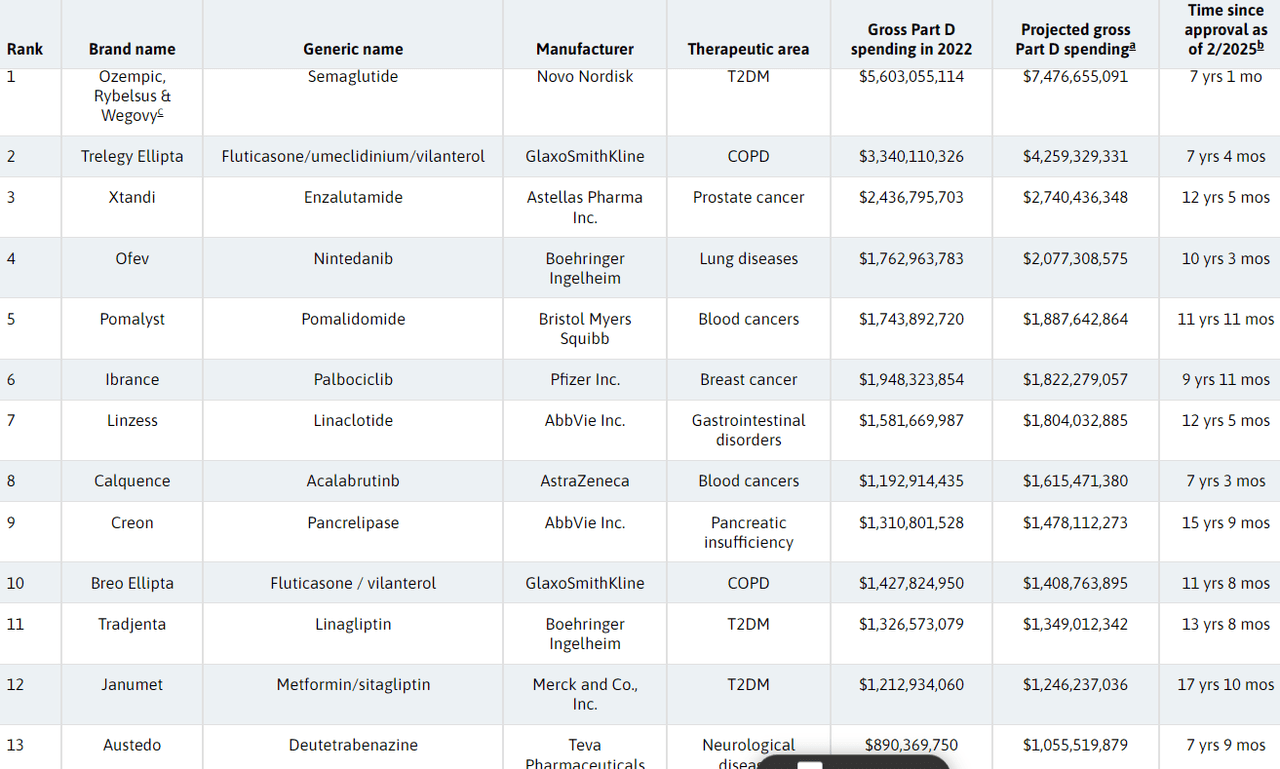

With prices finalized for the first 10 Medicare Part D drugs selected for the initial round of pricing negotiations, attention now turns to the next 15 drugs the U.S. government is eyeing for the bargaining process in 2025.

While blockbusters from pharma majors such as Bristol Myers (BMY), Pfizer (PFE), Eli Lilly (LLY), AbbVie (ABBV), J&J (JNJ), Amgen (AMGN), and Novo Nordisk (NVO) made up the initial list, a recent peer-reviewed study suggests that the next set of targets will include several new entrants.

A research paper published this week in the Journal of Managed Care & Specialty Pharmacy indicated that Novo Nordisk’s (NVO) weight loss/ diabetes therapy semaglutide will be a notable addition.

“We expect that Ozempic, Rybelsus, and Wegovy will be considered a single product for negotiation, as they contain the same active moiety, semaglutide, and are manufactured by the same firm,” researchers led by Sean Sullivan, a professor at the Choice Institute School of Pharmacy, wrote, referring to the drug’s brand names.

Their findings coincide with Medicare’s plans to unveil a list of 15 Part D drugs that will be subject to the next round of the bargaining process in February to implement revised prices in 2027.

GSK’s (NYSE:GSK), Astellas (OTCPK:ALPMF) (OTCPK:ALPMY), Boehringer Ingelheim, and Teva Pharmaceuticals (NYSE:TEVA) will enter the negation process for the first time with their blockbusters, Trelegy Ellipta, Breo Ellipta, Ofev, Tradjenta, and Austedo on the line for selections.

Additionally, researchers argued that products such as Ibrance from Pfizer (PFE) and Janumet from Merck (MRK) will also be subject to the bargaining process.

Treatments from Bristol Myers Squibb (BMY), AbbVie (ABBV), and AstraZeneca (AZN) are also likely to make the cut, they said, with their assumptions based on drugs expected to cost more than $1B in gross Medicare Part D spending in 2023.

The list of 13 included Medicare’s costliest drugs and excluded those already selected for the previous negotiation round.

Source: The Journal of Managed Care & Specialty Pharmacy

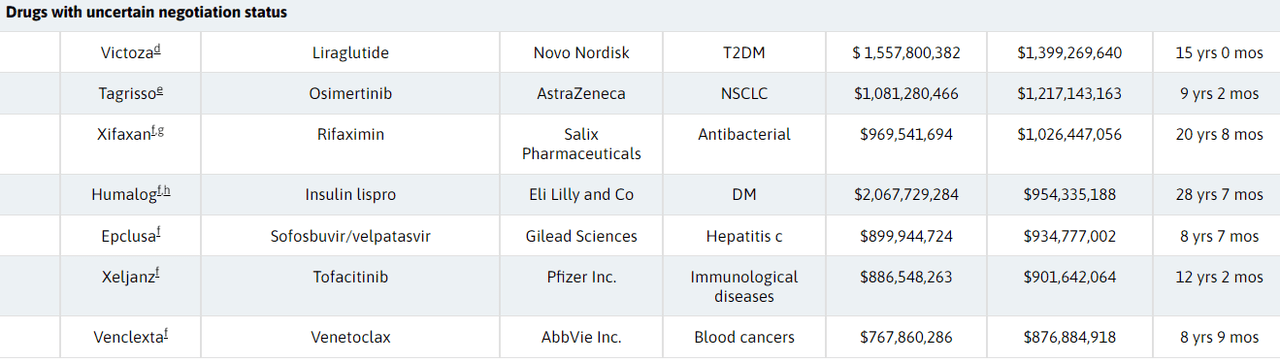

To complete the list, the researchers identified seven additional drugs with uncertain selection prospects, noting that those products are expected to command $877M-$1.4B in gross Part D spending in 2023.

Bausch Health’s (BHC) bowel disease therapy Xifaxan, Pfizer’s (PFE) JAK inhibitor Xeljanz, and Gilead’s (GILD) antiviral sofosbuvir/velpatasvir were part of that list.

Source: The Journal of Managed Care & Specialty Pharmacy