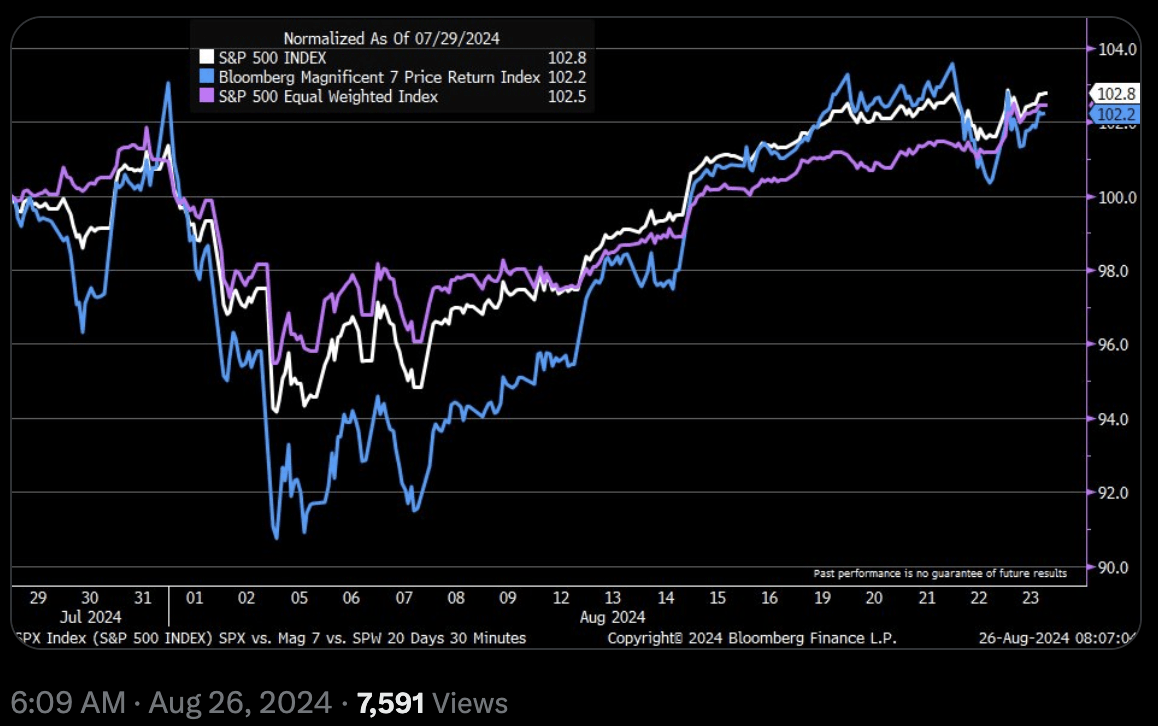

The story of the summer stumble and bounce back in Magnificent 7 stocks and the broadening theme in the stock market was summed in a chart shared Monday by a Charles Schwab senior strategist.

“Over the past month, almost neck and neck returns for cap-weighted S&P 500, Magnificent 7, and equal-weighted S&P 500 (SP500),” Kevin Gordon, senior investment strategist at Schwab, said in a post on X (formerly Twitter):

The Mag 7 group of tech stocks that represent roughly a third of the cap-weighted S&P 500’s (SP500)(SPY) performance – Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Meta Meta Platforms (NASDAQ:META) and Tesla (NASDAQ:TSLA) – were knocked back when recession fears ignited, prompting investors to assess their largely lofty valuations.

But, as Gordon highlights, their recovery has since produced nearly even-footing returns with the capitalization-weighted S&P 500 (SP500)(IVV)(VOO) and the equal-weighted S&P 500 index. The latter index includes the same constituents as the cap-weighted S&P 500 (SP500), but each company is allocated a fixed-weight, so a tech behemoth like Nvidia (NASDAQ:NVDA) carries the same heft as Dollar Tree (DLTR).

Meanwhile, profit growth for the so-called S&P 500 “493”, or the benchmark excluding the Magnificent 7, has increasingly driven investors to buy into those stocks. Bank of America recently said the S&P 493 was on course to mark the first quarter of earnings growth since 4Q22.