teddyleung

ZEEKR Intelligent Technology Holding (NYSE:ZK) is a Chinese electric vehicle stock with one of the biggest share price moves after Beijing’s stimulus announcements jolted markets broadly in China and Hong Kong. The EV stock is up more than 60% over the last two weeks and trades back above its IPO pricing level of $21.

The Chinese electric vehicle maker delivered 21,333 vehicles in September, which marked a 77% year-over-year increase. On a year-to-date basis, deliveries were up 81% year-over-year through three quarters. ZEEKR’s (ZK) financial performance has also been impressive, with total revenue in 2023 reaching 51.7 billion yuan, representing 62% year-over-year growth. ZEEKR (ZK) also posted a gross margin rate of 17.2% in Q2 of this year, which was one of the highest in the EV sector. “We made significant strides in optimizing costs while maintaining high-quality delivery standards, contributing to sustainable margin and profitability improvement,” stated ZEEKR (ZK) CFO Jing Yuan. “Moving forward, we remain dedicated to improving product quality, expanding our market share and propelling the sustainable growth of our business,” he added.

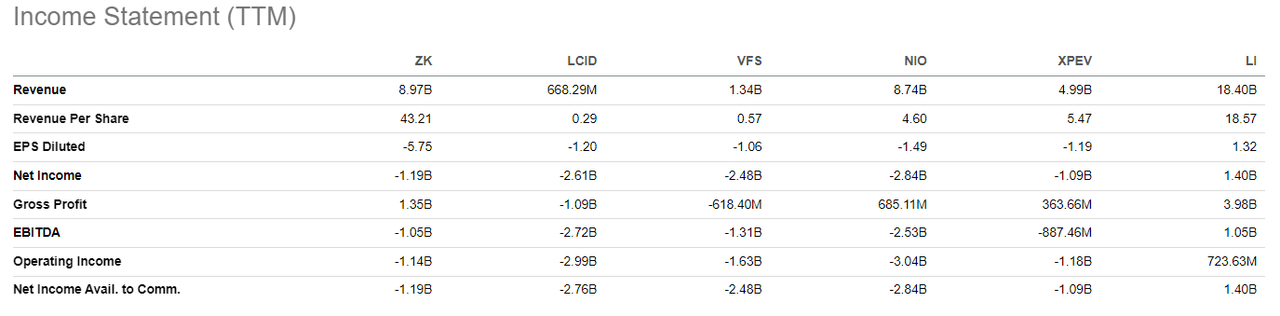

ZEEK’s (ZK) financials compare favorably on some metrics to EV peers, despite the company considered to be in startup mode.

ZEEKR (ZK) has a clean sweep of bull ratings on Wall Street. Macquarie recently started coverage on ZEEKR (ZK) with an Outperform rating on its view that shares look overly penalized for the corporate structure complexity and low liquidity. Notably, ZEEKR’s (ZK) product mix was said to look competitive, and the automaker is expected to increase its local market share to 13% by FY26 from 7% in FY23.

Analyst Eugene Hsiao noted that the Zeekr (ZK) story remains complex since auto sales are a relatively lower share of sales in comparison to peers due to consolidated auto components subsidiary Ningbo Viridi and R&D services arm CEVT accounting for 28% and 6% of FY23 sales, respectively. “The company also announced plans to sell a PHEV model in 2025, which brings its mix more into competition with sister brands Lynk & Co, Polestar (PSNY), and Volvo,” he noted. Hsiao and his team still think Zeekr (ZK) shares look undervalued, even when adjusting for those potential valuation discounts. Macquarie has a price target of $33.00 on ZEEKR.

On Seeking Alpha, analyst Disruptive Investor thinks ZEEKR (ZK) is among the attractive EV names that is poised for significant upside. “As ZEEKR expands into new markets, it’s likely that deliveries growth will remain robust. At the same time, vehicle margin is likely to improve as the upscale sedan model gains sales traction,” read the bullish thesis in part.

Looking ahead, ZEEKR (ZK) also has its hands in the potential autonomous boom through a collaboration with Waymo (GOOG) to develop ride-hailing vehicles. The companies are working together to create all-electric, autonomous vehicles for Waymo’s ride-hailing service in the United States.