Investors should consider shorting bonds of hyperscalers, but hold off on major shorts of the broader AI trade, according to BofA Securities.

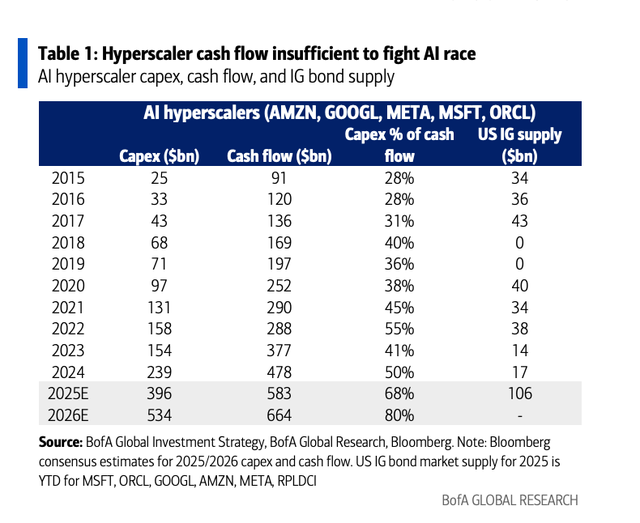

Hyperscaler cash flow is no longer sufficient for Amazon (AMZN), Alphabet (GOOG) (GOOGL), Meta (META), Microsoft (MSFT) and Oracle (ORCL) to sustain the ongoing “AI capex arms race,” strategist Michael Hartnett wrote in a note.

BofA

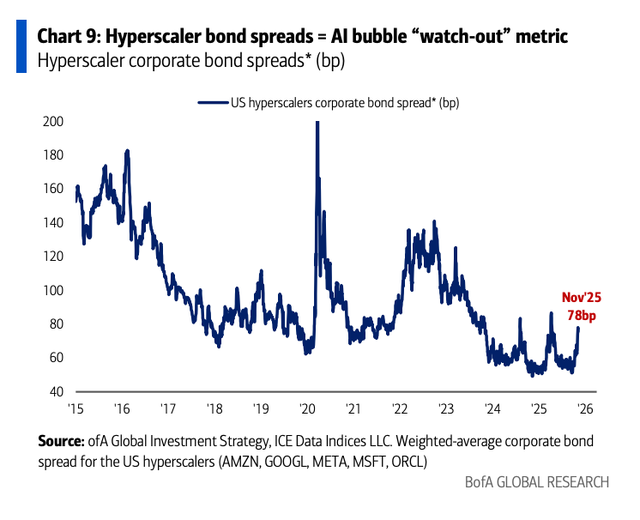

He pointed out that more than $120B in bonds have been issued over the past seven weeks and that even the “AI kings” are hinting at the need for a government backstop to help lower funding costs. Hyperscaler credit spreads have widened from 50 basis points in September toward 80 basis points, suggesting the lows are in, Hartnett said, adding that U.S. tech bond prices fell 8% in the 12 months leading up to the March 2000 bubble peak.

BofA

When it comes to booms and bubbles, Hartnett said they “always end with ‘watch out’ and ‘get out’ tells.”

For AI, he said markets are already flashing plenty of “watch out” signs — from surging market-cap concentration (AI-linked megacaps now over 40% of total value) and narrow breadth, to frothy valuations (AI leaders trading around 45x earnings), and a surge in global and retail buy-in (Japan’s Advantest and Korea’s SK Hynix both doubling in the past two months amid record tech inflows).

But Hartnett added that the real “get out” signals always come from rising rates — and for now, “the Fed ain’t hiking, and yields ain’t spiking.”