UnitedHealth Group (NYSE:UNH) will report its third-quarter results on Tuesday, October 28, before the market opens. Analysts expect earnings of $2.81 per share, down 60.7% year over year, on revenue of $113.06 billion, up 12.2%.

The company has beaten both EPS and revenue estimates 75% of the time over the past two years, but sentiment heading into the quarter remains cautious. However, sentiment heading into the quarter appears cautious—in the past three months, analysts have issued 22 downward EPS revisions and 11 downward revenue revisions, compared to 0 upward revisions on the bottom-line and only 7 upward revisions on the top line.

Investors will focus on management’s commentary around medical cost trends, Optum growth, and forward guidance. U.S. health insurers, including UnitedHealth, have been pressured by rising healthcare utilization and muted Medicare Advantage rate hikes. While MA plans were once a profit driver, the 3.7% rate increase for 2025 was viewed as a de facto reduction, squeezing margins and prompting several insurers, including UnitedHealth, to withdraw guidance earlier this year.

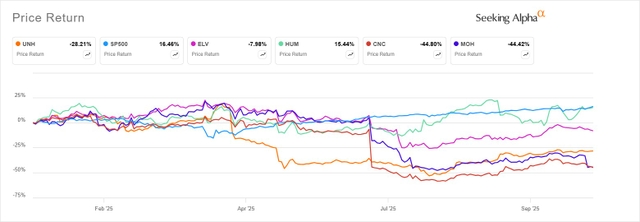

Health Insurers’ YTD share movement (Seeking Alpha)

After suspending its 2025 outlook and seeing its stock fall to a five-year low near $240, UNH has rebounded roughly 50%, supported by reset expectations, in-line Stars ratings, and renewed investor confidence following Warren Buffett’s August purchase and other hedge fund inflows. The appointment of CEO Stephen Hemsley, known for his strong operational record, has also helped restore long-term confidence.

“UnitedHealth Group Incorporated and Centene Corporation remain heavily discounted after recent selloffs, but are poised for recovery ahead of Q3 earnings,” Seeking Alpha columnist Edmund Ingham said. He added that “CMS’s commitment to higher Medicare Advantage rates in 2026 and improving Medicaid margins supports a bullish stance on both stocks.”